Jefferies (JEF) Stock Dips 2.3% Despite Q4 Earnings Beat

Jefferies Financial Group Inc JEF reported fourth-quarter fiscal 2023 (ended Nov 30) earnings per share of 29 cents, which beat the Zacks Consensus Estimate of 26 cents. However, the bottom line compared unfavorably with 57 cents earned in the prior-year quarter.

Results were aided by a decline in expenses and an improvement in equity and debt underwriting business. However, a decrease in equities and fixed-income capital markets revenues acted as an undermining factor. Because of these concerns, investors turned bearish on the stock, which lost 2.3% in after-hours trading.

Net income attributable to common shareholders was $65.6 million, down 53% year over year.

In fiscal 2023, earnings of $1.10 per share plunged 64% year over year but surpassed the consensus estimate of $1.08 per share. Net income attributable to common shareholders was $263 million, down 66% year over year.

Revenues & Expenses Fall

Quarterly net revenues were $1.20 billion, down 17% year over year. However, the top line surpassed the Zacks Consensus Estimate of $1.18 billion.

In fiscal 2023, net revenues were $4.7 billion, which declined 21% year over year.

Total non-interest expenses were $1.11 billion, down 11%. The fall was mainly due to lower compensation and benefits expenses and cost of sales.

Quarterly Segment Performance

Investment Banking and Capital Markets: Net revenues were $1.06 billion, up 1% from the prior-year quarter. The rise was driven by solid performance in equity and debt underwriting business, partially offset by weakness in advisory revenues.

Asset Management: Net revenues were $140.6 million, down 64% from the year-ago quarter.

Share Repurchase Update

During the fiscal fourth quarter, Jefferies did not repurchase any shares.

The company has a share buyback authorization of $250 million available for the future.

Our View

A solid trading business, improvements in underwriting activities and lower expenses are expected to support Jefferies’ financials. However, investment banking operations keep witnessing hurdles. This is expected to be a major near-term headwind for the company.

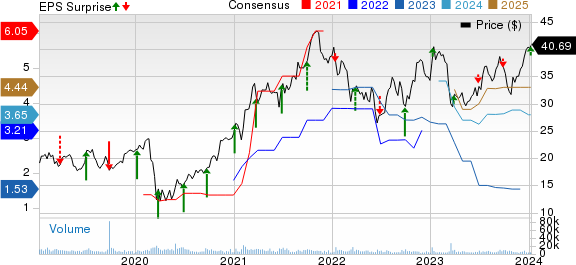

Jefferies Financial Group Inc. Price, Consensus and EPS Surprise

Jefferies Financial Group Inc. price-consensus-eps-surprise-chart | Jefferies Financial Group Inc. Quote

Currently, Jefferies has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Dates & Expectations of Other Banks

JP Morgan JPM is scheduled to report fourth-quarter and full-year 2023 results on Jan 12.

Over the past seven days, the Zacks Consensus Estimate for JPMorgan’s quarterly earnings have moved marginally north to $3.65. This indicates 2.2% growth from the prior-year quarter.

Bank of America BAC is slated to announce fourth-quarter and full-year 2023 results on Jan 12.

Over the past month, the Zacks Consensus Estimate for Bank of America’s quarterly earnings has moved 5.5% lower to 68 cents, implying a 20% fall from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report