Jana Partners Reduces Stake in Freshpet Inc

On August 7, 2023, Jana Partners (Trades, Portfolio), a renowned investment management firm, reduced its stake in Freshpet Inc (NASDAQ:FRPT), a leading manufacturer and marketer of natural fresh meals and treats for dogs and cats. This article provides an in-depth analysis of the transaction, the profiles of Jana Partners (Trades, Portfolio) and Freshpet Inc, and the potential implications for value investors.

Details of the Transaction

Jana Partners (Trades, Portfolio) reduced its holdings in Freshpet Inc by 819,073 shares, representing an 18.45% decrease from its previous position. The shares were traded at a price of $82.25 each. Following the transaction, Jana Partners (Trades, Portfolio) now holds 3,620,513 shares in Freshpet Inc, accounting for 23.75% of its portfolio. The transaction had a -5.1% impact on Jana Partners (Trades, Portfolio)' portfolio. The firm's current holdings represent 7.5% of Freshpet Inc's total shares.

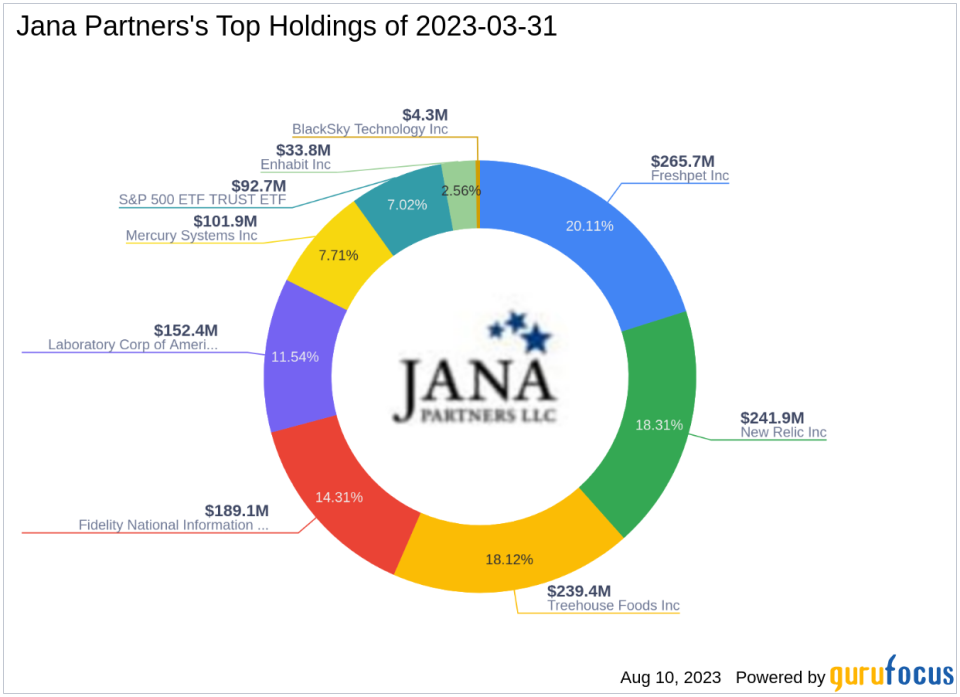

Profile of Jana Partners (Trades, Portfolio)

Jana Partners (Trades, Portfolio) LLC is an investment management firm founded in 2001 by Barry Rosenstein, Janas Managing Partner and Co-Portfolio Manager. The firm, headquartered in New York, follows a value-oriented, event-driven strategy. It applies a fundamental value discipline to identify undervalued companies that have one or more specific catalysts to unlock value. In certain cases, Jana can be the instrument for value creation by becoming an actively engaged shareholder. Jana invests both long and short and across the capital structure, including equity and debt. The firm currently holds nine stocks, with a total equity of $1.32 billion. Its top holdings include Freshpet Inc(NASDAQ:FRPT), Fidelity National Information Services Inc(NYSE:FIS), Laboratory Corp of America Holdings(NYSE:LH), New Relic Inc(NYSE:NEWR), and Treehouse Foods Inc(NYSE:THS). The firm's top sectors are Consumer Defensive and Technology.

