Jeff Auxier Establishes 4 New Holdings in 4th Quarter

- By James Li

Jeff Auxier (Trades, Portfolio), manager of the Auxier Focus Fund, disclosed this week four new positions for the fourth quarter of 2018: Cigna Corp. (CI), Value Line Inc. (VALU), Gates Industrial Corp. PLC (GTES) and RumbleON Inc. (RMBL).

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of CI

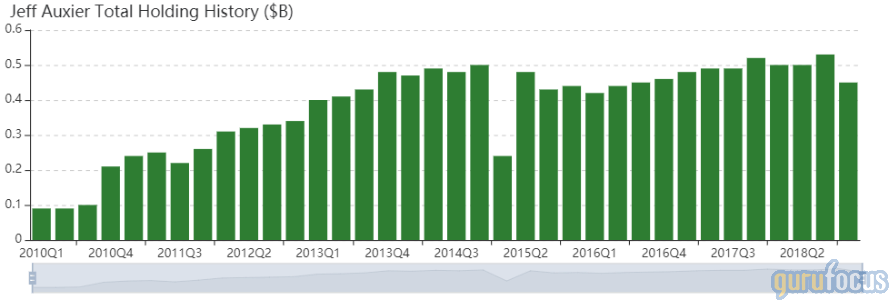

Managing an equity portfolio of 146 stocks, Auxier attempts to find compelling, undervalued securities with strong or improving fundamentals, consistency in operating results and ability to earn high rates of return on capital. Based on current portfolio statistics, the fund's top sectors in terms of portfolio weight are health care, financial services and consumer staples.

Guru champions attention to detail

Auxier said in his quarterly letter the fund returned -10.36% in a quarter where the Standard & Poor's 500 index declined 13.52%. The fund manager said Treasury bills outperformed most major investment classes as over 95% of global assets declined for the year.

Despite the market downturn, Auxier continues his mindset of identifying investment opportunities through rigorous fundamental research. Serious investing, according to the fund manager, means going through the "nitty gritty grinding focus of the details" and accumulating knowledge about underlying facts, fundamentals and business cycles.

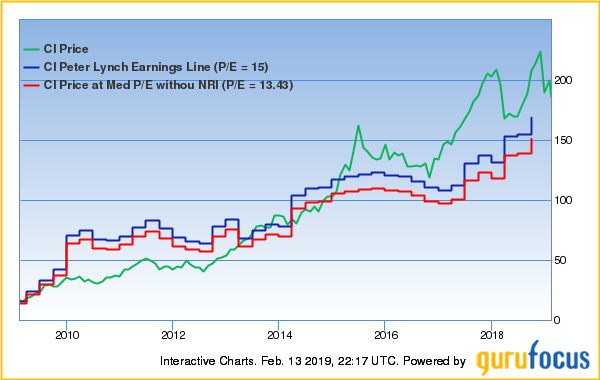

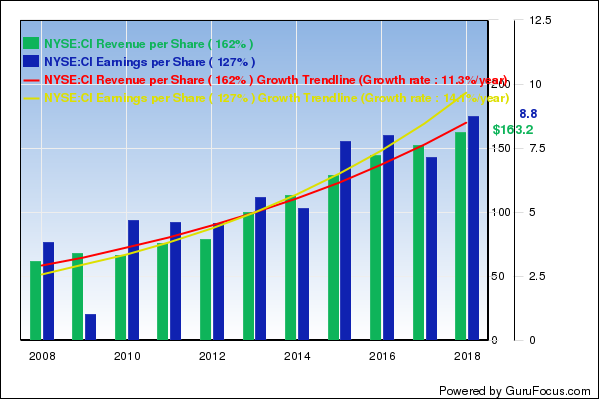

Cigna

Auxier invested in 21,390 shares of Cigna for an average price of $208.27 per share, giving the position 0.90% equity portfolio space.

The Bloomfield, Connecticut-based company provides a wide range of medical, dental, disability, life and accident insurance products. The company said on Feb. 1 that net earnings for 2018 were $10.54 per share on $49 billion in revenue. Adjusted earnings of $14.22 per share were up approximately $3.76 from 2017, driven by increased earnings contributions from Cigna's key business segments.

Other gurus that established holdings in Cigna include Charles Brandes (Trades, Portfolio)' Brandes Investments and Third Point fund manager Daniel Loeb (Trades, Portfolio).

