Jim Simons Adds Lakeland Industries to Portfolio in Recent Trade

Overview of Jim Simons (Trades, Portfolio)'s Recent Portfolio Addition

Jim Simons (Trades, Portfolio)'s Renaissance Technologies has recently expanded its investment portfolio with the addition of Lakeland Industries Inc (NASDAQ:LAKE). On December 29, 2023, the firm acquired 48,5862 shares of the industrial protective clothing manufacturer. This transaction reflects a 3.95% change in the firm's holdings, with a trade impact of 0% on the portfolio. The shares were purchased at a price of $18.54, which is noteworthy considering the stock's current market dynamics.

Profile of Renaissance Technologies and Jim Simons (Trades, Portfolio)

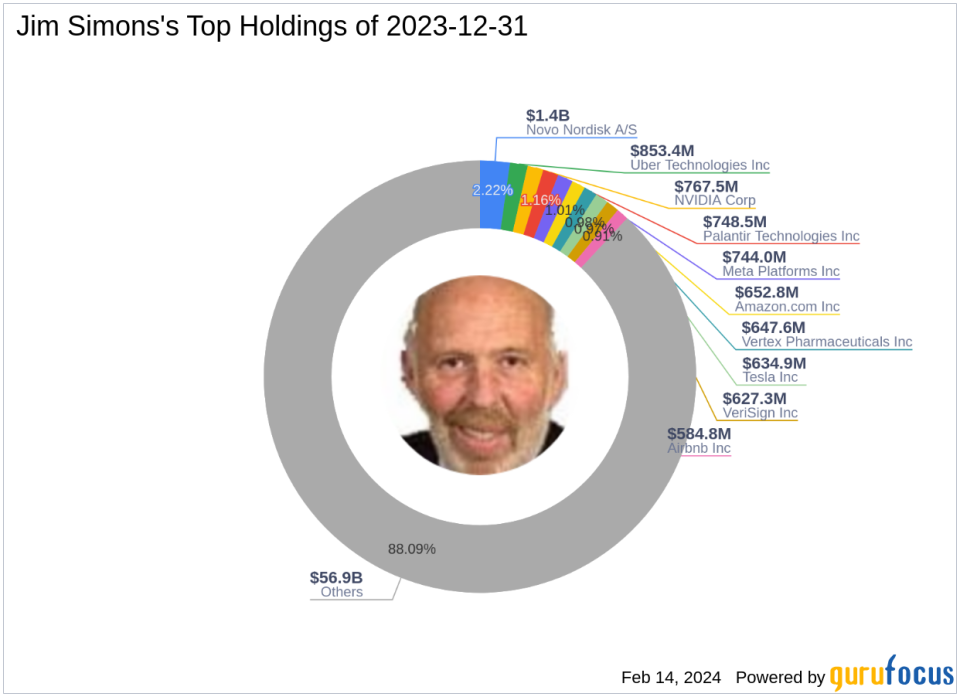

Founded in 1982 by Jim Simons (Trades, Portfolio), Renaissance Technologies is a private investment firm renowned for its quantitative, data-driven investment strategies. The firm's approach, led by Simons, involves the use of complex mathematical models to predict market changes and execute trades. This scientific methodology has positioned Renaissance Technologies as one of the most successful hedge funds globally. As of the latest data, the firm's equity stands at $64.61 billion, with top holdings in technology and healthcare sectors, including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

Lakeland Industries Inc: A Snapshot

Lakeland Industries Inc, with its stock symbol LAKE, operates within the industrial protective clothing market. The company's diverse product range includes disposables, chemicals, fire service gear, gloves, and high-visibility wear, catering to various industries such as oil, pharmaceuticals, and utilities. As of the latest data, Lakeland Industries boasts a market capitalization of $123.065 million and a stock price of $16.71. The company is currently valued as modestly undervalued with a GF Value of $18.60 and a price to GF Value ratio of 0.90. Despite a PE Ratio of 19.43, the stock has experienced a decline of 9.87% since the transaction date.

Insight into the Trade Impact

The acquisition of Lakeland Industries shares by Renaissance Technologies has resulted in a 6.60% ownership of the traded stock by the firm, with a portfolio position of 0.02%. The trade price of $18.54 is currently above the stock's market price, indicating a potential foresight by Simons's firm in anticipating future growth. The trade's impact on the portfolio is minimal, yet it signifies a strategic move by one of the world's leading hedge funds.

