JB Hunt: High-Quality Business, but Fully Valued

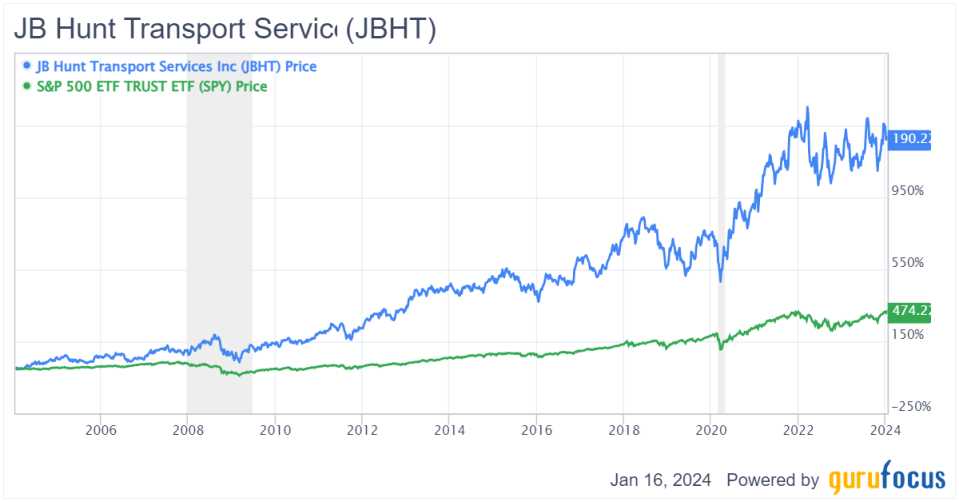

J.B. Hunt Transportation Services Inc. (NASDAQ:JBHT) has a solid history of delivering long-term results for shareholders. Over the past 20 years, the company has delivered a total return of 1,570% compared to a total return of 517% delivered by the S&P 500.

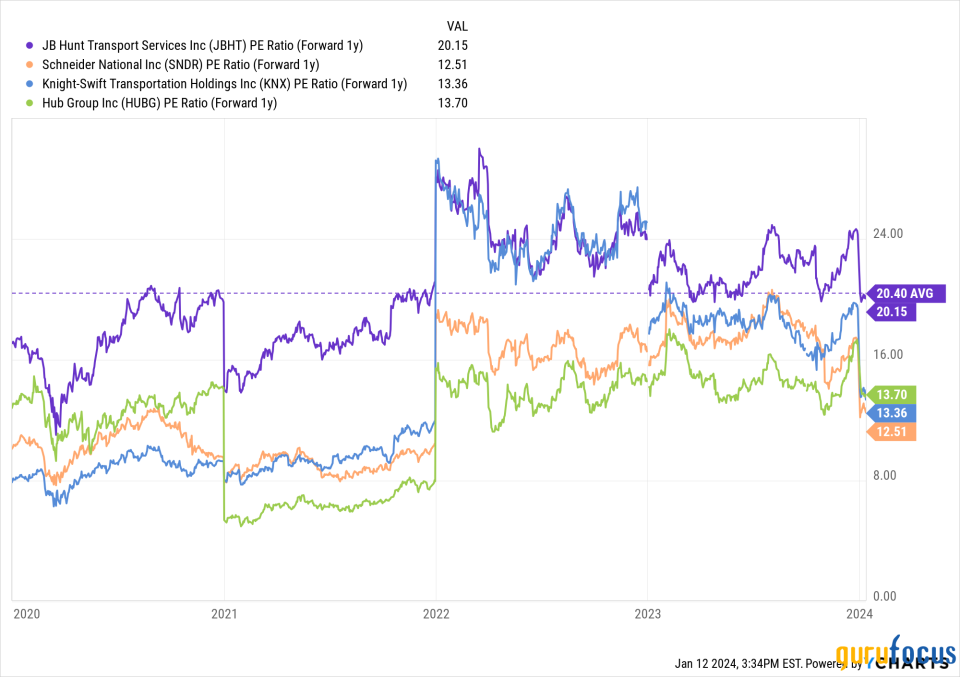

The company benefits from competitive advantages due to its size and scope of operations. However, J.B. Hunt currently trades at a slight premium valuation to the broader market and has growth prospects which are similar to the broader market. It is also trading at a premium valuation relative to its peers.

