How Japan Pulled Off an Early Victory in the Race to Make More Chips

(Bloomberg) -- When Taiwan Semiconductor Manufacturing Co. unveiled plans to begin building a new chip fabrication facility in Japan in 2022 and start production in 2024, it looked like an implausibly aggressive schedule. Chip plants often take three years to complete, and, although the Taiwanese company had moved faster on its own turf, this would be its first such attempt in Japan — where it would have to navigate foreign bureaucracies and regulations.

Most Read from Bloomberg

BYD’s New $233,450 EV Supercar to Rival Ferrari, Lamborghini

Stock Rally Stalls at Start of Data-Packed Week: Markets Wrap

A Spike in Heart Disease Deaths Since Covid Is Puzzling Scientists

Yet on Feb. 24, TSMC will officially open its Kumamoto fab, putting it on track to begin mass production later this year. The ribbon-cutting marks an early victory for Japan as governments around the world race to establish domestic chip capabilities in the wake of Covid-era disruptions and growing geopolitical tensions. While the US has also courted TSMC — the leading producer of the most advanced chips — the company has already pushed back start dates for both of its planned Arizona facilities after clashes with labor unions and delays in subsidy allocations.

The success in Japan stems from a combination of factors not easily repeated elsewhere: efficient government support, strict construction timetables and a low-cost workforce that flocked to the site from around the country and then labored 24-hours a day, seven days a week. Smoothing the entire effort was a deep partnership with local champion Sony Group Corp., an investor in and customer for the chip factory.

“We committed to getting it ready in two years because that’s what TSMC asked us,” Kumamoto Governor Ikuo Kabashima said in an interview. “Being on time is important to win trust.”

Governments from Washington to Beijing and Brussels have been pressing to build their own semiconductor production capabilities after pandemic lockdowns exposed how vulnerable nations are to disruptions in global supply chains. Chip shortages shut down automotive factories in Europe, the US and Japan, where the likes of Toyota Motor Corp. and Nissan Motor Co. form a cornerstone of the economy.

Adding to the risk is the geographic concentration of advanced-chipmaking in just two countries, South Korea and Taiwan. China has long claimed the latter as its own territory, and tensions over Taiwan have grown so serious that US security experts are gaming out scenarios for a maritime blockade or even an invasion.

In Japan, after Covid hit, the powerful Ministry of Economy, Trade and Industry (METI) quickly sketched out ambitious plans to lure the likes of TSMC, Samsung Electronics Co. and Micron Technology Inc. with billions of dollars in subsidies. The Taiwanese company has already said it plans to build a second fab in Japan, and is considering a third that would make advanced 3-nanometer chips.

“The contrast between TSMC in Arizona and in Kumamoto is quite striking,” said Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology. “The Japanese government has been less vocal, but perhaps even more supportive than the US and Europe.”

TSMC said its achievements in Japan are due to support from “suppliers, customers, business partners, government and academia.” The company added that its projects in different countries are “inherently incomparable.”

This account of how Japan jumped out to an early head start in the chips race is based on reporting in Kumamoto, public comments by the primary parties and interviews with more than a dozen people involved in the project, who asked not to be named because the details they revealed aren’t public.

While METI had been trying to get TSMC’s attention for years, it wasn’t until early 2021 that talks for a new plant grew serious. Japanese officials dangled an offer that included billions of dollars in subsidies, and TSMC began to consider the idea amid the rising geopolitical risks. The company insisted on one condition: Sony had to be involved.

TSMC figured that if one of Japan’s most iconic companies was invested in the venture, the path ahead would be much smoother. TSMC and METI officials approached the Japanese electronics giant together, and Sony ultimately agreed to become a minority shareholder in the Kumamoto factory with a stake of less than 20%.

The two companies had worked together for years, with TSMC helping produce the CMOS camera sensors that Sony sells to customers like Apple Inc. for use in the iPhone. But the Kumamoto project would mean a deeper level of cooperation. Over the course of 2021, Sony’s chip chief Terushi Shimizu and TSMC Chief Executive Officer C.C. Wei talked through strategic options. The two men, who had exchanged personal phone numbers, took to calling each other regularly and speaking over Zoom. By May, they had worked out a basic framework.

