Jim Simons Adds Haverty Furniture Companies Inc to Portfolio

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), executed a notable transaction by adding shares of Haverty Furniture Companies Inc (NYSE:HVT). The firm increased its stake in the company by a marginal 0.13%, purchasing an additional 1,100 shares at a trade price of $35.5. This move brought the total shareholding to 838,106 shares, reflecting a strategic addition to the firm's diverse investment portfolio.

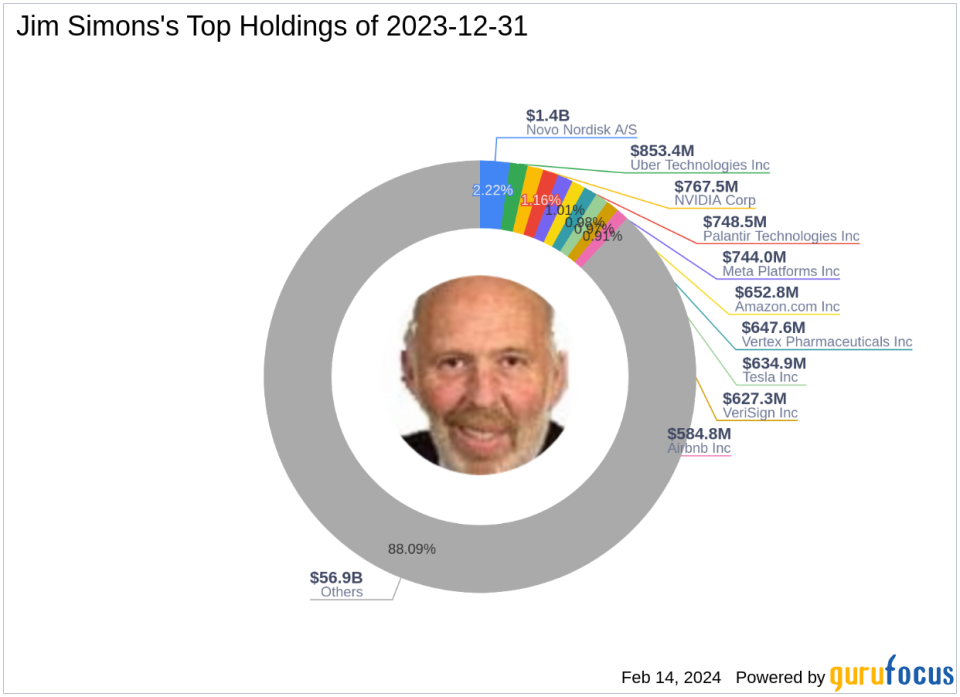

Jim Simons (Trades, Portfolio)'s Investment Firm Profile

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies Corporation in 1982. The firm has since become one of the world's leading hedge funds, known for its sophisticated mathematical models and automated trading strategies. Renaissance Technologies leverages vast amounts of data to identify non-random price movements and capitalize on them, a testament to Simons's scientific approach to investing. "The advantage scientists bring into the game is less their mathematical or computational skills than their ability to think scientifically. They are less likely to accept an apparent winning strategy that might be a mere statistical fluke."

Introduction to Haverty Furniture Companies Inc

Haverty Furniture Companies Inc, trading under the symbol HVT in the USA, has been a specialty retailer of residential furniture and accessories since its IPO on February 25, 1992. The company's operations span across the Southern and Midwestern U.S., with a focus on upholstery products and bedroom furniture. Haverty's diverse product range includes sofa tables, sleepers, and various other home furnishings, generating the majority of its revenue from its Merchandise division.

