Jim Simons Adds RCM Technologies Inc to Portfolio

Introduction to the Transaction

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently expanded its investment portfolio with the addition of RCM Technologies Inc (NASDAQ:RCMT). On December 29, 2023, the firm acquired 56,100 shares of RCMT at a trade price of $29.04. This transaction increased the firm's total holdings in RCMT to 597,073 shares, representing a 7.62% ownership stake in the company and a 0.03% position in the firm's portfolio.

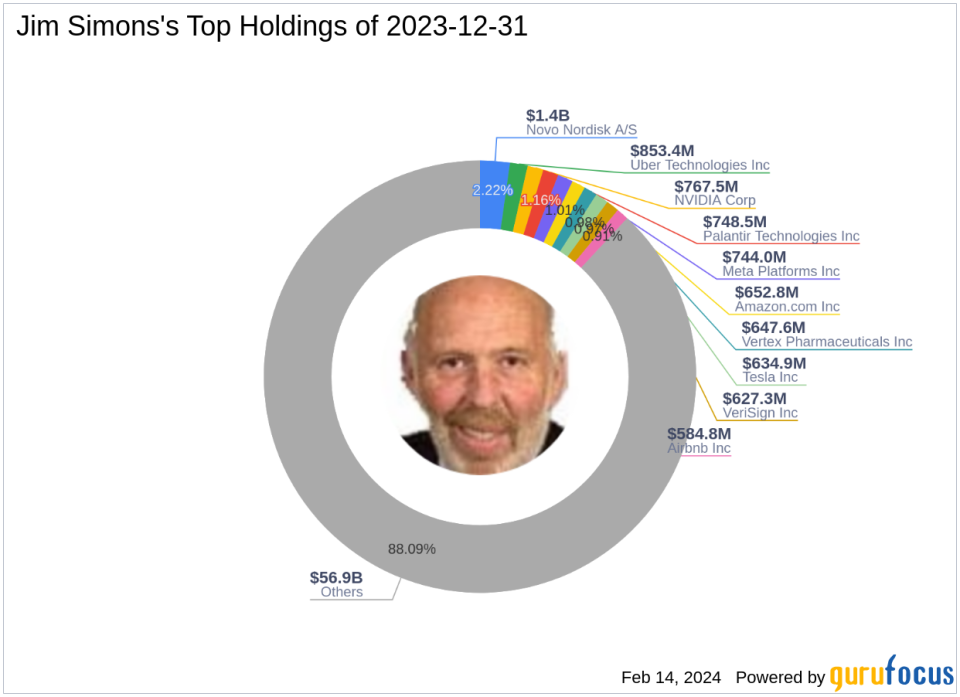

Guru Profile: Jim Simons (Trades, Portfolio)

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, is a renowned figure in the investment world. Since establishing the firm in 1982, Simons has led Renaissance to become one of the most successful hedge funds globally, thanks to its sophisticated mathematical models and data-driven trading strategies. The firm's approach to the market is rooted in scientific thinking and statistical evidence, avoiding reliance on apparent winning strategies that could be mere flukes. With a focus on technology and healthcare sectors, Renaissance Technologies manages an equity portfolio worth $64.61 billion, featuring top holdings such as Meta Platforms Inc (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA).

RCM Technologies Inc (NASDAQ:RCMT) Overview

RCM Technologies Inc, based in the USA, has been a provider of business and technology solutions since its IPO on August 18, 1995. The company operates through three segments: Engineering, Information Technology, and Specialty Health Care, with the latter generating the most revenue. With a market capitalization of $222.753 million and a stock price of $28.44, RCMT is currently deemed Significantly Overvalued by GuruFocus metrics. Despite this, the company has shown robust financial health and profitability, with a Financial Strength rank of 7/10 and a Profitability Rank of 7/10.

Analysis of the Trade

The recent acquisition by Renaissance Technologies has not only increased its stake in RCMT but also reflects confidence in the company's future performance. The trade was executed at a price slightly above the current market value, with RCMT's stock price experiencing a minor decline of -2.07% since the transaction. Despite this, the firm's position in RCMT is relatively small, with a 0.03% portfolio weight, suggesting a cautious investment approach.

