Jefferies Group Reduces Stake in Fiesta Restaurant Group Inc

On August 6, 2023, Jefferies Group (Trades, Portfolio), a renowned investment firm, executed a significant transaction involving Fiesta Restaurant Group Inc. (NASDAQ:FRGI). This article provides an in-depth analysis of the transaction, the profiles of both Jefferies Group (Trades, Portfolio) and Fiesta Restaurant Group Inc, and the potential implications of this move on the market.

Transaction Details

Jefferies Group (Trades, Portfolio) reduced its stake in Fiesta Restaurant Group Inc by 108,549 shares, representing a 2.06% change in their holdings. The shares were traded at a price of $7.86 each. Following this transaction, Jefferies Group (Trades, Portfolio) now holds a total of 5,153,640 shares in Fiesta Restaurant Group Inc, accounting for 0.38% of their portfolio and 20.10% of the company's total shares. This move could potentially impact the market dynamics and the performance of both entities.

Firm Profile: Jefferies Group (Trades, Portfolio)

Jefferies Group (Trades, Portfolio), currently led by CEO Richard Handler, was originally known as Leucadia National. The firm was renamed Jefferies Financial Group in 2018 following its acquisition by Jefferies Group (Trades, Portfolio) in 2013. The firm, which was founded by Harvard graduates Ian Cummings and Joseph S. Steinberg, operates in various sectors including investment banking, banking and lending, telecommunications, healthcare services, manufacturing, real estate, and winery businesses, among others.

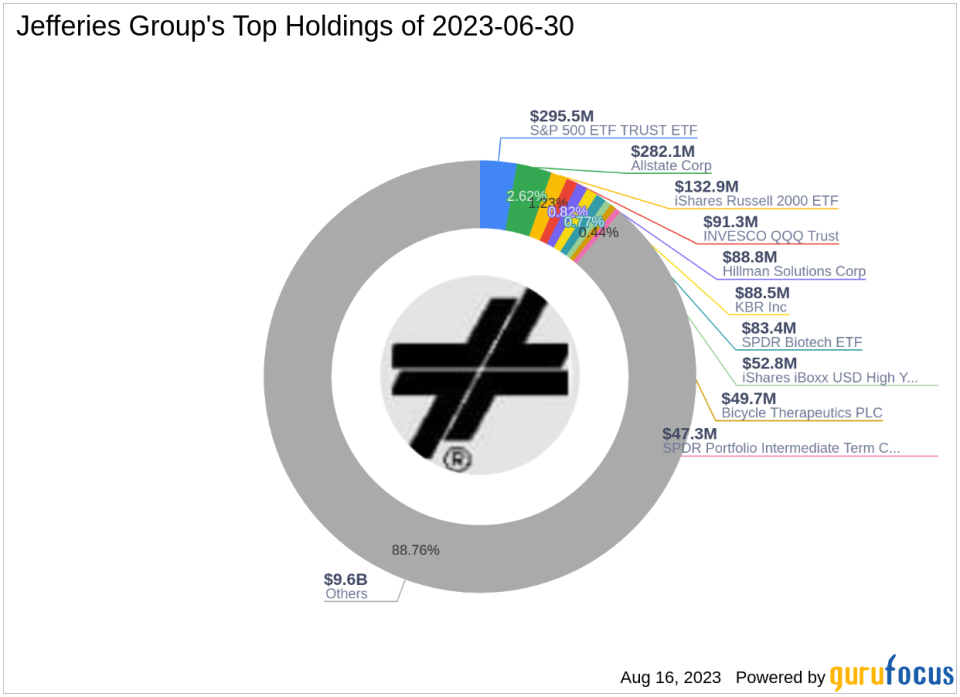

Jefferies Group (Trades, Portfolio) employs a value investing approach, focusing on distressed and out-of-favor companies. The firm's strategy revolves around buying these companies at discount prices, reviving them, and selling them for a profit. As of the date of this article, Jefferies Group (Trades, Portfolio) holds 1,498 stocks, with a total equity of $10.78 billion. The firm's top holdings include iShares Russell 2000 ETF(IWM), S&P 500 ETF TRUST ETF(SPY), INVESCO QQQ Trust(NASDAQ:QQQ), Allstate Corp(NYSE:ALL), and Hillman Solutions Corp(NASDAQ:HLMN). The healthcare and technology sectors dominate their portfolio.

