Is Jernigan Capital, Inc. (NYSE:JCAP) A Great Dividend Stock?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Jernigan Capital, Inc. (NYSE:JCAP) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Jernigan Capital is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . There are a few simple ways to reduce the risks of buying Jernigan Capital for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Jernigan Capital!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Jernigan Capital paid out 63% of its profit as dividends. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Of the free cash flow it generated last year, Jernigan Capital paid out 38% as dividends, suggesting the dividend is affordable.

It is worth considering that Jernigan Capital is a Real Estate Investment Trust (REIT). REITs have different rules governing their payments, and are often required to pay out a high portion of their earnings to investors.

Consider getting our latest analysis on Jernigan Capital's financial position here.

Dividend Volatility

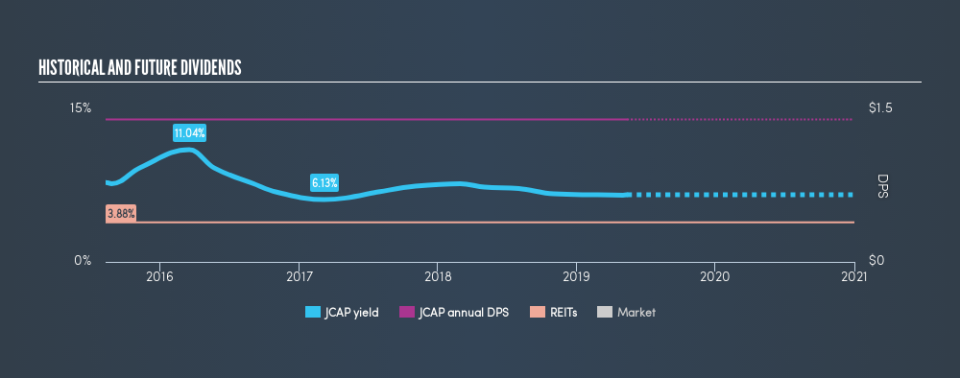

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Jernigan Capital has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. Its most recent annual dividend was US$1.40 per share, effectively flat on its first payment four years ago.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Jernigan Capital has grown its earnings per share at 34% per annum over the past five years. With recent, rapid earnings per share growth and a payout ratio of 63%, this business could be an interesting prospect if growth can be maintained.

We'd also point out that Jernigan Capital issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Jernigan Capital has an acceptable payout ratio and its dividend is well covered by cashflow. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Jernigan Capital has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 3 analysts we track are forecasting for Jernigan Capital for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.