Janus Henderson Group PLC Reports Solid Growth in Q4 and Full-Year 2023 Earnings

Operating Income: Q4 operating income surged to $143.7 million, a significant increase from $67.8 million in Q4 2022.

Diluted EPS: Adjusted diluted earnings per share rose to $0.82 in Q4, up from $0.61 in the same quarter last year.

Dividend: A Q4 dividend of $0.39 per share was declared, with payment scheduled for February 28, 2024.

Share Repurchase: Under the $150 million program, JHG repurchased approximately 2.3 million shares for about $62 million in Q4.

AUM: Closing Assets Under Management (AUM) increased to $334.9 billion, up from $287.3 billion at the end of 2022.

Investment Performance: A significant portion of AUM outperformed benchmarks across equities, fixed income, and alternatives.

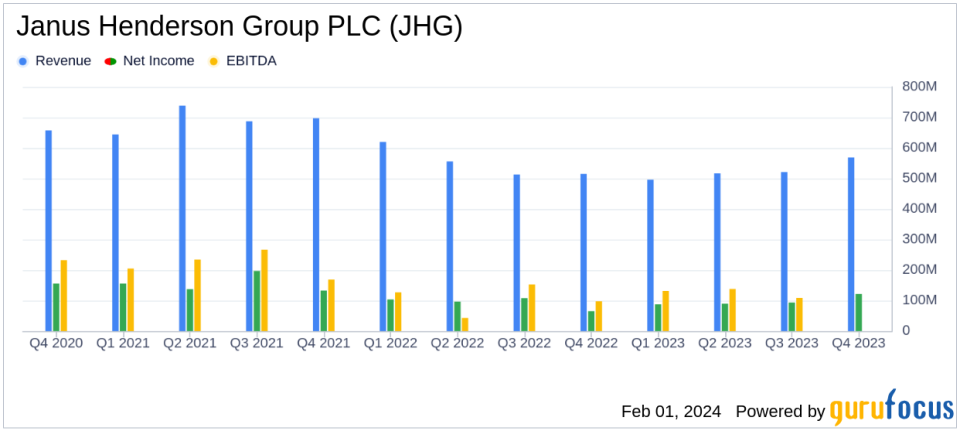

On February 1, 2024, Janus Henderson Group PLC (NYSE:JHG) released its fourth quarter and full-year 2023 results, showcasing a year of solid financial performance despite ongoing market challenges. The company's 8-K filing revealed a notable increase in operating income and earnings per share (EPS), reflecting the firm's effective cost management and strategic reinvestment in its business.

Janus Henderson Group, a global active asset manager, provides investment management services to a diverse client base, including retail intermediary, self-directed, and institutional clients. With a focus on active equities, fixed-income, multi-asset, and alternative investment platforms, JHG managed approximately $335 billion in assets as of December 31, 2023. The company, headquartered in London, is dual-listed on the New York Stock Exchange and the Australian Securities Exchange, with a significant presence in North America, Europe, the Middle East, Africa, Latin America, and the Asia-Pacific region.

Financial Highlights and Challenges

For the fourth quarter of 2023, JHG reported an operating income of $143.7 million, a substantial improvement from $67.8 million in the fourth quarter of 2022. Adjusted operating income also saw a healthy increase to $156.2 million, compared to $123.2 million in the prior year's quarter. This growth in operating income is a testament to the company's disciplined approach to cost management and its ability to adapt to market conditions.

Adjusted diluted EPS for the quarter stood at $0.82, marking an increase from $0.61 in the fourth quarter of 2022. This rise in EPS indicates not only improved profitability but also JHG's commitment to delivering value to its shareholders.

Despite these financial achievements, JHG's CEO, Ali Dibadj, acknowledged the uncertain environment and industry headwinds, emphasizing the company's focus on controlling what it can and positioning for growth. With a "fortress balance sheet" and strong cash generation, JHG is poised to navigate the challenges ahead.

Operational Efficiency and Shareholder Returns

The company's commitment to shareholder returns was evident in the declaration of a $0.39 per share dividend for the fourth quarter, payable on February 28, 2024. Additionally, JHG continued its share repurchase program, buying back approximately 2.3 million shares for a total outlay of approximately $62 million.

Closing AUM increased to $334.9 billion, up from $287.3 billion at the end of 2022, reflecting net positive flows and favorable market movements. This growth in AUM underscores JHG's ability to attract and retain client assets in a competitive landscape.

Investment performance remained a strong suit for JHG, with a significant portion of AUM outperforming benchmarks across equities, fixed income, and alternatives. This performance is crucial for an asset management firm, as it drives client satisfaction and retention.

Looking Forward

As JHG enters its 90th anniversary year, the company is encouraged by signs of progress and remains focused on achieving organic growth and delivering superior outcomes for all stakeholders. With disciplined investment teams and processes, JHG is well-equipped to continue its trajectory of financial success.

For a more detailed analysis of JHG's financial results, including income statements, balance sheets, and cash flow statements, please refer to the full 8-K filing.

Janus Henderson Group's financial resilience in the face of market volatility and its strategic initiatives aimed at growth and efficiency make it a noteworthy company for value investors and those seeking a robust asset management partner.

Explore the complete 8-K earnings release (here) from Janus Henderson Group PLC for further details.

This article first appeared on GuruFocus.