Sony has deep ties to the local community in Kumamoto, dating back to when it began making sensors in the prefecture’s Kikuyo town in 2001. The town had set aside a 21.3 hectare plot of land in 2018 with the idea that Sony may expand. In July of 2021, Sony approached Kikuyo about buying the land. Just months later, TSMC announced plans for the Kumamoto factory — the first time most locals realized the project would be TSMC’s, not Sony’s.

TSMC tapped as general contractor Tokyo-based Kajima Corp., a 184-year-old construction pioneer that built the country’s first high-rise and Supreme Court building. They broke ground in April 2022 and rushed to hire 7,000 workers, tapping recruiters who pulled in people with above-average pay and ready-made housing.

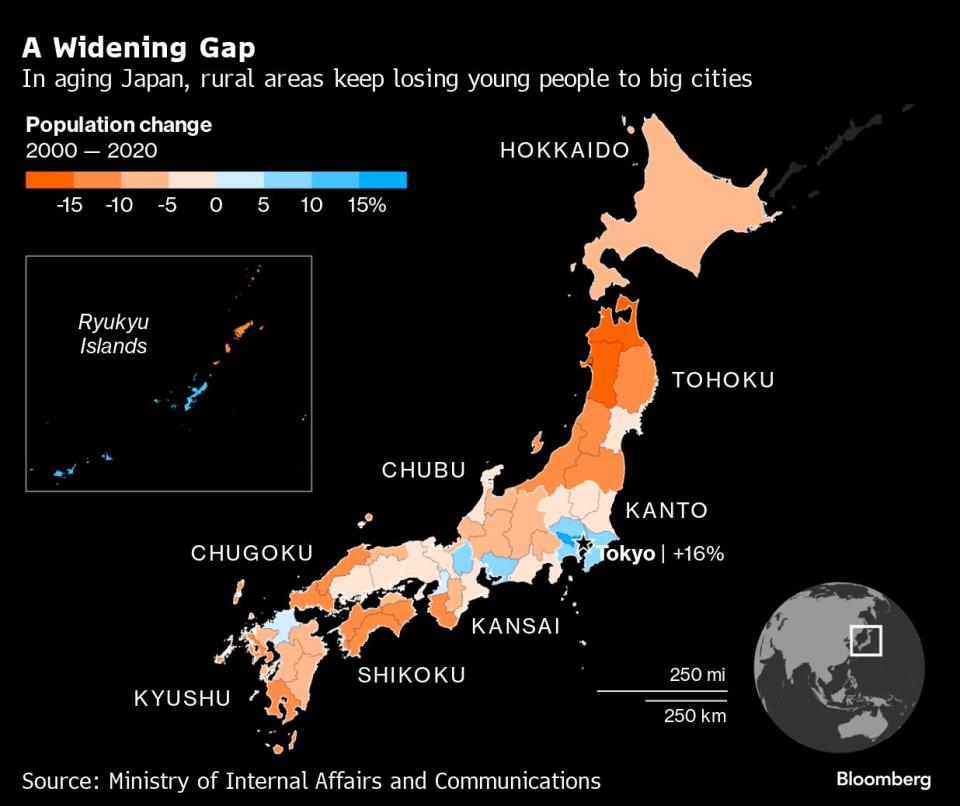

“We gathered workers from across the nation, from Hokkaido to Okinawa,” said Kazuhisa Matsuda, senior managing director at NowPlus, a Hyogo-based company that provides workers for construction sites. “A job that normally earns ¥30,000 was paid ¥50,000 at the TSMC site.”

The TSMC team could afford to pay a premium because Japan salaries are low by global standards, especially with a plunge in the yen over the last five years. Average pay for Japan construction workers is about ¥2,000 ($13) an hour, compared with $24 an hour in Arizona, according to the ERI Economic Research Institute.

Japan labor unions also tend to be more flexible than in the US and construction ran around the clock. Kikuyo residents took to calling the construction site, nestled between cabbage and carrot fields, the “nightless castle.”