Market Context and Stock Valuation

RCMT's current stock price stands at $28.44, with a PE ratio of 15.63, indicating profitability. However, the stock is considered Significantly Overvalued with a GF Value of $15.09 and a Price to GF Value ratio of 1.88. The stock has experienced a year-to-date price change ratio of -8.76%, yet it has grown significantly by 506.4% since its IPO.

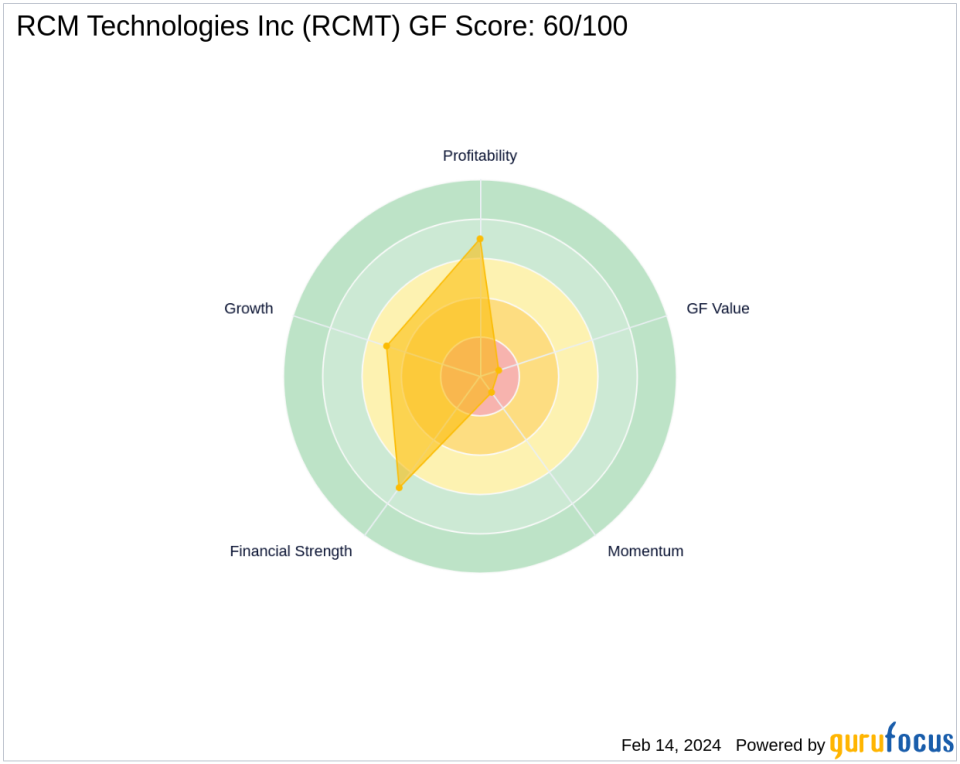

Performance and Rankings

RCMT's financial health is solid, with an interest coverage ratio of 19.41 and an Altman Z score of 4.76, indicating low bankruptcy risk. The company's ROE and ROA are impressive at 59.15% and 17.50%, respectively. However, its Growth Rank and Momentum Rank are modest, with scores of 5/10 and 1/10. The GF Score of 60/100 suggests that RCMT may have poor future performance potential.

Comparative Analysis

When compared to the largest guru shareholder in RCMT, Hotchkis & Wiley Capital Management LLC, Renaissance Technologies' recent acquisition represents a significant share percentage, potentially allowing for notable influence over the company's strategic decisions.

Conclusion

Jim Simons (Trades, Portfolio)' recent trade in RCM Technologies Inc reflects a strategic addition to Renaissance Technologies' diverse portfolio. While the firm's stake in RCMT is not large, it underscores a calculated move by one of the world's leading hedge funds. With RCMT's strong financials but overvalued stock price, it will be interesting to see how this investment aligns with Simons' data-driven investment philosophy in the long run.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.