Janus International Group Inc (JBI) Reports Solid Growth and Initiates Share Repurchase Program

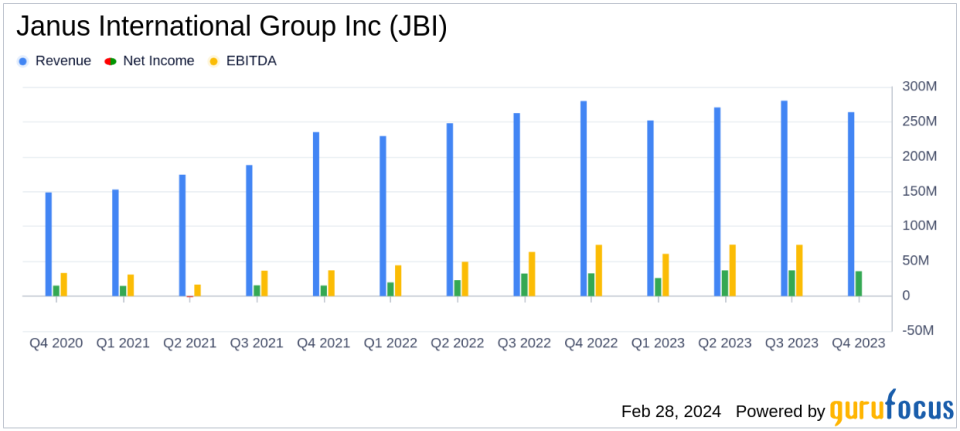

Revenue Growth: Full year revenue increased by 4.6% to $1,066.4 million.

Net Income Surge: Net income rose by 25.9% to $135.7 million, or $0.92 per diluted share.

Adjusted EBITDA Increase: Adjusted EBITDA for 2023 climbed 25.9% year-over-year to $285.6 million.

Free Cash Flow Conversion: Achieved a strong free cash flow conversion of Non-GAAP Adjusted Net Income of 142%.

Share Repurchase Program: Announced a $100 million share repurchase program, underscoring confidence in long-term value creation.

On February 28, 2024, Janus International Group Inc (NYSE:JBI), a global leader in building solutions and access control technologies for the self-storage and other commercial and industrial sectors, announced its financial results for the fourth quarter and full year ended December 30, 2023. The company released its 8-K filing, revealing a year of robust growth and strategic achievements.

Company Overview

Janus International Group Inc is renowned for its comprehensive range of products and services tailored to the self-storage industry, including roll-up and swing doors, hallway systems, and relocatable storage units. Additionally, the company offers advanced technologies for facility and door automation. With a footprint in both North America and internationally, Janus International Group Inc caters to a diverse clientele, delivering solutions that drive efficiency and customer satisfaction in the construction sector.

Financial Performance and Challenges

Despite a 5.7% decrease in fourth-quarter revenue compared to the same period in 2022, Janus International Group Inc achieved significant full-year revenue growth. The 4.6% increase to $1,066.4 million was primarily fueled by a 13.2% rise in self-storage revenues, which offset a 10.2% decline in Commercial and Other revenues. The company's net income for the year soared by 25.9% to $135.7 million, translating to $0.92 per diluted share, with adjusted earnings per diluted share reaching $0.94.

Adjusted EBITDA for the full year 2023 stood at $285.6 million, marking a substantial 25.9% improvement from the previous year. This growth was driven by increased revenue in the Self-Storage sales channels and effective cost containment measures. The company also reported a robust free cash flow conversion of Non-GAAP Adjusted Net Income of 142%, reflecting its strong cash generation capabilities.

However, the company faced challenges, including a decrease in fourth-quarter revenue and increased labor and logistics costs. These challenges highlight the importance of maintaining a focus on cost management and operational efficiency to sustain growth and profitability.

Financial Achievements and Importance

The company's financial achievements, particularly the improvement in net income and adjusted EBITDA margins, underscore its ability to navigate market dynamics effectively. The introduction of a $100 million share repurchase program demonstrates confidence in Janus International Group Inc's long-term value proposition and commitment to returning value to shareholders.

Key Financial Metrics

Janus International Group Inc's financial strength is further evidenced by its year-end net leverage ratio of 1.6x, a decrease from the previous year, reflecting a solid balance sheet and prudent debt management. The company's operating cash flow increased significantly to $215.0 million compared to $88.5 million in the previous year, highlighting its operational efficiency and cash management prowess.

Management Commentary

Ramey Jackson, CEO of Janus International Group Inc, commented on the results: "A relentless focus on execution and strong demand fundamentals in our end markets drove another year of record results in 2023. We are proud of all we accomplished including the pay down and refinancing of our term loan, the opening of our Atlanta software center and migration of the Nok? cloud provider to Amazon Web Services, and the opening of our manufacturing facility in Poland. Supported by our leading market position in self-storage, we generated solid organic growth, a 450-basis point improvement in adjusted EBITDA margin, substantial free cash flow generation, and another meaningful decrease in net leverage to 1.6x."

2024 Financial Outlook and Long-Term Targets

Looking ahead, Janus International Group Inc has provided an optimistic full-year 2024 revenue guidance, projecting an increase to a range of $1.092 billion to $1.125 billion. The company also anticipates adjusted EBITDA to range between $286 million and $310 million. These projections reflect the company's confidence in its growth trajectory and operational strategy.

The company reaffirms its long-term financial targets, aiming for annual organic revenue growth of 4% to 6%, an adjusted EBITDA margin of 25% to 27%, and a net leverage range of 2.0x to 3.0x. These targets highlight Janus International Group Inc's commitment to sustained growth and financial discipline.

For value investors and potential GuruFocus.com members, Janus International Group Inc's latest earnings report presents a compelling narrative of a company with robust financial health, strategic growth initiatives, and a shareholder-friendly capital allocation policy. The company's performance and outlook suggest that it is well-positioned to continue delivering value in the dynamic construction industry.

Explore the complete 8-K earnings release (here) from Janus International Group Inc for further details.

This article first appeared on GuruFocus.