Jasper Therapeutics (JSPR) Surges 110% in a Month: Here's Why

Jasper Therapeutics JSPR is a clinical-stage biotech company focused on developing novel therapeutics to treat patients with mast cell and stem cell-driven diseases.

The company is focused on the development of its lead pipeline candidate, briquilimab (formerly JSP191), an investigational monoclonal antibody designed to target c-Kit (CD117). The candidate is being evaluated in multiple clinical across a wide number of diseases, including as a conditioning agent for stem cell transplants for rare diseases.

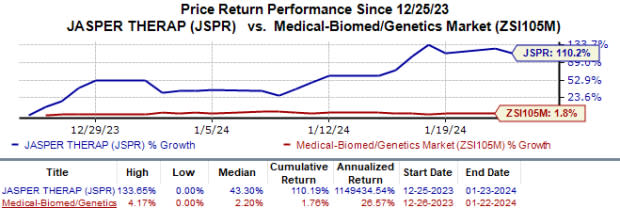

Since the past month, Jasper Therapeutics’ shareshave skyrocketed 110.2% compared with the industry’s 1.8% rise. The upside can be attributed to the company’s business updates, which were announced at the onset of this month.

Image Source: Zacks Investment Research

Last year, management decided to start two new clinical studies on briquilimab across two mast cell diseases, namely chronic spontaneous urticaria (CSU) and chronic inducible urticaria (CIndU).

In October, the FDA cleared Jasper’s investigational new drug (IND) application, seeking approval to start clinical studies on briquilimab in CSU patients. In this regard, management started the phase Ib/IIa BEACON study and is enrolling adult patients who are ineligible for, or refractory to, Novartis’ Xolair (omalizumab) in the study. JSPR recently announced that it has also received authorization from the European Union to start the BEACON study. Initial data from this study is expected in mid-2024.

Jasper has also been authorized in Europe to start the phase Ib/IIa SPOTLIGHT study on briquilimab in CIndU patients. While management has yet to begin enrolling patients in the SPOTLIGHT study, it expects to report initial data before this year's end.

Management is also enrolling patients in a phase I study evaluating intravenously-administered briquilimab as a second-line therapy for patients with lower to intermediate-risk myelodysplastic syndromes (LR-MDS). A data readout is expected in the first half of 2024.

Apart from the above clinical studies, Jasper is evaluating briquilimab in a phase I/II study as a one-time conditioning therapy for severe combined immunodeficiency (SCID) in patients who have failed a previous stem cell transplant.

The above clinical studies are being sponsored by Jasper. Briquilimab is also being studied as a conditioning agent in fanconi Anemia (FA), chronic granulomatous disease (CSD), GATA-2 Type MDS (GATA2 MDS) and sickle cell disease (SCD) indications. These studies are being sponsored by the company’s partners, Stanford University and National Institutes of Health.

With no marketed products/therapies in its portfolio, Jasper is entirely dependent on the successful development of its pipeline development. Apart from briquilimab, Jasper has no other candidate in its pipeline. Any pipeline/regulatory setbacks are likely to mar the company’s growth prospects.

Jasper Therapeutics, Inc. Price

Jasper Therapeutics, Inc. price | Jasper Therapeutics, Inc. Quote

Zacks Rank & Other Stocks Consider

Jasper Therapeutics currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX and Novo Nordisk sport a Zacks Rank #1 (Strong Buy), Sarepta carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics for 2023 have swung from a loss of 6 cents per share to earnings of 2 cents. During the same period, estimates for 2024 have narrowed from a loss of 21 cents to a loss of 6 cents. Shares of CytomX have lost 38.6% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.67. During the same period, the earnings estimates for 2024 have risen from $3.15 to $3.29. Shares of NVO have surged 51.7% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $6.90 per share to $6.57 per share. During the same period, earnings estimates per share for 2024 have risen from 98 cents to $2.14. Sarepta’s shares have lost 1.7% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Jasper Therapeutics, Inc. (JSPR) : Free Stock Analysis Report