January Top Dividend Stocks To Look Out For

Sino-Ocean Group Holding, NWS Holdings, and Jiangsu Expressway have one big thing in common. They are on my list of the best dividend stocks which have generously contributed to my portfolio income over the past couple of months. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

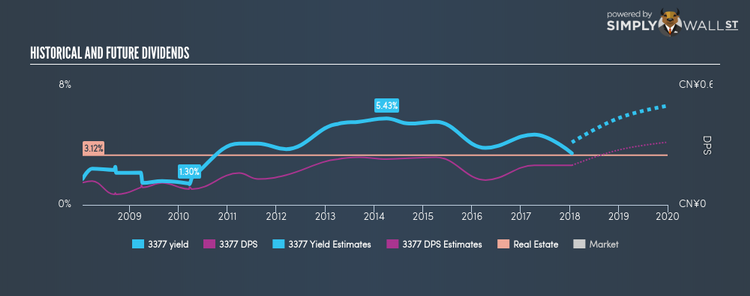

Sino-Ocean Group Holding Limited (SEHK:3377)

Sino-Ocean Group Holding Limited, an investment holding company, operates as a property developer in the People’s Republic of China. Formed in 1993, and currently lead by Ming Li, the company provides employment to 8,383 people and with the company’s market capitalisation at HKD HK$45.92B, we can put it in the large-cap category.

3377 has a sizeable dividend yield of 3.25% and is paying out 37.63% of profits as dividends , with analysts expecting the payout ratio in three years to be 42.23%. Despite some volatility in the yield, DPS has risen in the last 10 years from ¥0.11 to ¥0.2. Continue research on Sino-Ocean Group Holding here.

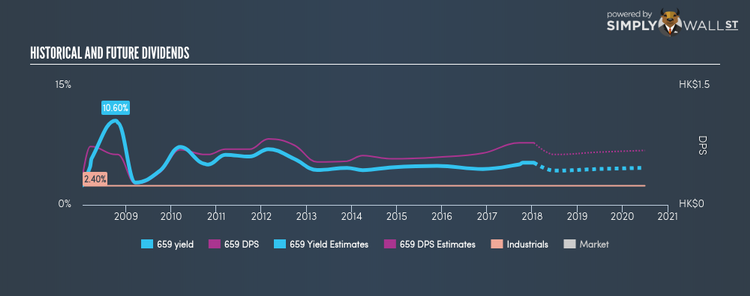

NWS Holdings Limited (SEHK:659)

NWS Holdings Limited, an investment holding company, invests in and operates various facilities. The company currently employs 28100 people and with the stock’s market cap sitting at HKD HK$57.25B, it comes under the large-cap stocks category.

659 has a large dividend yield of 5.31% and the company has a payout ratio of 49.91% , and analysts are expecting a 50.34% payout ratio in the next three years. While there’s been some level of instability in the yield, 659 has overall increased DPS over a 10 year period from $0.37 to $0.78. More detail on NWS Holdings here.

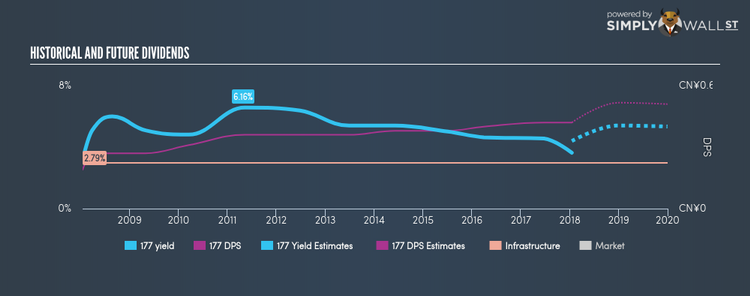

Jiangsu Expressway Company Limited (SEHK:177)

Jiangsu Expressway Company Limited invests in, constructs, operates, and manages toll roads and bridges in the People’s Republic of China. Founded in 1992, and currently run by Dejun Gu, the company employs 5,581 people and with the market cap of HKD HK$61.28B, it falls under the large-cap stocks category.

177 has a good-sized dividend yield of 3.40% and is currently distributing 55.64% of profits to shareholders , with analysts expecting a 65.17% payout in the next three years. 177’s dividends have seen an increase over the past 10 years, with payments increasing from ¥0.19 to ¥0.42 in that time. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. More detail on Jiangsu Expressway here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.