Jazz (JAZZ) Lags Q3 Earnings, Beats Sales, Raises '23 View

Jazz Pharmaceuticals JAZZ reported adjusted earnings of $4.84 per share in third-quarter 2023, missing the Zacks Consensus Estimate of $4.90. The reported figure declined 6% year over year due to increased R&D expenditures during the quarter.

Total revenues in the reported quarter rose 3% year over year to $972.1 million. Sales of Xywav, Epidiolex and Rylaze drove the upside. Total revenues beat the Zacks Consensus Estimate of $969.5 million.

Quarter in Detail

Net product sales increased by 0.3% from the year-ago quarter’s levels to $938.4 million. The reported figure missed the Zacks Consensus Estimate and our model estimates of $946.9 million and $952.7 million, respectively.

Jazz recorded $28.9 million during the quarter as royalty revenues from high-sodium oxybate authorized generic (AG), beating our model estimates of $8 million.

Other royalties and contract revenues dropped 1% to $4.8 million in the quarter.

Neuroscience Products

Sales of Jazz’s neuroscience products dropped 5% to $675.1 million.

Net product sales for the combined oxybate business (Xyrem + Xywav) fell 11% to $456.7 million in the quarter. This combined revenue figure beat the Zacks Consensus Estimate and our model estimates of $465 million and $472 million, respectively.

Sales of the sleep disorder drug Xyrem plunged 51% year over year to $125.1 million due to patients switching to Xywav and the launch of AGs in 2023.

Xywav, a low-sodium formulation of Xyrem, recorded sales of $331.6 million in the quarter, up 30% year over year. The upside can be attributed to the encouraging uptake of the drug in narcolepsy and idiopathic hypersomnia (IH) indications. The drug is currently Jazz’s most extensive product by net sales.

Sales of the epilepsy drug Epidiolex/Epidyolex rose 9% to $213.7 million. The drug was added to Jazz’s portfolio with the GW Pharmaceuticals’ acquisition in 2021. Jazz is making significant progress related to the launch of Epidyolex in Europe and other ex-U.S. markets. Epidiolex sales missed the Zacks Consensus Estimate and our model estimates of $219 million and $221 million, respectively.

Another drug added with the GW Pharma acquisition was Sativex, a cannabis-based mouth spray for multiple sclerosis-related spasticities, approved in Europe but not in the United States. The drug recorded sales of $4.6 million in the quarter, up 44% year over year.

Oncology Products

Oncology product sales increased 17% to $260.4 million.

New drug Rylaze recorded sales of $104.9 million in the quarter, up 43% year over year. Jazz stated that demand remained strong during the quarter. Rylaze is approved in the United States for treating acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL) patients. The drug was recently approved in Europe for a similar indication, where it will be commercially launched before this year’s end under the trade name Enrylaze.

Rylaze sales beat the Zacks Consensus Estimate and our model estimates of $102 million and $100 million, respectively.

Zepzelca, approved for small cell lung cancer, recorded sales worth $78 million in the quarter, up 11% year over year, driven by an increase in underlying demand.

Acute myeloid leukemia drug Vyxeos generated sales of $29.8 million, down 1% from the year-ago period’s levels.

Defitelio sales were down 4% year over year at $47.7 million in the quarter.

Cost Discussion

Adjusted selling, general and administrative (SG&A) expenses were down 1% year over year at $273 million.

Adjusted research and development (R&D) expenses rose 80% to $217.8 million, mainly due to the support for the increased costs of developing pipeline candidates.

2023 Guidance

Jazz revised its financial guidance for the full year 2023.

Total revenues are now expected to be in the range of $3.75-$3.88 billion, a $25 million raise in the lower limit of the previously provided guidance range of $3.73-$3.88 billion. The revised guidance suggests a 4% year-over-year growth at the midpoint compared with 2022 levels. In 2023, Jazz expects continued growth in net sales of Xywav, Epidiolex and its oncology portfolio.

Neuroscience sales are expected to be $2.72-$2.83 billion (unchanged), suggesting flat year-over-year growth at the midpoint compared to 2022. The Oncology franchise is expected to record sales in the range of $0.98-$1.05 billion (previous guidance: $0.95-$1.05 billion), indicating growth of 16% at the midpoint compared with 2022 levels.

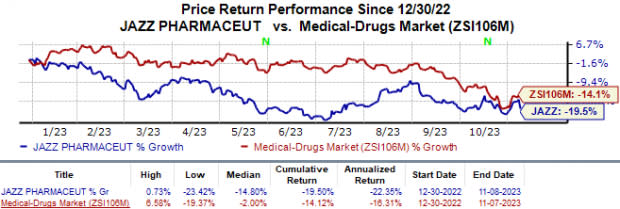

Jazz’s shares were up 2.5% in after-market trading on Nov 8, likely due to the raised revenue guidance. In the year so far, Jazz’s shares have declined 19.5% compared to the industry’s 14.1% fall.

Image Source: Zacks Investment Research

While adjusted SG&A expenses are anticipated between $1.07 billion and $1.11 billion (previous guidance: $1.05-$1.11 billion), adjusted R&D expenses are now expected to be in the band of $780-$820 million (previous guidance: $675-$725 million).

Management reiterated its 2023 adjusted earnings in the range of $18.15-$19.00 per share.

Based on the royalty structures within the AG agreements, the company expects to record higher royalty revenues from high-sodium oxybate AG in second-half 2023 compared with the first half’s levels.

Pipeline Update

Management plans to initiate a rolling biologics license application (BLA) submission with the FDA, seeking accelerated approval for zanidatamab for second-line treatment of biliary tract cancer before year-end. It expects to complete this rolling submission by first-half 2024.

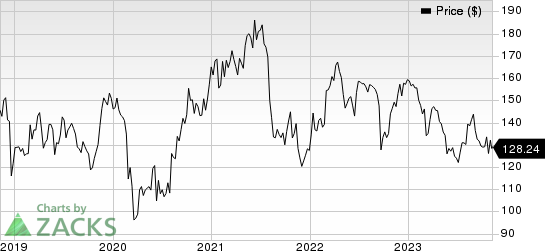

Jazz Pharmaceuticals PLC Price

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Other Stock to Consider

Jazz currently has a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include Apellis Pharmaceuticals APLS, Avid Bioservices CDMO and Biohaven BHVN, also carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apellis Pharmaceuticals’ loss estimates for 2023 have narrowed from $4.89 to $4.59 per share in the past 60 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.78 to $1.92. Year to date, Apellis Pharmaceuticals’ stock has lost 9.1%.

Apellis Pharmaceuticals beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing a negative earnings surprise of 3.91% on average. In the last reported quarter, APLS reported a negative earnings surprise of 39.29%.

In the past 60 days, estimates for Avid Bioservices’ 2023 loss per share have narrowed from 15 cents to 5 cents. During the same period, the earnings estimates per share for 2024 have risen from 13 cents to 21 cents. Shares of CDMO are down 60.1% in the year-to-date period.

Earnings of Avid Bioservices beat estimates in three of the last four quarters while meeting the mark on one occasion, witnessing an average earnings surprise of 181.25%. In the last reported quarter, Avid’s earnings beat estimates by 100.00%.

Biohaven’s loss estimate has narrowed from $4.99 to $4.93 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $4.81 to $4.79. Shares of BHVN have surged 114.9% in the year-to-date period.

The earnings of Biohaven beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing a negative average earnings surprise of 29.37%. Biohaven’s earnings missed estimates by 6.47%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Biohaven Ltd. (BHVN) : Free Stock Analysis Report

Avid Bioservices, Inc. (CDMO) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report