Traded Stock Company Profile: Fiesta Restaurant Group Inc

Fiesta Restaurant Group Inc, a US-based company, operates two fast-casual restaurant brands: Pollo Tropical and Taco Cabana. The company, which went public on April 26, 2012, owns and operates over 300 restaurants in the southern United States. The majority of Pollo Tropical restaurants are located in Florida, while Taco Cabana restaurants are predominantly in Texas. The company also franchises restaurants in Central and South America.

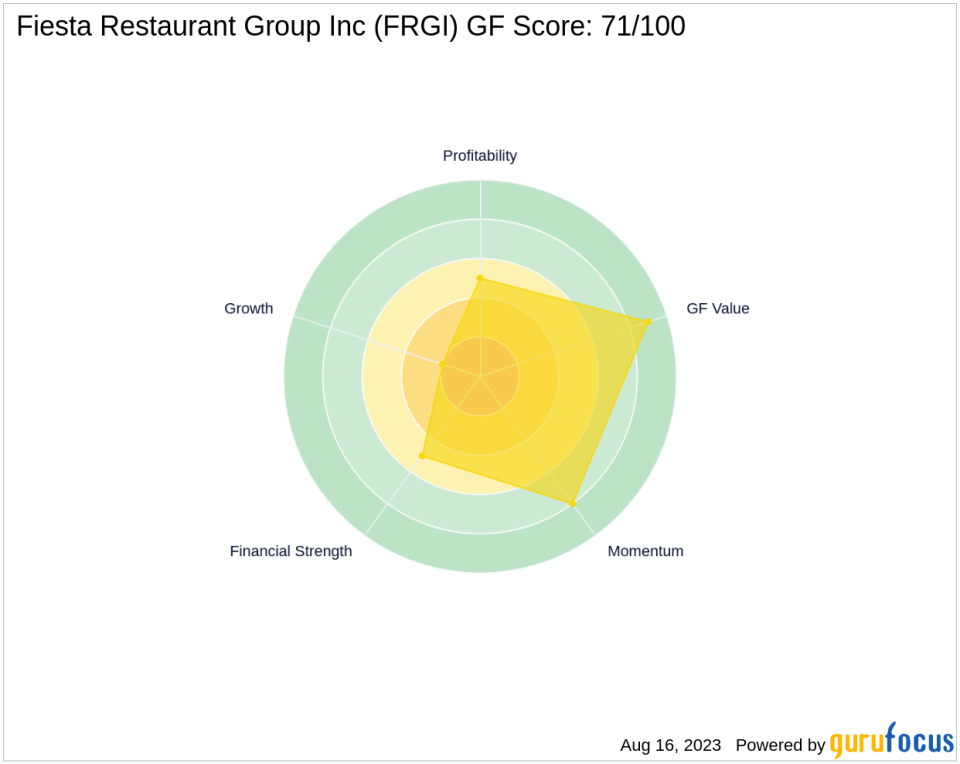

As of the date of this article, Fiesta Restaurant Group Inc has a market capitalization of $213.591 million. The company's stock is currently priced at $8.33, with a GF Value of $10.68, indicating that it is modestly undervalued. The company's GF Score is 71/100, suggesting a likely average performance in the future.

Stock Performance and Rankings

Fiesta Restaurant Group Inc's financial strength is rated 5/10, with an interest coverage of 0.00. The company's profitability rank is also 5/10, while its growth rank stands at 2/10. The company's GF Value rank is 9/10, and its momentum rank is 8/10. The company's Piotroski F-Score is 3, and its Altman Z score is 1.60. The company's operating margin growth is not applicable, and its 3-year revenue, EBITDA, and earning growth are 4.20, -50.30, and -106.90, respectively.

Largest Guru Holding the Traded Stock

Leucadia National is currently the largest guru holding shares in Fiesta Restaurant Group Inc. However, the exact share percentage held by Leucadia National is not available at this time.

Other Gurus Holding the Traded Stock

Private Capital (Trades, Portfolio) is another notable guru that holds shares in Fiesta Restaurant Group Inc.

Conclusion

In conclusion, Jefferies Group (Trades, Portfolio)'s recent transaction involving Fiesta Restaurant Group Inc could potentially influence the market dynamics and the performance of both entities. However, the long-term implications of this move remain to be seen. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.