Jim Simons Adds Data I/O Corp to Renaissance Technologies Portfolio

Overview of Jim Simons (Trades, Portfolio)'s Recent Portfolio Addition

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable addition to its investment portfolio by acquiring 11,188 shares of Data I/O Corp (NASDAQ:DAIO). This transaction expanded the firm's holding to a total of 542,643 shares in the company. Despite the trade having a seemingly negligible impact on the overall portfolio, the move is significant given Simons's reputation for data-driven investment decisions. The shares were purchased at a price of $2.94, reflecting the firm's confidence in the potential of Data I/O Corp.

Jim Simons (Trades, Portfolio)'s Investment Philosophy

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, is renowned for his quantitative approach to investing. Since 1982, the firm has utilized complex mathematical models to predict market movements and execute trades. This scientific methodology is grounded in the analysis of vast datasets to identify non-random price movements. Simons's strategy emphasizes the importance of empirical evidence over intuition, aiming to minimize the influence of statistical anomalies on investment decisions.

Data I/O Corp at a Glance

Data I/O Corp, with its roots in the USA since its IPO in 1981, specializes in programming and security solutions for electronic devices. The company's offerings include automated and non-automated programming systems, catering to the needs of electronics manufacturers worldwide. With a market capitalization of $28.415 million and a PE ratio of 35.00, Data I/O Corp operates in a niche segment of the hardware industry. The company's historical performance and current valuation suggest a cautious approach, as indicated by its "Possible Value Trap, Think Twice" GF Valuation.

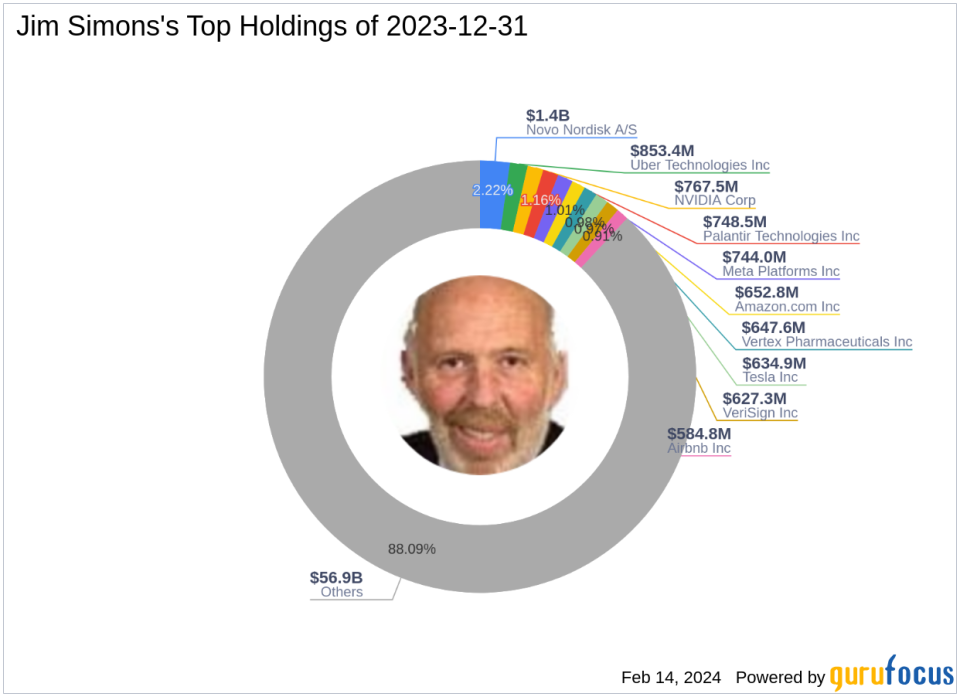

Impact of the Trade on Simons's Portfolio

The acquisition of Data I/O Corp shares by Renaissance Technologies represents a 2.11% change in the firm's holdings, with the position now accounting for 6.02% of the traded stock. Although the trade did not significantly alter the portfolio's composition, it demonstrates Simons's interest in the company's future prospects. The trade price of $2.94, coupled with the current stock price of $3.1499, shows a gain of 7.14% since the transaction, indicating a positive short-term outcome.

