Janus (JBI) Completes Migration of Noke to Amazon Web Services

Janus International Group, Inc. JBI has successfully completed the backend migration of its Noke Smart Entry system to Amazon Web Services, Inc. (“AWS”).

The company remains optimistic about the completion of the transition as it believes this will provide its customers with improved cloud connectivity, performance, operations, and quality assurance benefits.

Benefits of the Migration

The migration allows Noke to ensure its digital innovation by leveraging AWS’ leading industrial Internet of Things, artificial intelligence, and security capabilities.

Following the complex migration, Noke has witnessed an increase in its availability and global reach while running on AWS. Also, its processing times have dropped to half for almost all functions and across-the-board improvement. This success is mainly driven by the redesign of the database structure, code improvements and inherent architecture improvements provided by AWS.

Overall, Noke running on AWS showcases enabled real-time over-the-air device management accompanied by improved owner-operator and end-user experience through latency reduction and improved data synchronization.

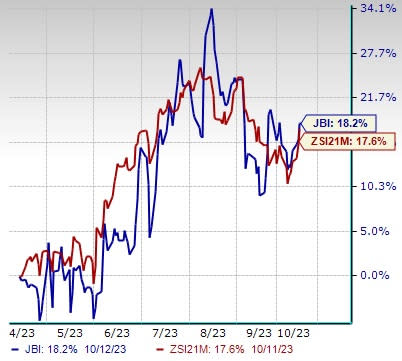

Image Source: Zacks Investment Research

The migration news most likely induced bullish sentiments among investors, considering shares of JBI increased 1.8% on Oct 11, during the trading session. Furthermore, the shares gained 18.2% in the past six months, outperforming the Zacks Building Products - Miscellaneous industry’s 17.6% growth.

Business Growth Strategies

Janus primarily focuses on achieving long-term growth targets by expanding its position in its end markets, increasing the Noke system adoption by its self-storage customers, driving efficiencies across the platform along with executing strategic and value-accretive mergers and acquisitions.

In the fiscal second quarter of 2023 (ended Jul 1), Janus witnessed an overall growth trend, which was attributable to favorable product mix, productivity as well as cost-savings initiatives, and commercial actions. These factors drove the customer demand across its self-storage, commercial and industrial end markets.

Also, during the quarter, the company witnessed 39% year-over-year growth in the Noke Smart Entry system installation units, bringing the number to approximately 230,000. Janus is consistently in the process of ramping up its technological capabilities and expanding its market penetration aligned with its Noke smart system.

Zacks Rank

Janus currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Construction sector are EMCOR Group, Inc. EME, Fluor Corporation FLR and Toll Brothers, Inc. TOL.

EMCOR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have risen 69.7% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.3% and 35.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 35.4% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Toll Brothers currently sports a Zacks Rank of 1. TOL delivered a trailing four-quarter earnings surprise of 31.4%, on average. Shares of the company have surged 75.9% in the past year.

The Zacks Consensus Estimate for TOL’s fiscal 2024 sales and EPS indicates growth of 4% and 1.5%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report