Jeff Auxier's 13F Filing Highlights UnitedHealth Group's Position Adjustment

Insights into Auxier's Q4 Moves and UnitedHealth Group's -1.04% Portfolio Impact

Jeff Auxier (Trades, Portfolio), the seasoned investor at the helm of Auxier Asset Management, has revealed his Q4 2023 investment strategy through the latest 13F filing. Auxier, known for his meticulous search for undervalued companies with strong fundamentals and competitive advantages, manages both the Auxier Focus Fund and separate accounts for clients. His investment philosophy centers on identifying companies with high returns on capital, clear products, and management that is both competent and shareholder-focused. Auxier's approach is grounded in thorough research to determine the fair value of potential investments, aiming for low-risk opportunities with the prospect of above-average returns.

Summary of New Buys

Jeff Auxier (Trades, Portfolio) expanded his portfolio with 8 new stocks in the fourth quarter. Noteworthy additions include:

The Hershey Co (NYSE:HSY), with 8,210 shares, making up 0.25% of the portfolio and valued at $1.53 million.

Devon Energy Corp (NYSE:DVN), comprising 9,400 shares, or approximately 0.07% of the portfolio, with a total value of $425,820.

Arch Capital Group Ltd (NASDAQ:ACGL), with 4,100 shares, accounting for 0.05% of the portfolio and a total value of $304,510.

Key Position Increases

Auxier also bolstered his stakes in 17 stocks, with significant increases in:

Philip Morris International Inc (NYSE:PM), adding 4,060 shares for a total of 210,227 shares. This represents a 1.97% increase in share count, impacting the portfolio by 0.06%, and a total value of $19.78 million.

Sally Beauty Holdings Inc (NYSE:SBH), with an additional 14,271 shares, bringing the total to 90,427. This adjustment marks an 18.74% increase in share count, with a total value of $1.2 million.

Summary of Sold Out Positions

In Q4 2023, Jeff Auxier (Trades, Portfolio) exited 2 holdings:

Global Medical REIT Inc (NYSE:GMRE): All 12,000 shares were sold, impacting the portfolio by -0.02%.

Key Position Reductions

Position reductions were made in 116 stocks, with the most significant being:

UnitedHealth Group Inc (NYSE:UNH), reduced by 12,075 shares, leading to a -15.19% decrease in shares and a -1.04% impact on the portfolio. The stock's average trading price was $533.34 during the quarter, with a -2.84% return over the past 3 months and a 0.01% year-to-date return.

Franklin Resources Inc (NYSE:BEN), cut by 48,763 shares, resulting in a -44.81% reduction and a -0.21% portfolio impact. The average trading price was $24.88, with a 14.76% return over the past 3 months and a -8.01% year-to-date return.

Portfolio Overview

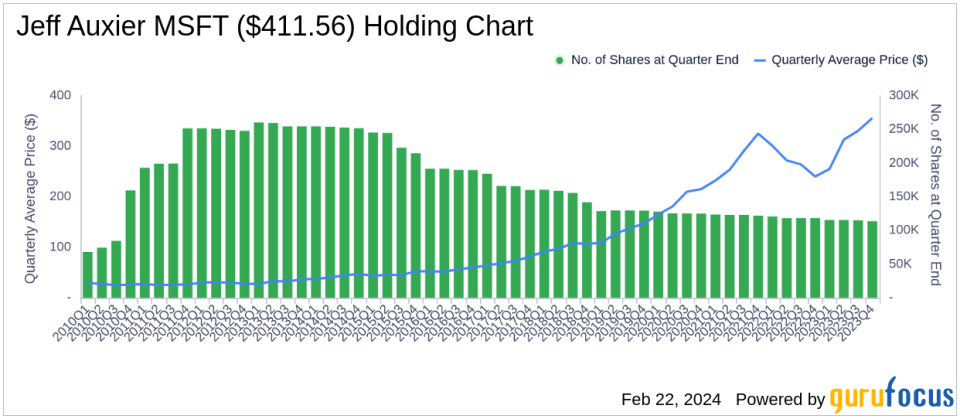

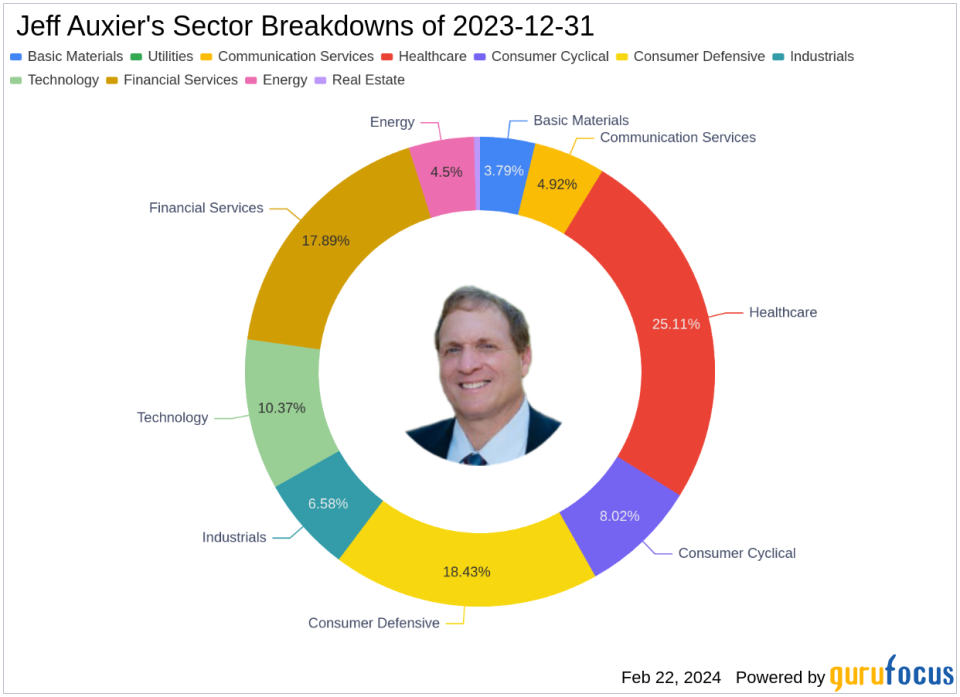

As of the end of Q4 2023, Jeff Auxier (Trades, Portfolio)'s portfolio comprised 173 stocks. The top holdings included 6.93% in Microsoft Corp (NASDAQ:MSFT), 5.74% in UnitedHealth Group Inc (NYSE:UNH), 3.52% in Elevance Health Inc (NYSE:ELV), 3.2% in Philip Morris International Inc (NYSE:PM), and 2.78% in The Kroger Co (NYSE:KR). The investments span across 10 of the 11 industries, with significant concentration in Healthcare, Consumer Defensive, Financial Services, Technology, Consumer Cyclical, Industrials, Communication Services, Energy, Basic Materials, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.