Financial Snapshot of Haverty Furniture Companies Inc

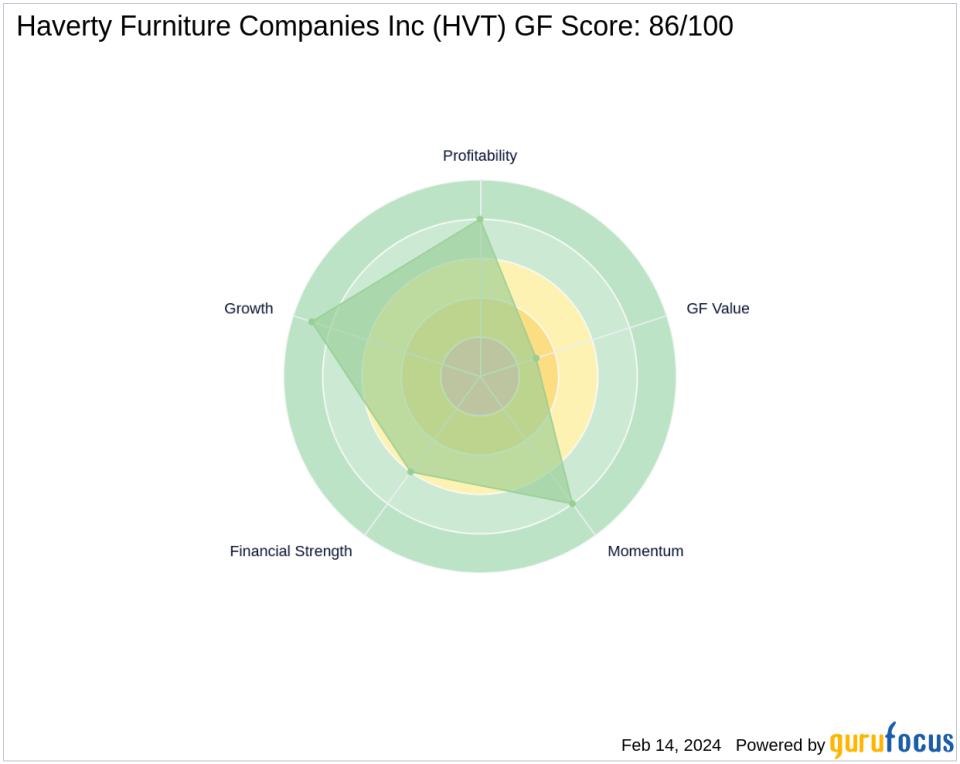

As of the latest data, Haverty Furniture Companies Inc boasts a market capitalization of $572.83 million, with a current stock price of $35.17. The stock's PE Ratio stands at 9.06, indicating profitability, while the GF Valuation labels it as Modestly Overvalued with a price to GF Value ratio of 1.25. These metrics provide a glimpse into the company's financial health and market perception.

Guru's Position in Haverty Furniture Companies Inc

Jim Simons (Trades, Portfolio)'s firm holds a significant position in Haverty Furniture Companies Inc, with 838,106 shares representing 0.05% of the portfolio and 5.59% of the company's stock. Despite the recent trade, there has been no notable impact on the portfolio due to the trade's relatively small size.

Haverty's Stock Performance and Rankings

Since the trade date, Haverty's stock has experienced a slight decline of 0.93%, yet it has seen an impressive growth of 4,467.53% since its IPO. The company's stock performance is further highlighted by a strong GF Score of 86/100, indicating good potential for outperformance. Additionally, Haverty holds a Financial Strength rank of 6/10 and a Profitability Rank of 8/10, showcasing its solid financial and operational performance.

Sector and Industry Analysis

While Renaissance Technologies primarily focuses on the Technology and Healthcare sectors, its investment in Haverty Furniture Companies Inc represents a strategic foray into the Retail - Cyclical industry. This move suggests a diversification strategy, as Haverty's financial health and growth prospects are compared with industry peers.

Analysis of Largest Guru Shareholder

Hotchkis & Wiley Capital Management LLC currently stands as the largest guru shareholder in Haverty Furniture Companies Inc. However, the exact share percentage held by the firm is not available, indicating an area for further research or monitoring.

Transaction Analysis and Impact

The recent addition of Haverty Furniture Companies Inc shares by Jim Simons (Trades, Portfolio)'s firm is a calculated decision, likely based on the company's strong financial metrics and growth potential. Although the trade did not significantly impact the portfolio, it reinforces the firm's confidence in Haverty's market position and future prospects. Investors will be watching closely to see how this investment plays out in the context of Renaissance Technologies' data-driven, scientific approach to the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.