Jefferies Group's Strategic Moves: A Deep Dive into Allstate Corp's Significant Reduction

Insights from Jefferies Group (Trades, Portfolio)'s Latest 13F Filing for Q3 2023

Jefferies Group (Trades, Portfolio), under the leadership of CEO Richard Handler, has a storied history of value investing, with a knack for revitalizing distressed companies. Since its inception as Leucadia National and its transformation into Jefferies Financial Group in 2018, the firm has been a powerhouse in various sectors, including investment banking and asset management. Jefferies' investment philosophy is straightforward yet effective: focus on undervalued companies, prioritize essential goods and services, and value sheltered earnings over taxed ones. The latest 13F filing for the third quarter of 2023 offers a window into the firm's strategic investment decisions during a dynamic market period.

New Additions to the Portfolio

Jefferies Group (Trades, Portfolio) has expanded its portfolio with 317 new stocks. Noteworthy additions include:

Axsome Therapeutics Inc (NASDAQ:AXSM), acquiring 553,195 shares, which now comprise 0.36% of the portfolio, valued at $38.66 million.

Intercept Pharmaceuticals Inc (NASDAQ:ICPT), with a new holding of 2,000,000 shares, representing 0.35% of the portfolio, totaling $37.08 million.

NET Power Inc (NYSE:NPWR), adding 1,814,069 shares, accounting for 0.26% of the portfolio, with a value of $27.39 million.

Significant Increases in Existing Holdings

In addition to new acquisitions, Jefferies Group (Trades, Portfolio) bolstered its stakes in 290 stocks, with the most significant increases being:

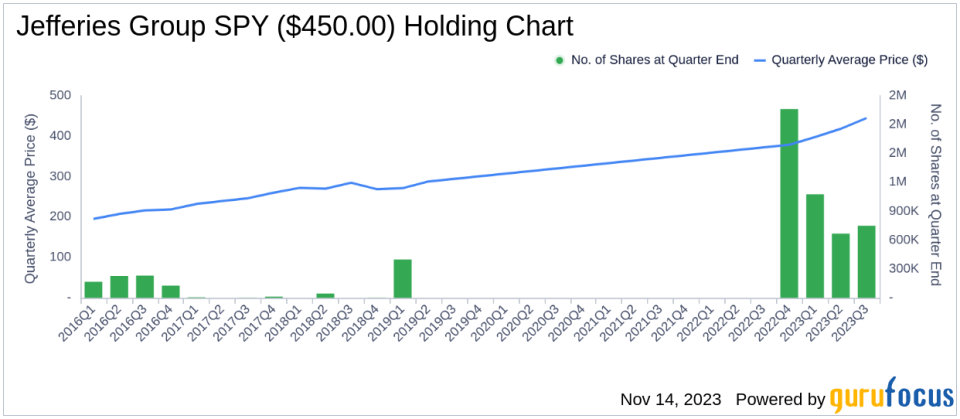

INVESCO QQQ Trust (NASDAQ:QQQ), with an additional 283,413 shares, bringing the total to 530,623 shares. This represents a 114.64% increase in share count and a 0.95% impact on the current portfolio, valued at $190.11 million.

iShares iBoxx USD High Yield Corporate Bond ETF (HYG), adding 700,386 shares for a total of 1,404,036 shares. This adjustment marks a 99.54% increase in share count, with a total value of $103.51 million.

Complete Exits from Certain Holdings

Jefferies Group (Trades, Portfolio) also made the decision to exit 373 holdings entirely in the third quarter of 2023, including:

SPDR Portfolio Intermediate Term Corporate Bond ETF (SPIB), selling all 1,472,210 shares, impacting the portfolio by -0.44%.

Liberty Formula One Group (NASDAQ:FWONA), liquidating 598,469 shares, which had a -0.36% impact on the portfolio.

Notable Reductions in Portfolio Positions

The firm reduced its positions in 290 stocks, with Allstate Corp (NYSE:ALL) seeing the most significant cut:

Allstate Corp (NYSE:ALL) was reduced by 2,573,782 shares, a -99.5% decrease, impacting the portfolio by -2.61%. The stock traded at an average price of $109.12 during the quarter, with a 24.30% return over the past three months and a -0.52% year-to-date performance.

Walmart Inc (NYSE:WMT) saw a reduction of 196,141 shares, a -97.98% decrease, affecting the portfolio by -0.28%. The stock's average trading price was $159.64 for the quarter, with a 4.76% return over the past three months and a 19.57% year-to-date return.