JBHT Data by GuruFocus

A leading transportation, delivery and logistics company

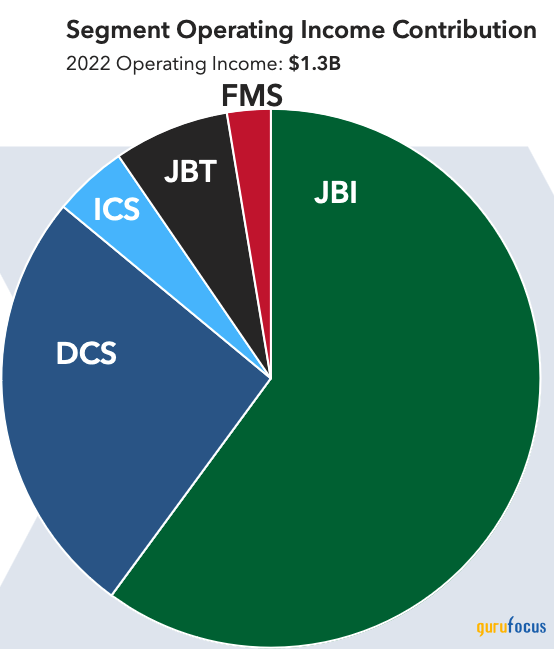

J.B. Hunt is a leader in the transportation business and is one of the largest logistics companies in North America. It breaks out its business into five segments.

The Intermodal segment utilizes arrangements with most major North American rail carriers to provide intermodal freight solutions across the U.S., Canada and Mexico.

As for the Dedicated Contract Services segment, it focuses on private fleet conversion and creation in replenishment and specialized equipment. It specializes in the design, development and execution of supply chain solutions that support a variety of transportation networks.

The Integrated Capacity Solutions segment provides traditional freight brokerage and transportation logistics solutions to customers through third-party carries and integration with other segments.

The Truckload segment provides full-load, dry-van freight, utilizing tractors and trailers operating over roads and highways. The company uses company-owned tractors and employee drivers or independent contractors or third-party carriers who agree to transport freight on its trailers.

The Final Mile Services segment provides last-mile delivery services to customers.

While J.B. Hunt is diversified in terms of its offerings, the company's key business is Intermodal, which accounts for nearly half of the company's revenue and a majority of segment operating income. Dedicated Contract Services is also a significant contributor, while its other segments are less significant revenue and income contributors.

Highly competitive business, but advantages due to scale

J.B. Hunt competes with a wide range of companies in the logistics business. Key competitors in the intermodal business, which is the company's most important business, include Hub Group (NASDAQ:HUBG), Schneider (NYSE:SNDR), Knight-Swift (NYSE:KNX) and STG Logistics. It also competes with some less-than truckload carriers, railroads and transportation brokerage companies.

In its most recent 10-K, J.B. Hunt noted the highly competitive nature of its business as a key risk:

"We compete with many other transportation service providers of varying sizes and, to a lesser extent, with LTL carriers and railroads, some of which have more equipment and greater capital resources than we do. Additionally, some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or to maintain our profit margins.

In an effort to reduce the number of carriers it uses, a customer often selects so-called core carriers as approved transportation service providers, and in some instances, we may not be selected. Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors. Also, certain customers that operate private fleets to transport their own freight could decide to expand their operations, thereby reducing their need for our services."

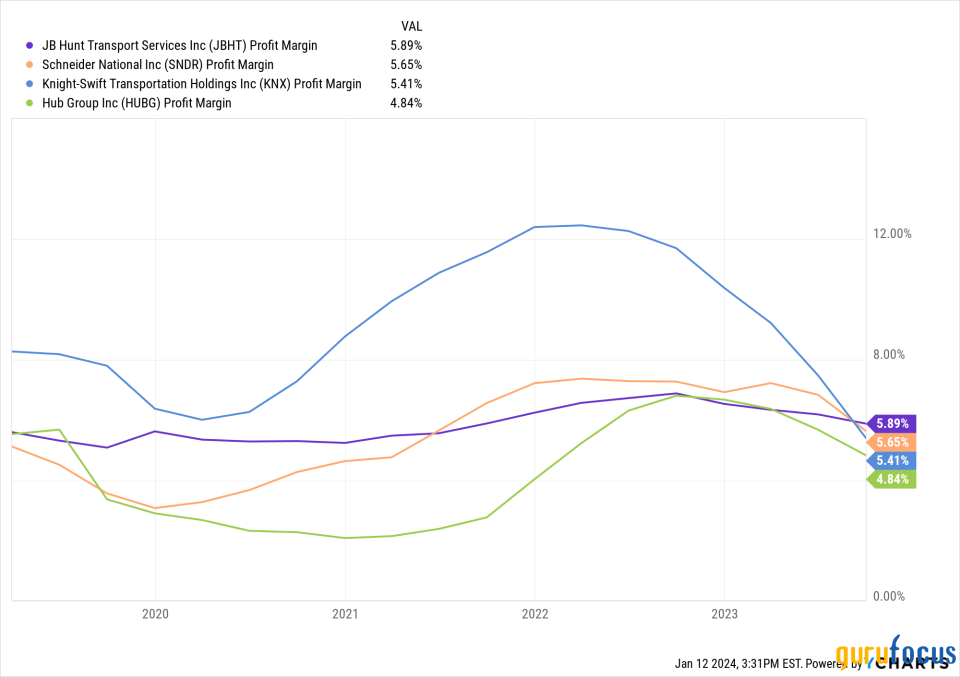

Further evidence for the highly competitive nature of the company's business can be seen in the relatively low profit margins for industry leaders. As shown by the chart below, J.B. Hunt and its three biggest competitors all have profit margins in the mid-single digits.

