JANUS HENDERSON GROUP PLC Increases Stake in Avadel Pharmaceuticals PLC

On July 31, 2023, the London-based investment firm, JANUS HENDERSON GROUP PLC, made a significant addition to its portfolio by acquiring a substantial stake in Avadel Pharmaceuticals PLC. (NASDAQ:AVDL). This article provides an in-depth analysis of the transaction, the profiles of the involved firm and company, and the potential implications for value investors.

About JANUS HENDERSON GROUP PLC

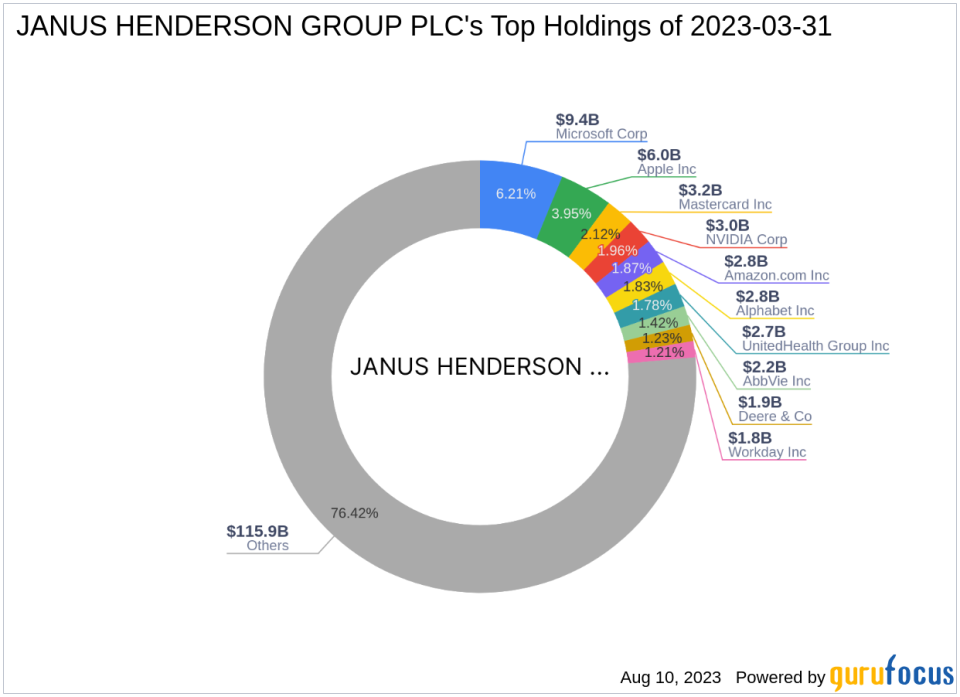

JANUS HENDERSON GROUP PLC, located at 201 BISHOPSGATE, LONDON, is a renowned investment firm with a diverse portfolio. The firm's investment philosophy is centered around identifying and capitalizing on market trends and opportunities. With 2683 stocks in its portfolio, the firm's equity stands at a staggering $151.62 billion. The firm's top holdings include tech giants like Apple Inc(NASDAQ:AAPL), Amazon.com Inc(NASDAQ:AMZN), Microsoft Corp(NASDAQ:MSFT), NVIDIA Corp(NASDAQ:NVDA), and Mastercard Inc(NYSE:MA). The firm has a strong presence in the Technology and Healthcare sectors, which are its top sectors.

Transaction Details

The transaction involved the addition of 2,616,855 shares of Avadel Pharmaceuticals PLC to JANUS HENDERSON GROUP PLC's portfolio, bringing the total shares held to 9,443,642. The shares were traded at a price of $14.1 each. This acquisition has a 0.02% impact on the firm's portfolio and represents a 12.30% stake in Avadel Pharmaceuticals PLC. The transaction has increased the firm's position in Avadel Pharmaceuticals PLC to 0.09%.