Portfolio Overview and Sector Allocation

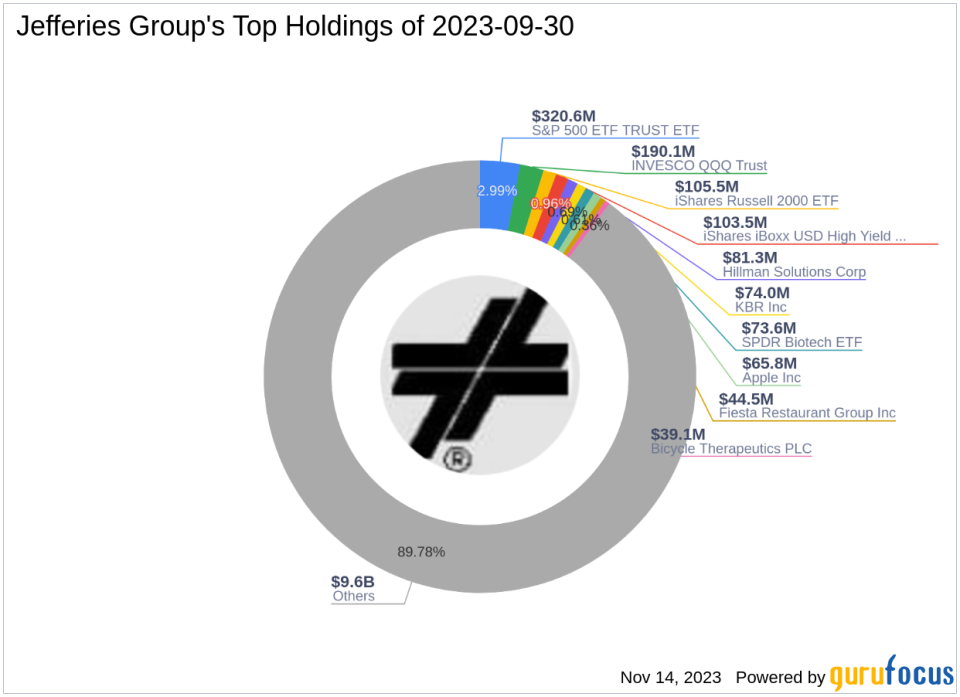

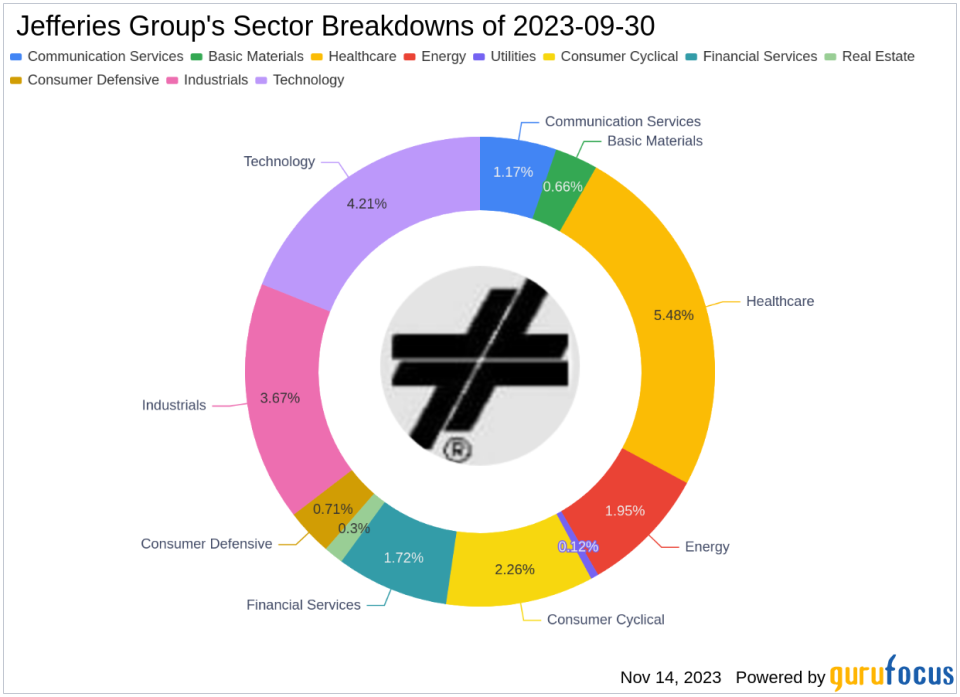

As of the third quarter of 2023, Jefferies Group (Trades, Portfolio)'s portfolio consisted of 1,419 stocks. The top holdings included 2.99% in S&P 500 ETF TRUST ETF (SPY), 1.77% in INVESCO QQQ Trust (NASDAQ:QQQ), 0.98% in iShares Russell 2000 ETF (IWM), 0.96% in iShares iBoxx USD High Yield Corporate Bond ETF (HYG), and 0.76% in Hillman Solutions Corp (NASDAQ:HLMN). The investments are predominantly concentrated across all 11 industries, with a strategic focus on Healthcare, Technology, Industrials, and Consumer Cyclical sectors, among others.

Jefferies Group (Trades, Portfolio)'s latest 13F filing reveals a calculated approach to portfolio management, with strategic additions, increases, and reductions that reflect the firm's commitment to value investing. The significant reduction in Allstate Corp, in particular, highlights the group's active management and responsiveness to market conditions. For value investors seeking to understand the moves of seasoned players like Jefferies Group (Trades, Portfolio), these insights are invaluable for informed financial decision-making.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.