As the project spilled into 2023, shortage turned to glut. One worker said he would show up on site only to find there were no jobs for him to do.

The surge of investment and workers disrupted the farm town of 44,000. Local roads suffered chronic gridlock, while shortages of housing and basic services emerged. Matsuda of NowPlus praised the lodging the TSMC team provided, but said some workers ended up commuting an hour each way because so many people were living around the construction site. The local government of Kabashima worked to alleviate the tensions, but made allowances to keep work on schedule.

Sony helped navigate other challenges. Kumamoto boasts plentiful underground water supplies — one reason it was chosen as a site for chip production — but there are risks that additional chip fabs would lead to shortages for both companies and locals. Sony staff worked with TSMC on efforts to replenish the water supplies and ease the environmental impact.

“We helped TSMC in setting up the Kumamoto factory, by providing a wide range of support such as securing the supply of water, electricity and engineers as well as obtaining permits and licenses,” a Sony spokeswoman said.

Joanne Chiao, an analyst at Taipei-based research firm TrendForce, said that Sony’s two decades of operation in the area helped develop the supply chains and infrastructure that helped keep the TSMC factory on schedule.

METI also moved quickly in agreeing to pay for about half of the roughly $8 billion Kumamoto plant, a generous subsidy by global standards. The agency knew it had developed a reputation for sluggish decision-making in the past — and was determined to proceed faster this time.

“Everybody thought Japan was too small, too slow in terms of the financial support; we sincerely regret that misdemeanor,” Hisashi Kanazashi, one of the primary officials orchestrating the chip policy, said in an interview with Bloomberg Television. “That’s why we recognized the importance of speed.”

METI has also touted the economic benefits of its chip investments for regions beyond Tokyo. It’s concentrated its efforts on the southern island of Kyushu, where Kumamoto is, and the northern island of Hokkaido.

By December of 2023, the construction company Kajima finished the building’s outer walls, allowing TSMC to proceed with installation of the enormous chip-making machines made by the likes of Tokyo Electron Ltd. and Applied Materials Inc. Engineers work four shifts a day setting up the production lines, with effectively no breaks in the labor.

Chip-making machines require delicate and skilled handling during the preparations. TSMC staff from Taiwan have taken the lead in the process given their prior experience, but the rigor of their instructions and the complexity of the workflow has led to frustration among some Japanese workers. Some local workers have quit, despite the high pay.

Nevertheless, TSMC has shown growing confidence in Japan. The company began discussions for a second fab in 2023 and it was officially announced this month. The first fab will produce less advanced chips, at 12 nanometers to 28 nanometers, while the third facility may manufacture chips sophisticated enough for today’s iPhone and artificial-intelligence applications.

In a sign of how important chips are for the Japan economy, Toyota Motor Corp. and auto supplier Denso Corp. have joined TSMC and Sony as investors in the Kumamoto joint venture.

“By providing a large amount of subsidies, the government is showing the direction that the companies should head toward,” said Waseda Business School professor Atsushi Osanai. “That is decreasing the psychological burden for corporate executives in making big investment decisions.”

METI, after years of backing off from what was once considered the world’s most fearsome industrial policy, is enjoying something of a revival. Besides the support for foreign players like TSMC and Samsung, the government is helping fund a domestic startup called Rapidus Corp. in its long-shot mission to become a leading foundry. All told, Japan is aiming to offer ¥10 trillion in financial support, along with the private sector.

“Japan is a really impressive case study,” said Reva Goujon, a director at the Rhodium Group think tank. “METI has been very introspective about where they made mistakes in the past and where they can do better. This is Japan’s comeback tour.”

--With assistance from Jane Lanhee Lee and Debby Wu.

Most Read from Bloomberg Businessweek

Elon Musk’s Vegas Tunnel Project Has Been Racking Up Safety Violations

Transcript: Did Musk Buy Twitter to Keep His Movements Secret?

Can the Masters of Hipster Cringe Conquer Hollywood With Wall Street Cash?

©2024 Bloomberg L.P.