Despite the highly competitive nature of the transportation and logistics business, the company does enjoy some degree of competitive advantage due to scale. J.B. Hunt's scale and offering suite allows it to offer better prices than smaller players that lack scale. Moreover, its diverse set of offerings allows it to serve as a one-stop logistics solution for customers. This represents an additional advantage it has relative to smaller players.

While I do believe J.B. Hunt has a defensible competitive advantage due to size and scale, for these reasons I would not characterize it as a wide moat business due to the high degree of competition.

Growth potential

J.B. Hunt has a long history of delivering revenue and earnings growth. Over the past 10 years, the company has grown revenue per share at a 12% annual growth rate and normalized earnings per share at an 11.4% annual growth rate. Moreover, despite the highly cyclical nature of the transportation and logistics business, the company has been able to maintain profitability through difficult economic cycles.

Currently, consensus estimates call for J.B. Hunt to report earnings per share growth of 13.4%, 16.2% and 10.8% for fiscal years 2024, 2025 and 2026. I view these estimates as somewhat aggressive given the company's past 10-year earnings per share annual growth rate of 11.4%.

That said, I do believe the above trend growth is possible for 2024 given the weakness in 2023. Fiscal 2023 normalized earnings per share are expected to fall 19% from 2022. The company commented on recent weakness during its third-quarter earnings call:

"As you've heard us say since the fourth quarter call earlier this year, we have been in a challenging freight environment or a freight recession, largely driven by excess inventory in the supply chain. Our customers have been working through excess inventory, and as we stated last quarter, we felt like that de-stocking trend started to moderate in June. As we sit here today, we see further evidence of this trend, and most notably in our intermodal business, which is at the forefront of the North American supply chain. To be clear on the overall environment, we are not at a point yet to say we're out of the freight recession, but we do feel like we're coming out of it or said differently, directionally we are seeing signs of things moving in a positive direction."

Things are moving in a positive direction and thus, I expect J.B. Hunt to post solid earnings growth in 2024 versus depressed 2023 numbers. However, I am somewhat more skeptical of the consensus 16.2% earnings per share growth estimates for 2025.

Dividend and share repurchases

Despite operating in a highly cyclical business, J.B. Hunt has been able to steadily grow its dividend over time. Currently, the stock yields just 0.88% and thus the dividend yield is not highly attractive.

However, I believe the company will continue growing its dividend over the long term. Over the past 10 years, it has grown its dividend at a CAGR of 10.8%, which is roughly in line with historical earnings per share growth. I expect this to continue going forward.

In addition to a steadily rising dividend, J.B. Hunt has returned capital to shareholders via stock repurchases. Over the past 10 years, the company has reduced its share count by 12%.

During the third quarter, the company repurchased 267,000 shares for around $51 million, which implies an average repurchase price of $191 per share. As of Sept.r 30, the company had about $416 million remaining under its current repurchase authorization program. Based on current market prices, the remaining authorization represents roughly 2% of shares outstanding.

While I view share repurchases as a positive, the size and pace of J.B. Hunt's current repurchase program is not highly attractive. At a rate of $51 million per quarter, the current authorization would take 8.15 quarters or just over two years to complete. While the company may get more aggressive in terms of the size and pace of repurchases, I believe that is more likely to occur at lower stock prices.

Valuation is not highly attractive

Currently, J.B. Hunt trades at 22.7 times consensus 2024 earnings per share. This represents a slight premium to the broader market as the S&P 500 trades at 21 times consensus 2024 earnings.

While the company is expected to grow its 2024 earnings at a slightly better rate than the broader market (13.4% versus 12%), I believe its longer-term growth prospects are fairly in line with the broader market. That said, J.B. Hunt is a more cyclical business with higher earnings volatility compared to the broader market. Thus, I would only find the stock highly attractive if it were trading at a valuation somewhat below the broader market.

