Jefferies Group's Q2 2023 13F Filing Update: Key Transactions and Portfolio Overview

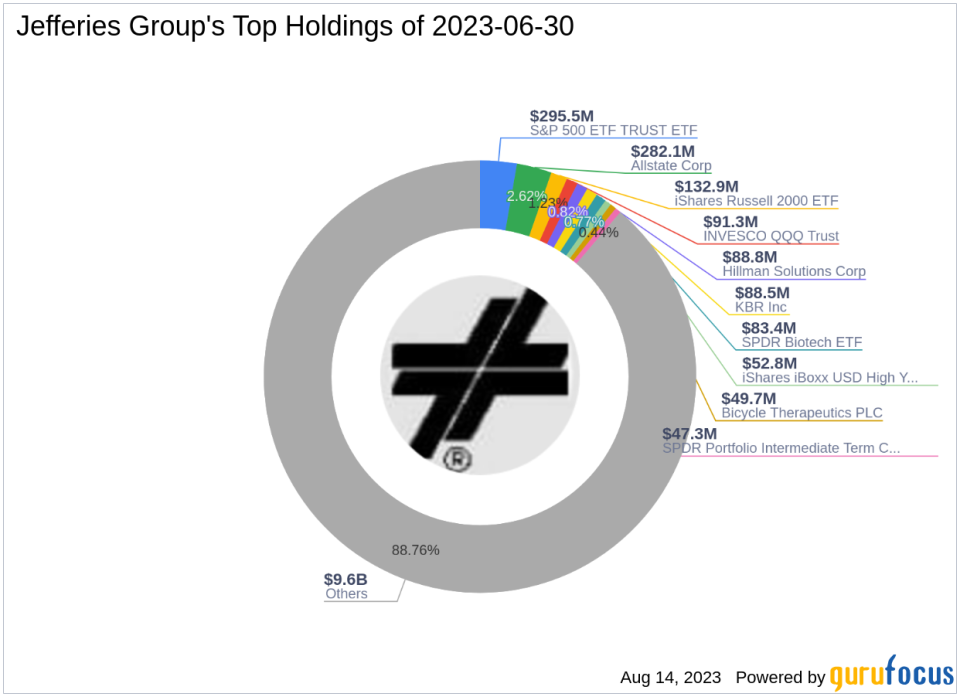

Jefferies Group (Trades, Portfolio), a renowned investment firm, recently filed its 13F report for the second quarter of 2023, which concluded on June 30, 2023. The firm's portfolio comprised 1,498 stocks with a total value of $10.78 billion. The top holdings included SPY (2.74%), ALL (2.62%), and IWM (1.23%).

About Jefferies Group (Trades, Portfolio)

Jefferies Group is a globally recognized investment firm known for its strategic and diversified investment approach. The firm's investment philosophy is rooted in rigorous research, risk management, and a long-term perspective. It seeks to generate consistent returns by investing in a broad range of assets, including equities, fixed income, and alternative investments.

Key Transactions of Q2 2023

The firm's top three trades of the quarter involved Allstate Corp (NYSE:ALL), S&P 500 ETF TRUST ETF (ARCA:SPY), and Xtrackers USD High Yield Corporate Bond ETF (ARCA:HYLB).

Allstate Corp (NYSE:ALL)

During the quarter, Jefferies Group (Trades, Portfolio) purchased 2,575,022 shares of Allstate Corp, bringing its total holding to 2,586,715 shares. This transaction had a 2.61% impact on the equity portfolio. The stock traded at an average price of $113.39 during the quarter. As of August 14, 2023, ALL's price was $106.37, with a market cap of $27.82 billion. The stock has returned -15.30% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, ALL has a price-book ratio of 2.06, a EV-to-Ebitda ratio of -15.82, and a price-sales ratio of 0.53.

S&P 500 ETF TRUST ETF (ARCA:SPY)

Jefferies Group (Trades, Portfolio) reduced its investment in the S&P 500 ETF TRUST ETF by 409,206 shares, impacting the equity portfolio by 1.4%. The stock traded at an average price of $418.22 during the quarter. As of August 14, 2023, SPY's price was $446.83, with a market cap of $419.94 billion. The stock has returned 6.33% over the past year. GuruFocus gives the ETF a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. In terms of valuation, SPY has a EV-to-Ebitda ratio of 15.09 and a price-sales ratio of 2.64.

Xtrackers USD High Yield Corporate Bond ETF (ARCA:HYLB)

The firm sold out of its 2,497,097-share investment in the Xtrackers USD High Yield Corporate Bond ETF. The shares traded at an average price of $33.93 during the quarter. As of August 14, 2023, HYLB's price was $34.37, with a market cap of $3.91 billion. The stock has returned 0.18% over the past year.

In conclusion, Jefferies Group (Trades, Portfolio)'s Q2 2023 13F filing reveals a strategic mix of buy and sell transactions, reflecting the firm's dynamic investment approach. The firm's portfolio adjustments provide valuable insights into its investment strategy and market outlook.

This article first appeared on GuruFocus.