Japan is poised to become the leading bitcoin market

September brought only bad news for bitcoin in China.

First, China banned initial coin offerings (ICOs), a red-hot new method for blockchain-based startups to raise money in a token sale; then officials ordered Chinese bitcoin exchanges like OKcoin and Huobi, some of the biggest exchanges by volume in the world, to halt trading of fiat currency (yuan) for cryptocurrency (crypto to crypto trading is still permitted).

They were crippling blows to what was previously the leading global market for bitcoin activity. And last week, South Korea followed suit in banning ICOs.

In their place, look for Japan to become the leading bitcoin market.

In April, Japan officially recognized bitcoin as legal currency and will regulate it accordingly. That boosted the price globally and boosted bitcoin trading volume on Japanese exchanges. (In May, Australia followed suit.) Japanese internet giant GMO Internet is investing $3 million to launch a bitcoin mining operation next year. And Japanese banks are reportedly planning to launch a digital currency, J-Coin, in time for the 2020 Olympics in Tokyo.

China crackdown boosts Japan

As bitcoin mining (the process of uploading “blocks” of transaction records to the bitcoin blockchain, a public ledger) became more and more prohibitively expensive, requiring large machinery to compute quickly, China became the leading country for mining. (And to be clear, there has not yet been any ban on bitcoin mining in China.) Chinese investors also ramped up bitcoin buying since last year, when the People’s Bank of China (PBOC) tightened capital controls. Bitcoin is thought to be a “safe haven” for when a nation’s currency is faltering and a hedge against general market uncertainty; with the yuan falling, bitcoin took off in China. Until now.

Japan is already pulling ahead in the aftermath of China’s crackdown.

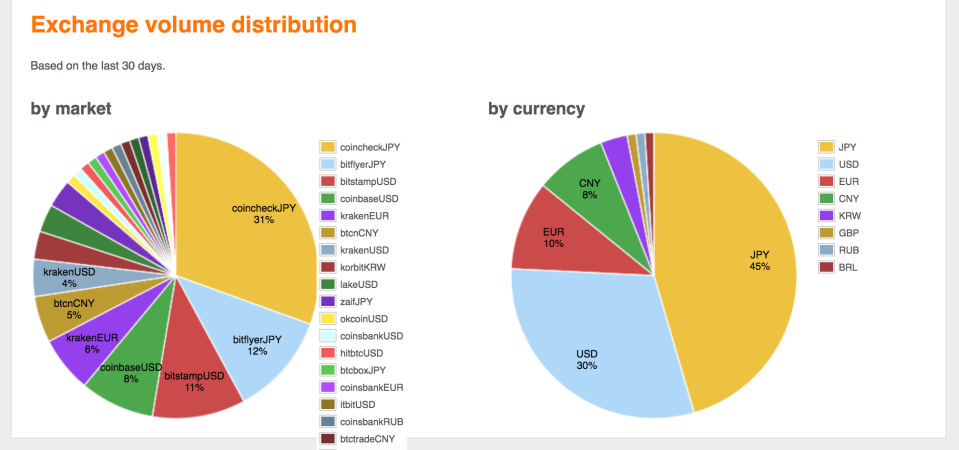

Look at the below chart of trading activity by currency in the past 30 days: the biggest slice has been bitcoin trading in the Japanese yen (45%) vs. the U.S. dollar (30%). Note also how the biggest exchanges by activity have been Coincheck and bitFlyer, both in Japan. (It helps that the yen has dipped vs the dollar in the past week.)

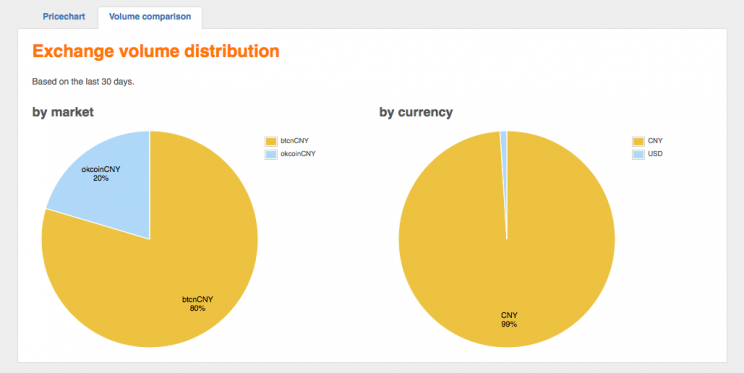

Take a look at the same chart, from the same site, one year ago. In November 2016 99% of the trading volume on exchanges was happening in the Chinese yuan.

For another look at the same trend, here’s bitcoin transaction activity in yen in the past 24 hours, up more than 2%.

And here’s the same chart for the yuan: Activity is dead.

Bitcoin price still cruising

To be sure, the China crackdown has hardly crushed the price of bitcoin overall. After an initial drop, it has rallied: The currency is down 5% in the past 30 days, but up 16% in the past week. And it’s still up more than 600% over the past 12 months.

The coin has been so resilient as a speculative investment that Goldman Sachs is now considering launching a bitcoin trading operation. On the other hand, JPMorgan Chase CEO Jamie Dimon insists that bitcoin is a “fraud… worse than tulip bulbs.”

—

Daniel Roberts closely covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Why China’s central bank fears bitcoin

Why Ethereum is the hottest new thing in digital currency

More than 75 banks are now on Ripple’s blockchain network

Expect more blockchain hype in 2017

Here’s why 21 Inc. is the most exciting bitcoin company right now

How bitcoin company Coinbase is staying relevant amid the blockchain craze