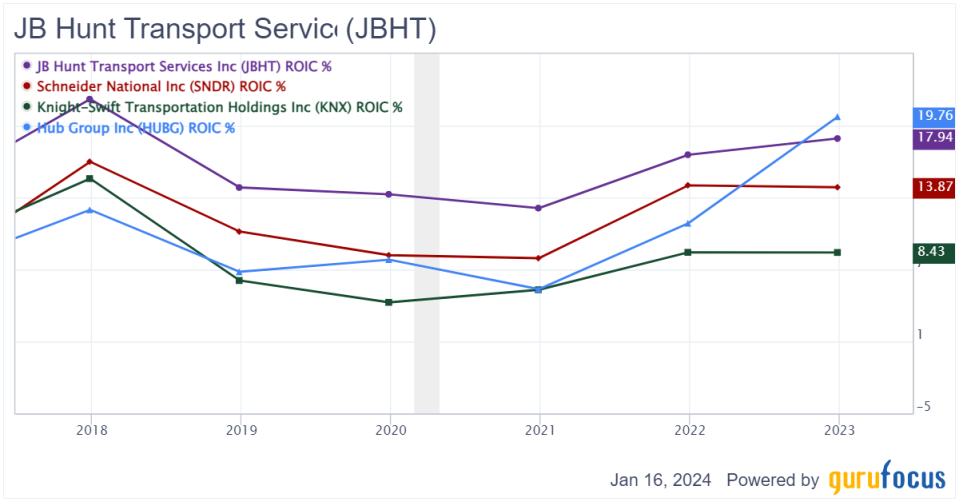

J.B. Hunt is currently trading at significant premium to peers. I do not view this premium as fully warranted given these companies all have similar growth prospects and are subject to the same risks. However, the company has historically delivered a better return on invested capital than these peers, suggesting it may have an edge due to its larger scale. For these reasons, I believe a valuation of 18 times 2024 earnings is more reasonable as that valuation represents a moderate premium to its peer group. Historically, the company has traded at a small premium to its peer group and thus, I believe this can continue going forward, though I would prefer to buy when the valuation premium is smaller than is currently the case.

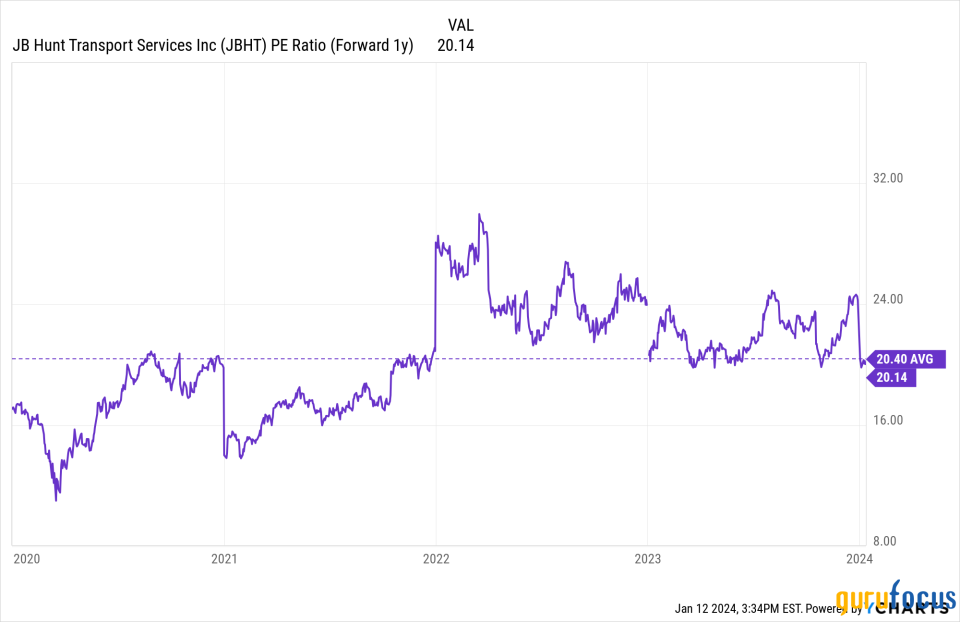

In terms of valuation relative to its own historical norm, J.B. Hunt is trading at a small premium relative to its own history. Over the past few years, the stock has traded an an average forward price-earnings ratio of 20.40.

For these reasons, I view the stock as fully valued at current levels. I believe it would be much more attractive if it were to trade at 18 times forward earnings or less. Based on current estimates, this multiple represents a share price of $152 per share.

JBHT Data by GuruFocus

Conclusion

J.B. Hunt is a high-quality company with a solid history of delivering strong results for shareholders over the long term. Despite operating in a highly competitive industry, the company has certain competitive advantages due to its scale and scope of operations.

The company has grown earnings at an 11.4% annual growth rate over the past 10 years and I expect this level of growth to continue going forward.

The company has been repurchasing shares close to the current share price, but the tepid pace of repurchases suggests management does not view the stock as highly undervalued at current levels. J.B. Hunt currently trades at a reasonable valuation relative to the broader market, but at a premium valuation to peers.

For these reasons, I view the stock as fully valued at current levels and plan to wait for the valuation to improve before adding it to my portfolio.

This article first appeared on GuruFocus.