Jasper (JSPR) Up on FDA Nod to Begin Early-Stage Urticaria Study

Jasper Therapeutics, Inc. JSPR announced the FDA clearance of its investigational new drug application to begin a phase Ib/IIa study of subcutaneous (SC) briquilimab, the company’s lead pipeline candidate, to treat chronic spontaneous urticaria (CSU).

Briquilimab (formerly JSP191) is Jasper’s proprietary antibody therapy targeting c-Kit (CD117) and is being developed to treat several mast and stem cell diseases.

Management believes that the phase Ib/IIa dose-escalation study of briquilimab SC will provide the proof of concept for the candidate’s novel mechanism of action in CSU treatment.

Jasper expects to enroll the first patient in its phase Ib/IIa dose-escalation study of briquilimab for CSU by the end of 2023 and report data from early cohorts by mid-2024.

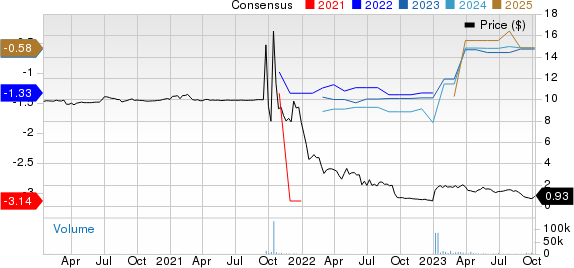

The company’s stock surged 16.3% on Monday, in response to the encouraging news. Year to date, shares of Jasper have shot up 92.6% against the industry’s 18.3% fall.

Image Source: Zacks Investment Research

The planned phase Ib/IIa dose-escalation study will evaluate the repeat doses of briquilimab SC in adult CSU patients. JSPR expects to enroll patients who are ineligible for, or refractory to, Novartis’ NVS Xolair (omalizumab) in the study.

The early-mid-stage study of briquilimab in the CSU indication is expected to enroll approximately 40 patients from across the United States and EU, and divided into six cohorts. The study’s primary endpoints will be the safety and tolerability of briquilimab. The secondary endpoints of the phase Ib/IIa dose-escalation study will comprise the measures of efficacy and pharmacokinetics.

In mast cell disease indications, briquilimab is also being developed for chronic inducible urticaria (CIndU), which is currently in the pre-clinical stage. A clinical trial application for the CIndU study has now been filed with the European Medicines Agency to begin a clinical study for the CIndU indication. In the EU, Jasper expects to begin the clinical study of briquilimab in the CIndU indication in the first quarter of 2024, subject to clearance by the regulatory body. Initial data readout is anticipated by the end of 2024.

Furthermore, JSPR is evaluating briquilimab to treat lower-intermediate-risk myelodysplastic syndromes (LR-MDS) and novel stem cell transplant conditioning regimens in separate early-stage studies. In June 2023, Jasper reported that it has successfully dosed the first patient in its phase I study evaluating briquilimab as second-line therapy in patients with LR-MDS.

Novartis’ Xolair, an injectable prescription medicine, was initially approved in the United States for the treatment of moderate-to-severe or severe persistent allergic asthma. It is currently approved in more than 90 countries, including the United States and EU. The drug’s label was later expanded to include the treatment of CSU as well as nasal polyps, in both the EU and U.S. markets.

In the United States, Novartis co-develops and co-promotes Xolair with Roche and shares a portion of the operating income. NVS does not record any U.S. sales of Xolair. However, outside the United States, Novartis records all sales of Xolair.

Jasper Therapeutics, Inc. Price and Consensus

Jasper Therapeutics, Inc. price-consensus-chart | Jasper Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Jasper has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are Corcept Therapeutics CORT and Better Therapeutics BTTX, each carrying a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has remained constant at 78 cents. During the same period, the estimate for Corcept’s 2024 earnings per share has also remained constant at 83 cents. Year to date, shares of CORT have gained 31.2%.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

In the past 30 days, the Zacks Consensus Estimate for Better Therapeutics’ 2023 loss per share has remained constant at 98 cents. During the same period, Better Therapeutics’ 2024 loss per share has also remained constant at 80 cents. Year to date, shares of BTTX have lost 64.7%.

BTTX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 24.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Jasper Therapeutics, Inc. (JSPR) : Free Stock Analysis Report

Better Therapeutics, Inc. (BTTX) : Free Stock Analysis Report