New Jersey Resources Corp Reports Mixed Fiscal 2024 First-Quarter Results

Net Income: Reported at $89.4 million, a decrease from $115.9 million in the same period last year.

Basic EPS: Declined to $0.91 from $1.20 year-over-year.

Net Financial Earnings (NFE): Totaled $72.4 million, down from $110.3 million in the prior year.

NFE per Share: Decreased to $0.74, compared to $1.14 in the same quarter of fiscal 2023.

Guidance: NJR increases its fiscal 2024 NFEPS guidance range by $0.15 to $2.85 to $3.00.

Business Segment Contributions: Energy Services expected to represent a higher percentage of NFEPS.

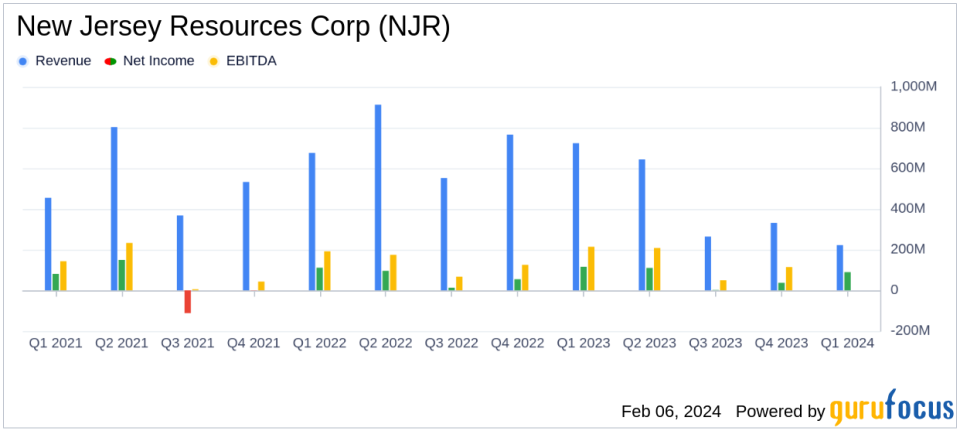

On February 6, 2024, New Jersey Resources Corp (NYSE:NJR) released its 8-K filing, announcing its financial results for the first quarter of fiscal 2024. The company, a Fortune 1000 energy services holding company, operates both regulated and nonregulated businesses, including New Jersey Natural Gas, which serves over 575,000 customers.

Financial Performance and Challenges

NJR reported a decrease in net income and basic earnings per share (EPS) compared to the same quarter in the previous fiscal year. The company's net income totaled $89.4 million, or $0.91 per share, a decline from $115.9 million, or $1.20 per share, in fiscal 2023. Similarly, net financial earnings (NFE) decreased to $72.4 million, or $0.74 per share, from $110.3 million, or $1.14 per share.

Despite these challenges, NJR's management remains optimistic. President and CEO Steve Westhoven commented,

Our results for the first quarter were consistent with our expectations. Additionally, our performance in the beginning of our fiscal second quarter has exceeded our original projections, as Energy Services benefited from natural gas price volatility. As a result, we are raising our fiscal 2024 NFEPS guidance range by $0.15 to $2.85 to $3.00."

Financial Achievements and Importance

The company's decision to raise its NFEPS guidance reflects confidence in its ability to navigate the complexities of the energy market and capitalize on favorable conditions, such as price volatility in natural gas. This adjustment is significant for investors as it suggests potential for improved profitability and returns.

Moreover, NJR's Energy Services segment is expected to contribute a higher percentage to the company's NFEPS, highlighting the strategic importance of this nonregulated operation in the company's overall financial health.

Key Financial Metrics and Analysis

NJR's financial achievements are underscored by a detailed analysis of its income statement, balance sheet, and cash flow statement. The company reported an increase in delivery rates of $222.6 million, which is a critical metric for the regulated utility industry as it directly impacts revenue.

However, the company faced headwinds with a decrease in utility gross margin contributions from its Basic Gas Supply Service (BGSS) incentive programs, which fell to $5.4 million from $8.7 million in the previous year, largely due to lower natural gas prices and reduced weather volatility.

From a balance sheet perspective, NJR continues to focus on maintaining a strong financial profile, which is essential for supporting its capital expenditures and ensuring the company's ability to fund its operations and growth initiatives.

Overall, while NJR faces challenges such as lower net income and NFE, the company's proactive management and strategic focus on its Energy Services segment, along with its increased NFEPS guidance, provide a balanced view of its financial performance and future prospects.

For more detailed information and financial tables, investors are encouraged to review the full 8-K filing released by New Jersey Resources Corp.

Conclusion

In conclusion, New Jersey Resources Corp's first-quarter fiscal 2024 results present a mixed picture, with declines in net income and EPS but an optimistic outlook as evidenced by the raised NFEPS guidance. The company's strategic focus on its Energy Services segment and its ability to adapt to market conditions are key factors that will continue to influence its financial performance. Value investors and potential GuruFocus.com members interested in the regulated utilities sector may find NJR's proactive approach and financial resilience to be of particular interest.

Explore the complete 8-K earnings release (here) from New Jersey Resources Corp for further details.

This article first appeared on GuruFocus.