Overview of Freshpet Inc

Founded in 2006, Freshpet Inc is a US-based company that manufactures and markets natural fresh meals and treats for dogs and cats. The company's products are distributed throughout the United States, Canada, and other international markets, into major retail classes including Grocery (including online), Mass and Club, Pet Specialty, and Natural retail. The company's products include Nature's Fresh, Deli Fresh, Vital, and Freshpet among others. As of August 10, 2023, Freshpet Inc has a market capitalization of $3.82 billion and a stock price of $79.275. Since its IPO on November 7, 2014, the company's stock has increased by 299.57%.

Analysis of Freshpet Inc's Financials

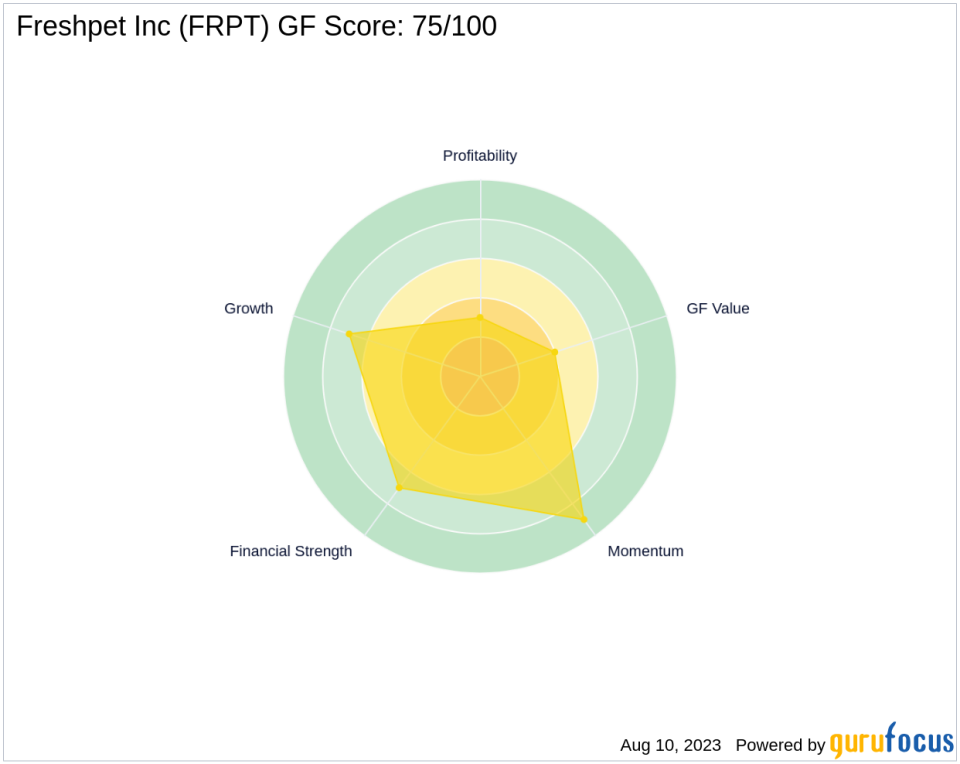

According to GuruFocus, Freshpet Inc's GF Value is $161.70, indicating that the stock may be overvalued with a Price to GF Value of 0.49. The company's GF Score is 75/100, suggesting a good outperformance potential. However, the company's Profitability Rank is 3/10, and its Growth Rank is 7/10, indicating poor profitability and average growth. Freshpet Inc's GF Value Rank is 4/10, and its Momentum Rank is 9/10. The company's Piotroski F-Score is 3, suggesting poor business operations. Its Altman Z score is 5.51, indicating it is not in financial distress.

Other Gurus' Investment in Freshpet Inc

Fisher Asset Management, LLC is the largest guru holding shares in Freshpet Inc. Other notable gurus who also hold shares in Freshpet Inc include George Soros (Trades, Portfolio).

Conclusion

In conclusion, Jana Partners (Trades, Portfolio)' recent reduction in its stake in Freshpet Inc is a significant move that could have implications for value investors. Despite Freshpet Inc's strong market presence and growth potential, its current financial performance and valuation suggest that investors should exercise caution. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.