JANUS HENDERSON GROUP PLC Acquires New Stake in Benitec Biopharma Inc

Introduction to the Transaction

On August 9, 2023, JANUS HENDERSON GROUP PLC, a London-based investment firm, made a significant move in the biotechnology sector by acquiring 206,170 shares of Benitec Biopharma Inc (NASDAQ:BNTC). This transaction marked a new holding for the firm, with the shares purchased at a price of $3.2 each. Despite the substantial share acquisition, the impact on the firm's portfolio was not significant, with the position in BNTC representing 0% of the total portfolio. The firm now holds 9.90% of Benitec Biopharma Inc's total shares.

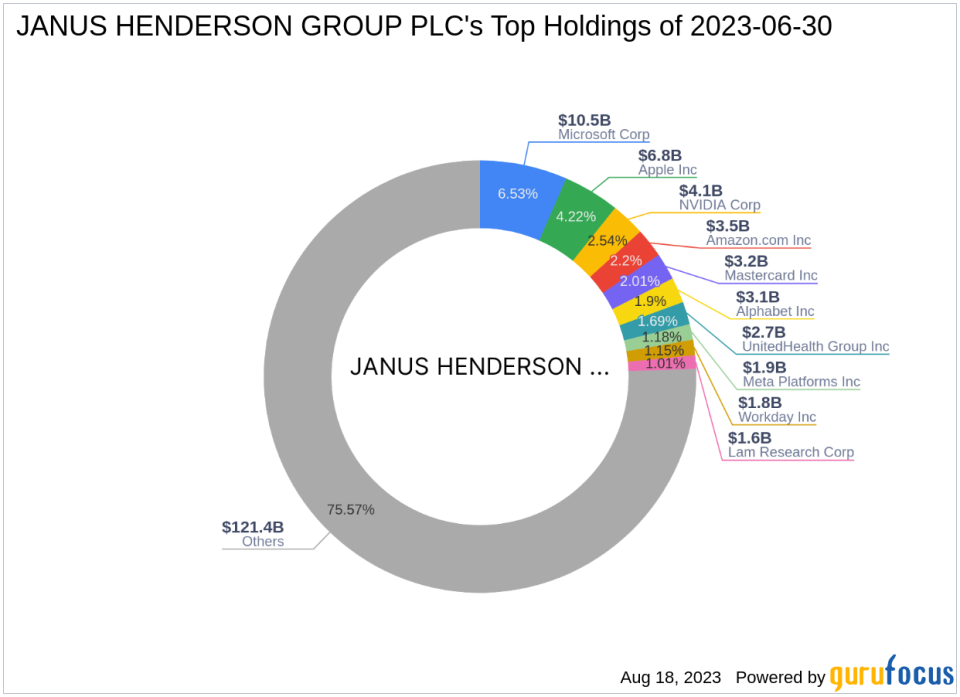

Profile of the Guru

JANUS HENDERSON GROUP PLC, located at 201 BISHOPSGATE, LONDON, X0 EC2M 3AE, is a renowned investment firm with a diverse portfolio. The firm currently holds 2,591 stocks, with a total equity of $160.73 billion. Its top holdings include tech giants like Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Mastercard Inc (NYSE:MA). The firm's investment strategy is primarily focused on the Technology and Healthcare sectors.

Overview of the Traded Stock

Benitec Biopharma Inc (NASDAQ:BNTC), a US-based biotechnology company, was first listed on the stock market on July 11, 2012. The company is engaged in developing a proprietary therapeutic technology platform that combines RNA interference with gene therapy. This innovative approach aims to provide sustained, long-lasting silencing of disease-causing genes from a single administration. As of August 19, 2023, the company has a market cap of $7.16 million and a stock price of $2.84. Despite the company's current PE percentage being 0.00, indicating a loss, the stock is considered fairly valued according to the GF-Score, with a GF Value of 2.87 and a Price to GF Value ratio of 0.99.

