Jim Simons Adds Ituran Location and Control Ltd to Portfolio

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), expanded its investment portfolio by adding shares of Ituran Location and Control Ltd (NASDAQ:ITRN). The firm acquired 16,100 shares at a trade price of $27.24. This transaction increased the total holdings to 1,123,800 shares, representing a 0.05% position in the firm's portfolio and a 5.65% ownership of the traded stock.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

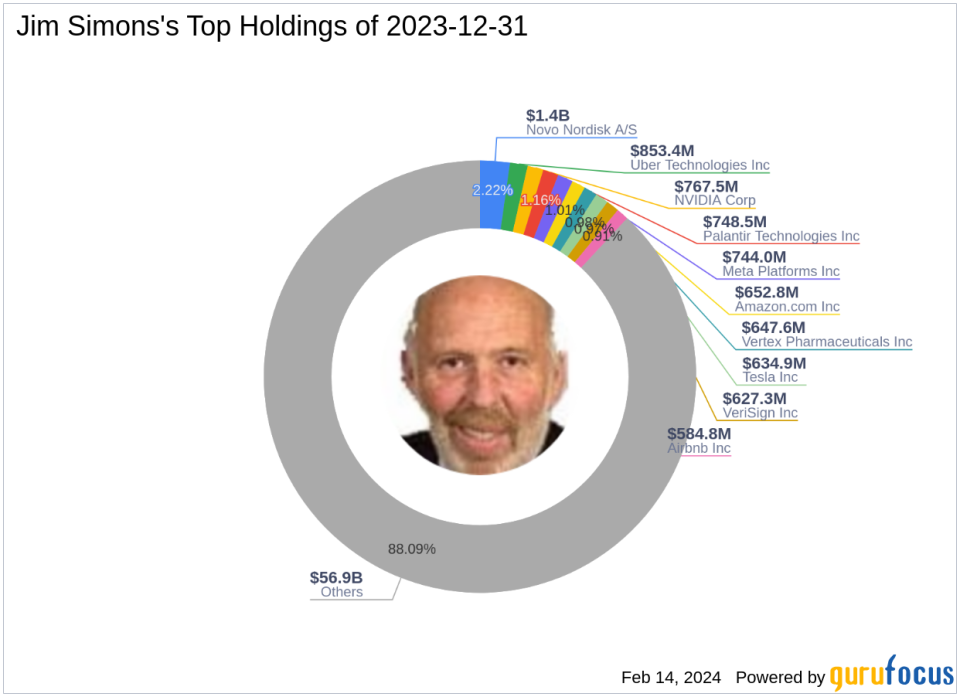

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its quantitative, data-driven investment strategies, utilizing complex mathematical models to predict market movements. Renaissance Technologies is a pioneer in automated trading, and its success is attributed to a scientific approach to investing. The firm's top holdings include Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO), with a significant equity of $64.61 billion, primarily in the Technology and Healthcare sectors.

Ituran Location and Control Ltd at a Glance

Ituran Location and Control Ltd, based in Israel, specializes in location-based services, including stolen vehicle recovery and fleet management. The company operates two main segments: Telematics services and Telematics products. With a market capitalization of $503.904 million, ITRN's financial metrics reveal a PE Ratio of 11.15, indicating profitability. The stock is currently priced at $25.33, which is modestly undervalued according to the GF Value of $28.71.

Impact of the Trade on Simons's Portfolio

The addition of ITRN shares has a minor yet strategic impact on Simons's portfolio. The trade's position size and share change suggest a targeted investment rather than a major portfolio shift. With the trade price at $27.24 and the current stock price at $25.33, there is a -7.01% price change since the transaction, reflecting market volatility.

Market Valuation and Stock Performance

ITRN's current market valuation indicates that the stock is modestly undervalued with a GF Value of $28.71 and a price to GF Value ratio of 0.88. The stock has experienced a -6.57% change year-to-date, and despite the recent dip, it has grown 92.62% since its IPO.

Financial Health and Growth Prospects

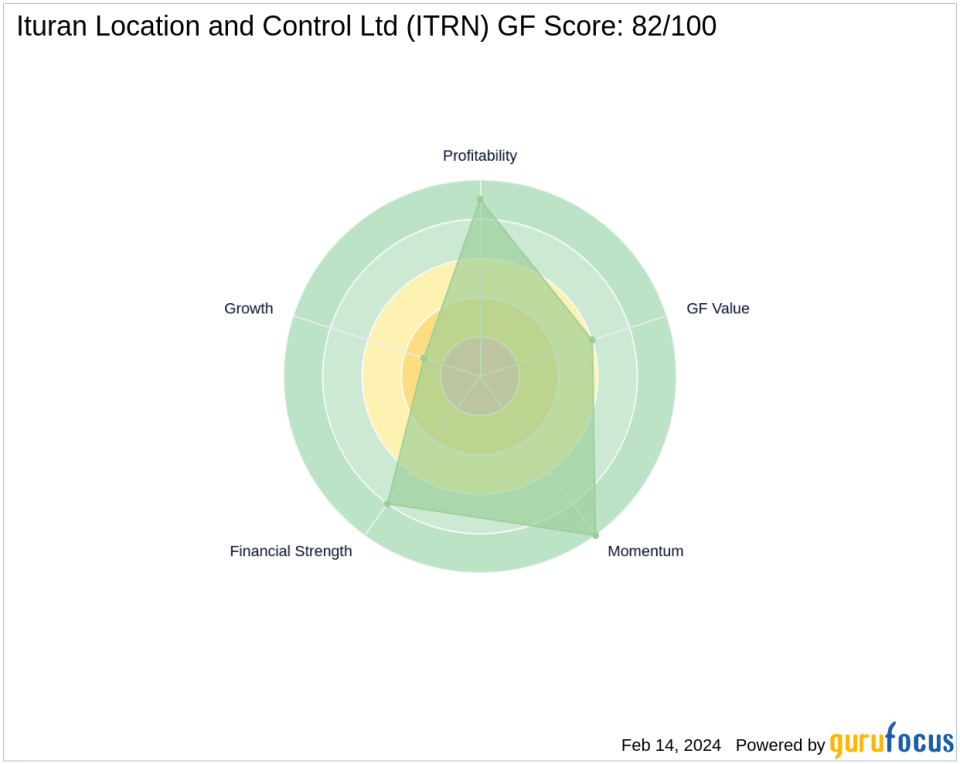

Ituran's financial health is robust, with a GF Score of 82/100, suggesting good outperformance potential. The company has a strong Financial Strength rank of 8/10 and a high Profitability Rank of 9/10. However, its Growth Rank is lower at 3/10, indicating potential areas for improvement.

Industry Context and Comparative Analysis

Operating in the competitive hardware industry, ITRN's performance must be contextualized within its sector. The company's Momentum Rank is impressive at 10/10, suggesting strong market trends. When compared to the largest guru shareholder, Pzena Investment Management LLC, Simons's stake in ITRN is significant, though the exact share percentage held by Pzena is not disclosed.

Conclusion: Evaluating the Strategic Addition

Jim Simons (Trades, Portfolio)'s acquisition of ITRN shares appears to be a calculated move, aligning with Renaissance Technologies' data-driven investment philosophy. The firm's position in ITRN, while not a major portion of the portfolio, reflects confidence in the company's value proposition and potential for growth. As the market continues to evolve, investors will watch closely to see how this trade influences the performance of both Ituran Location and Control Ltd and Renaissance Technologies' diverse investment portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.