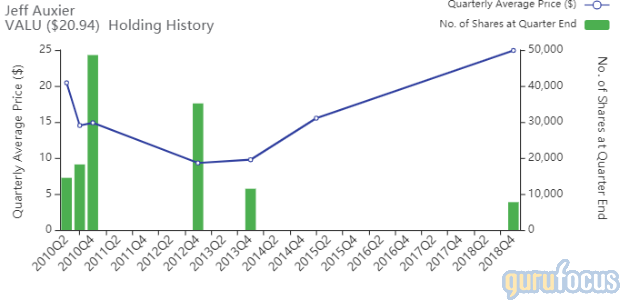

Value Line

Auxier invested in 7,740 shares of Value Line for an average price of $24.93 per share.

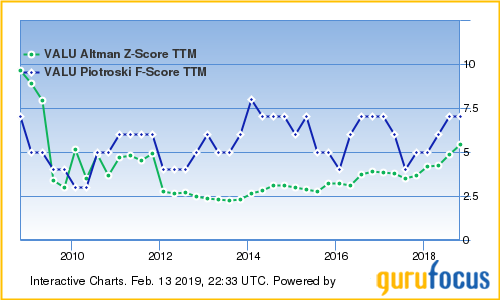

GuruFocus ranks Value Line's financial strength 9 out of 10 on several positive indicators, which include a strong Piotroski F-score of 7 and an Altman Z-score that suggests little or no financial distress.

Gates Industrial

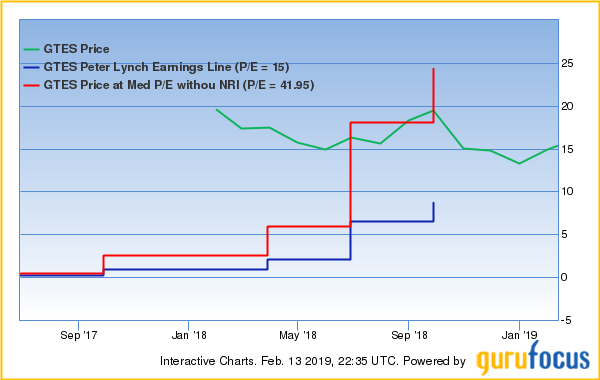

Auxier invested in 11,357 shares of Gates Industrial for an average price of $14.93 per share.

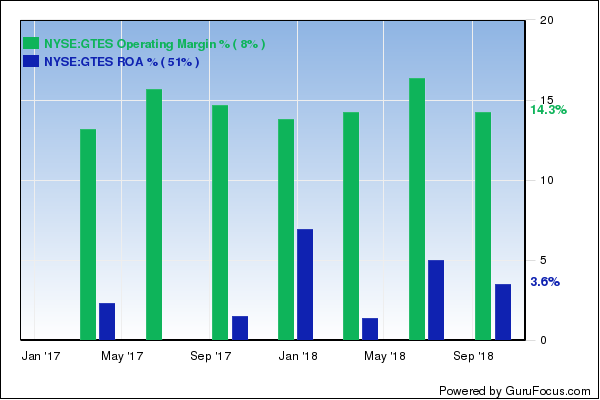

Gates Industrial manufactures power transmission and fluid power products for industrial and automotive applications. GuruFocus ranks the company's profitability 6 out of 10: even though the return on assets outperforms just 55% of global competitors, Gates Industrial's operating margin is near a 10-year high of 14.78% and outperforms 81% of global diversified industrial companies.

RumbleOn

Auxier invested in 26,509 shares of RumbleOn for an average price of $6.61 per share.

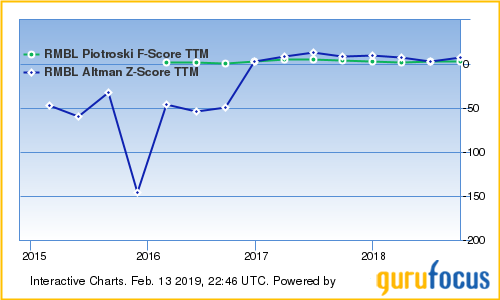

RumbleOn provides an online platform in which customers can buy, sell and trade pre-owned motorcycles. GuruFocus ranks the company's financial strength 6 out of 10: even though the Piotroski F-score ranks 3 out of 9, RumbleOn's Altman Z-score of 4.33 suggests low financial distress.

Disclosure: No positions.

Read more here:

Jeremy Grantham's Top 6 Buys During a Lousy 4th Quarter

Robert Olstein's Top 5 Buys in 4th Quarter

Brandes Investments' Top 5 Buys in 4th Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of CI