Janus' (JBI) Noke Smart System at Extra Space's 400 Facilities

Janus International Group, Inc.’s JBI Noke Smart Entry system is yet again selected by Extra Space Storage, Inc. EXR for expanding the installation base in more than 400 of its additional facilities, housing the Noke Screen, through the year 2024.

The partnership of Janus and Extra Space has been advanced with this project initiation, bringing the incorporation of the Noke smart technology and digital access to the latter’s 700 facilities approximately in this year so far. After the completion of the project, the Extra Space customer app will be integrated with the Noke Smart Entry system, aimed to provide efficient digital access with the Noke Screen to about 1,110 Extra Space properties.

Janus is optimistic about the expansion of its long-standing partnership with Extra Space through the new project. It believes that with the help of new technology, this partnership can help elevate and improve the self-storage customer experience in the upcoming period.

Image Source: Zacks Investment Research

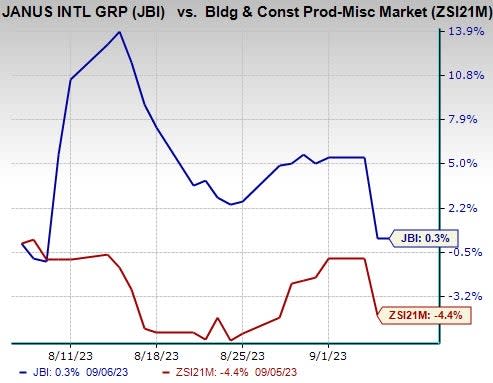

Shares of JBI declined 4.9% on Sep 5, during the trading session. Nonetheless, the shares gained 0.3% in the past month against the Zacks Building Products - Miscellaneous industry’s 4.4% decline.

JBI’s Business Growth Initiatives

Janus primarily focuses on achieving long-term growth targets by expanding the position in its end markets, increasing the Noke system adoption by its self-storage customers, driving efficiencies across the platform along with executing strategic and value-accretive mergers and acquisitions.

In the fiscal second quarter of 2023 (ended Jul 1), Janus witnessed overall growth trend attributable to favorable product mix, productivity as well as cost-savings initiatives, and commercial actions. These factors drove the customer demand across its self-storage, commercial and industrial end markets. During the quarter, the company witnessed 39% year-over-year growth in the Noke Smart Entry system installation units, bringing the number to approximately 230,000. Janus is consistently in the process of ramping its technological capabilities and expanding its market penetration aligned with its Noke smart system.

Considering the current backlog and pipeline, continued benefit of commercial actions and productivity initiatives and strong year-to-date results, Janus increased its fiscal 2023 guidance. It now expects revenues to range within $1.07-$1.09 billion, up from the previous range of $1.06-$1.08 billion. Also, the adjusted EBITDA is now expected in the range of $269.5 million to $289.5 million, up from the prior range of $253 million to $278 million.

Zacks Rank

Janus currently sports a Zacks Rank #1 (Strong Buy).

About Extra Space

Extra Space is a self-storage facilities operator, headquartered in Salt Lake City, UT. As of Jun 30, 2023, it managed 2,438 self-storage stores in 41 states and Washington, D.C. The company makes concerted efforts to consistently grow its business and achieve geographical diversity through accretive acquisitions, mutually beneficial JV partnerships and third-party management services.

The company currently carries a Zacks Rank #4 (Sell). EXR delivered a trailing four-quarter negative earnings surprise of 0.8%, on average. The Zacks Consensus Estimate for EXR’s 2023 sales indicates growth of 13.5% while earnings per share indicates decline of 4.4%, from the previous year’s reported levels.

Other Key Picks

Some other top-ranked stocks from the Construction sector are EMCOR Group, Inc. EME and TopBuild Corp. BLD.

EMCOR currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. Shares of the company have risen 87% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share indicates growth of 11.5% and 35.9%, respectively, from the previous year’s reported levels.

TopBuild currently sports a Zacks Rank of 1. BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 55.2% in the past year.

The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share indicates growth of 3.3% and 6.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report