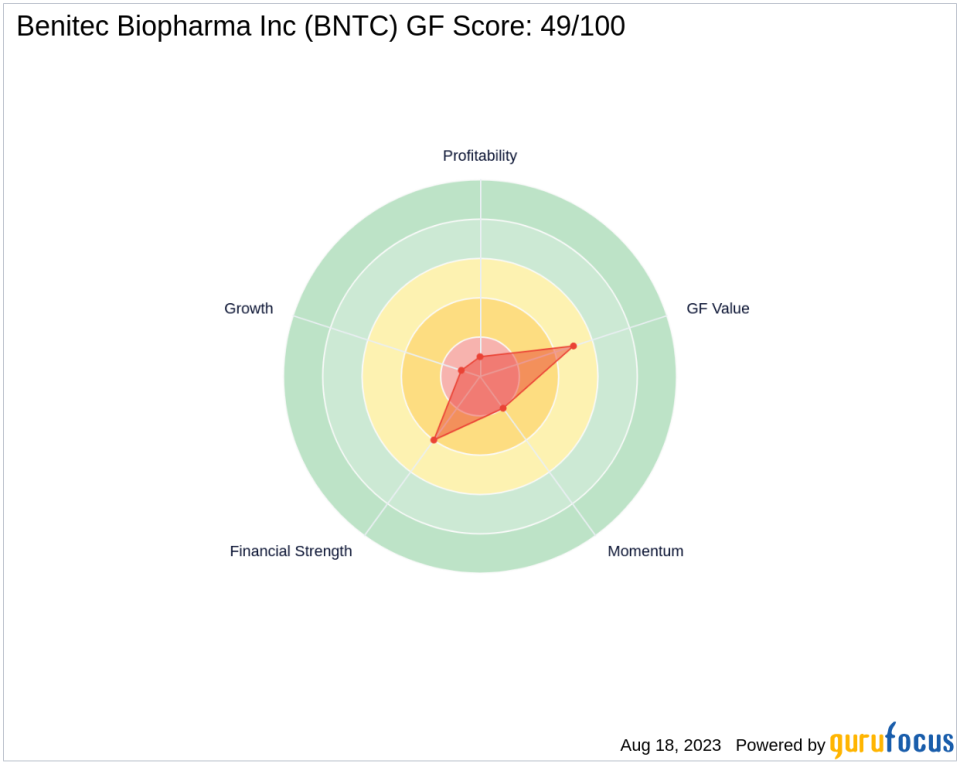

Performance of the Traded Stock

Since the transaction, BNTC's stock has seen a decrease of 11.25%. The stock has also experienced a significant drop of 99.95% since its IPO. The year-to-date performance shows a decrease of 4.54%. The stock's GF-Score is 49/100, indicating a poor future performance potential. The stock's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are both at 1/10. The GF Value Rank is 5/10, and the Momentum Rank is 2/10. The stock's Piotroski F-Score is 3, and its Altman Z score is -33.98, indicating financial distress.

Financial Health of the Traded Stock

Benitec Biopharma Inc's cash to debt ratio is 10.52, ranking 723rd in the biotechnology industry. The company's ROE and ROA are -257.84 and -183.95, respectively, with respective ranks of 1304 and 1470. The company has not shown any growth in gross margin or operating margin.

Growth of the Traded Stock

Over the past three years, Benitec Biopharma Inc has experienced a significant decrease in revenue growth, with a rate of -91.30%. The company's EBITDA and earning growth over the same period are both at 0.00. The company's 3-year revenue growth rank is 761, and its predictability rank is not available.

Momentum of the Traded Stock

The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 53.91, 47.61, and 45.07, respectively. The Momentum Index 6 - 1 Month is 6.15, while the Momentum Index 12 - 1 Month is -71.58. The stock's RSI 14 Day Rank is 948, and its Momentum Index 6 - 1 Month Rank is 369.

In conclusion, JANUS HENDERSON GROUP PLC's acquisition of Benitec Biopharma Inc shares represents a strategic move into the biotechnology sector. Despite the stock's current performance and financial health, the firm's investment could yield potential returns in the long run, given the innovative nature of Benitec Biopharma Inc's business.

This article first appeared on GuruFocus.