Avadel Pharmaceuticals PLC Overview

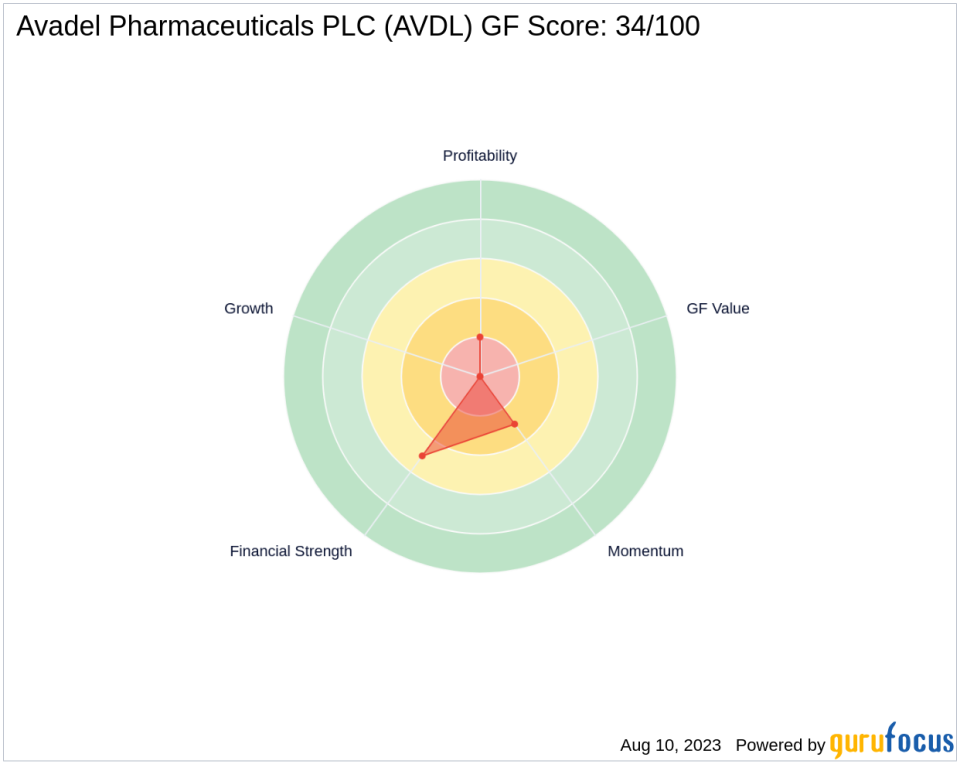

Avadel Pharmaceuticals PLC (NASDAQ:AVDL) is a specialty pharmaceutical company based in Ireland. The company, which went public on June 7, 1996, develops and commercializes branded pharmaceutical products, including controlled-release therapeutic products based on its proprietary drug delivery technologies in the United States. The company's market cap stands at $1.2 billion, with a current stock price of $13.43. However, the stock is significantly overvalued according to the GF Valuation, with a GF Value of 0.56 and a Price to GF Value ratio of 23.98. The company's GF Score is 34/100, indicating poor future performance potential.

Avadel Pharmaceuticals PLC's Financial Performance and Predictability

Avadel Pharmaceuticals PLC's financial performance has been less than stellar, with a Profitability Rank of 2/10 and a Growth Rank of 0/10 due to insufficient growth data. The company's Financial Strength is also low, with a rank of 5/10. Additionally, the company's Piotroski F-Score is 1 out of 9, indicating very poor business operations. The company's predictability rank is not available due to insufficient data.

Brandes Investment: The Largest Guru Holder of Avadel Pharmaceuticals PLC

Brandes Investment currently holds the largest share of Avadel Pharmaceuticals PLC among all gurus. However, the exact share percentage is not available due to insufficient data.

Conclusion

In conclusion, JANUS HENDERSON GROUP PLC's acquisition of a significant stake in Avadel Pharmaceuticals PLC is a noteworthy transaction. Despite Avadel Pharmaceuticals PLC's poor financial performance and overvaluation, the firm's decision to increase its stake in the company could indicate a potential turnaround in the future. However, value investors should exercise caution and conduct thorough research before making investment decisions.

This article first appeared on GuruFocus.