Performance Metrics of Lakeland Industries

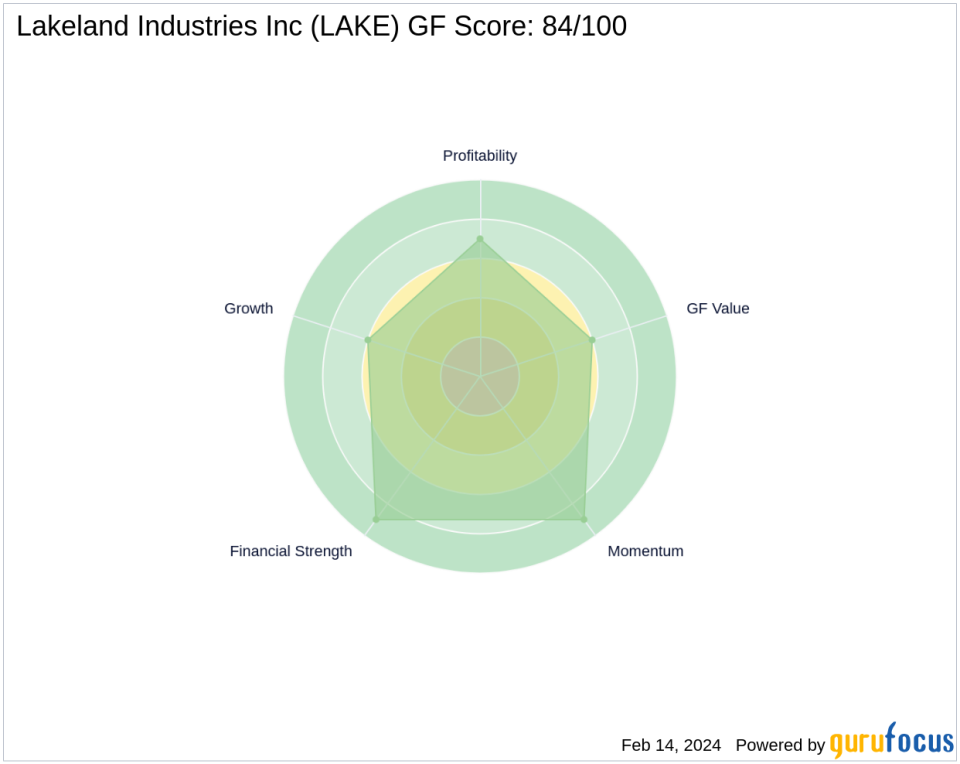

Lakeland Industries Inc has demonstrated a solid financial foundation with a GF Score of 84/100, indicating good outperformance potential. The company's financial strength is further supported by a Financial Strength rank of 9/10 and a Profitability Rank of 7/10. Additionally, Lakeland Industries has a Piotroski F-Score of 7, indicating a healthy financial situation. The stock's Growth Rank and GF Value Rank are both at 6/10, while the Momentum Rank stands at 9/10, reflecting strong market dynamics.

Simons's Portfolio and Sector Context

Within Jim Simons (Trades, Portfolio)'s diverse portfolio, Lakeland Industries Inc represents a smaller, yet strategic position. The firm's top sectors remain technology and healthcare, with LAKE adding to the industrial segment of the portfolio. This addition aligns with Simons's data-driven investment philosophy, potentially identifying LAKE as a stock with future growth prospects.

Comparative Guru Holdings in Lakeland Industries

Other notable investment firms, such as HOTCHKIS & WILEY, also hold shares in Lakeland Industries, indicating a broader interest in the stock among value investors. Private Capital (Trades, Portfolio) Management currently stands as the largest guru shareholder, although the specific share percentage is not disclosed.

Market Reaction and Future Outlook for Lakeland Industries

The market has shown a mixed reaction to Lakeland Industries, with RSI indicators suggesting some bearish momentum. However, the stock's intrinsic value and Renaissance Technologies' recent acquisition could signal a turning point for interested value investors. As market trends evolve, the implications of this trade will become clearer, potentially validating Simons's investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.