JD.com Gains Most in Two Years After CEO Touts Consumer Recovery

(Bloomberg) -- JD.com Inc.’s shares notched their biggest gain since 2022 after the e-commerce major reported a better-than-expected 3.6% revenue rise and predicted Beijing will drive a Chinese consumer recovery.

Most Read from Bloomberg

Stock Traders Bracing for Worst Shrug Off Hot CPI: Markets Wrap

One of the Most Infamous Trades on Wall Street Is Roaring Back

Ex-Wall Street Banker Takes On AOC in New York Democratic Primary

US Core Inflation Tops Forecasts Again, Reinforcing Fed Caution

The online retailer reported sales of 306.1 billion yuan ($42.6 billion) from October to December, beating estimates by 2%. This year, policies to drive consumption should shore up confidence and prop up JD’s own business, Chief Executive Officer Sandy Xu said. Its shares rose more than 16% in New York, helped by the initiation of a $3 billion stock buyback program that matched a previous outlay.

JD.com’s results follow calls from billionaire founder Richard Liu in December to fix deep-seated issues from poor merchant support to an overly pricey item list. The company, which traditionally focused on big-ticket items such as smartphones and electronics, has since last year wielded discounts and added cheaper products to tap bargain-hunting during China’s economic downturn.

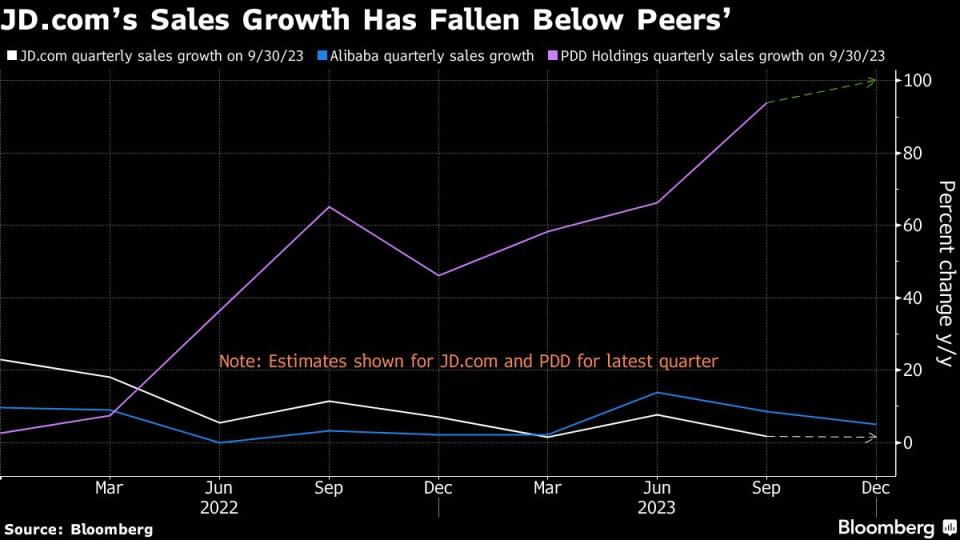

The idea was to revive topline growth — which has remained mired in single-digits in the post-Covid era — and reclaim ground lost to Alibaba Group Holding Ltd. and PDD Holdings Inc. as well as newer entrants like ByteDance Ltd.’s Douyin. This week, Premier Li Qiang pledged to promote consumer spending in electronics, appliances and even cars, though he stopped short of outlining specific measures.

“The national economy is on track for recovery,” Xu, who took the helm in mid-2023, told analysts on an earnings call. “With the expected effects of the micro stimulus plans and consumption promotion policies, we believe the momentum of consumption recovery and expansion will be further consolidated or strengthened.”

JD.com Soars as Profitability, Buyback Impress: Street Wrap

It’s unclear if JD.com can galvanize its businesses at a time China’s grappling with several major issues, including an unfolding property crisis and stubborn deflation. The company reported net income of 3.4 billion yuan in the December quarter, compared with the 4.6 billion yuan estimate.

Economic data, including retail sales, have disappointed in recent months. Top economic officials this week defended the nation’s plan to grow the economy by around 5% this year, addressing skepticism from some economists due to a perceived lack of sufficient policy support.

Read More: Billionaire JD Founder Channels Jack Ma in Call for Change

What Bloomberg Intelligence Says

JD.com could struggle to curb a decline in 1Q retail profit from a year earlier as it keeps spending on incentives to acquire new users and merchants through March amid intense e-commerce rivalry on mainland China. The resulting drag from the added costs on retail profit, 12% lower in 4Q year-over-year, may persist as a result. JD.com rolled out several initiatives over the past 12 months, including refund services without product returns and lower value thresholds for free delivery, to lure new shoppers. The company also waived fees for new merchants and cut commissions for select categories.

JD.com’s logistics business, which incurred losses in 1Q23, will likely be profitable from January-March as the enlarged unit operates more efficiently.

- Catherine Lim and Trini Tan, analysts

Click here for the research.

JD is also fighting rivals beyond online shopping. Last week, JD.com slashed the fees it charges for cloud services in response to deep cuts from Alibaba, a move that could erode margins at both their internet computing arms.

Read More: China Calls for New Appliances, More Vacation to Revive Spending

And because of mounting domestic challenges, Chinese e-commerce giants such as PDD and Alibaba are increasingly exploring overseas markets.

JD.com is considering buying UK electronics retailer Currys Plc, a deal that could grant it a foothold in Europe. That’s after the Chinese firm axed its shopping sites in Thailand and Indonesia about a year ago.

At home, investors harbor hope that Chinese consumption will gradually improve in 2024 as the central government enacts stimulus to stabilize the world’s No. 2 economy.

“Our checks suggested JD saw solid trends in electronics and home appliances in 4Q, while general merchandise and supermarket categories were softer partially due to tough comps a year ago,” Barclays analyst Jiong Shao wrote before the results.

--With assistance from Mayumi Negishi and Ville Heiskanen.

Most Read from Bloomberg Businessweek

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

Academics Question ESG Studies That Helped Fuel Investing Boom

Luxury Postnatal Retreats Draw Affluent Parents Around the US

Primaries Show Candidates Can Win on TikTok But Lose at the Polls

How Apple Sank About $1 Billion a Year Into a Car It Never Built

©2024 Bloomberg L.P.