Financial Health and Performance of Data I/O Corp

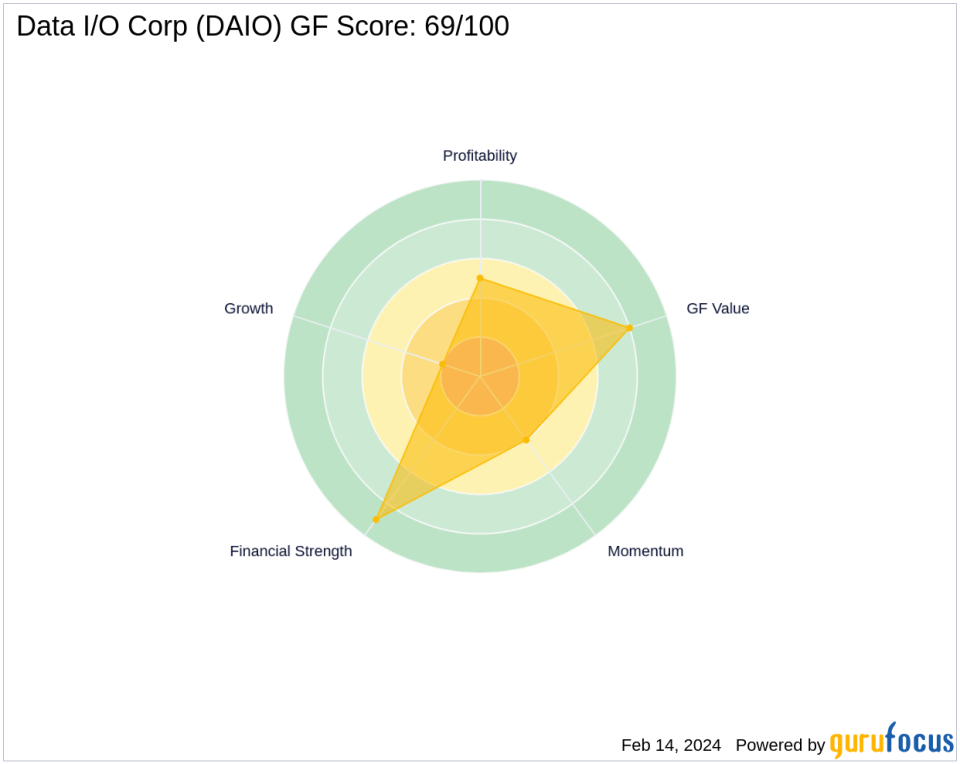

Data I/O Corp's financial health is reflected in its Financial Strength rank of 9/10 and a Piotroski F-Score of 8, suggesting a robust balance sheet and operational efficiency. However, the company's Growth Rank of 2/10 indicates limited growth potential. The stock's GF Score of 69/100 points to a potential for poor future performance, which investors should consider alongside the company's market position and growth prospects.

Comparative Metrics and Industry Position

Data I/O Corp's industry position is further elucidated by its GF Score components, including a Profitability Rank of 5/10 and a GF Value Rank of 8/10. The company's financial ratios and industry rankings, such as a Momentum Rank of 4/10, provide a comprehensive view of its competitive standing. These metrics are essential for investors to assess the company's performance relative to its peers.

Conclusion

The recent acquisition of Data I/O Corp shares by Jim Simons (Trades, Portfolio)'s Renaissance Technologies is a strategic move that aligns with the firm's data-centric investment philosophy. While the trade has not significantly impacted the portfolio, it underscores Simons's confidence in the company's value proposition. Investors should closely monitor Data I/O Corp's financial health, market position, and growth prospects to better understand the potential implications of this investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.