Jim Simons Adds StealthGas Inc to Portfolio in Recent Trade

Overview of Jim Simons (Trades, Portfolio)'s Recent Portfolio Addition

On March 1, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable addition to its investment portfolio by acquiring 2,122,816 shares of StealthGas Inc (GASS), a Greece-based international shipping transportation company. The transaction, which saw the firm add shares at a trade price of $3, reflects a 14.38% change in the firm's holdings, with a trade share change of 266,933 shares. Despite the significant number of shares purchased, the trade impact on the portfolio was registered at 0, indicating a minimal effect on the overall investment strategy.

Jim Simons (Trades, Portfolio) and Renaissance Technologies Corporation

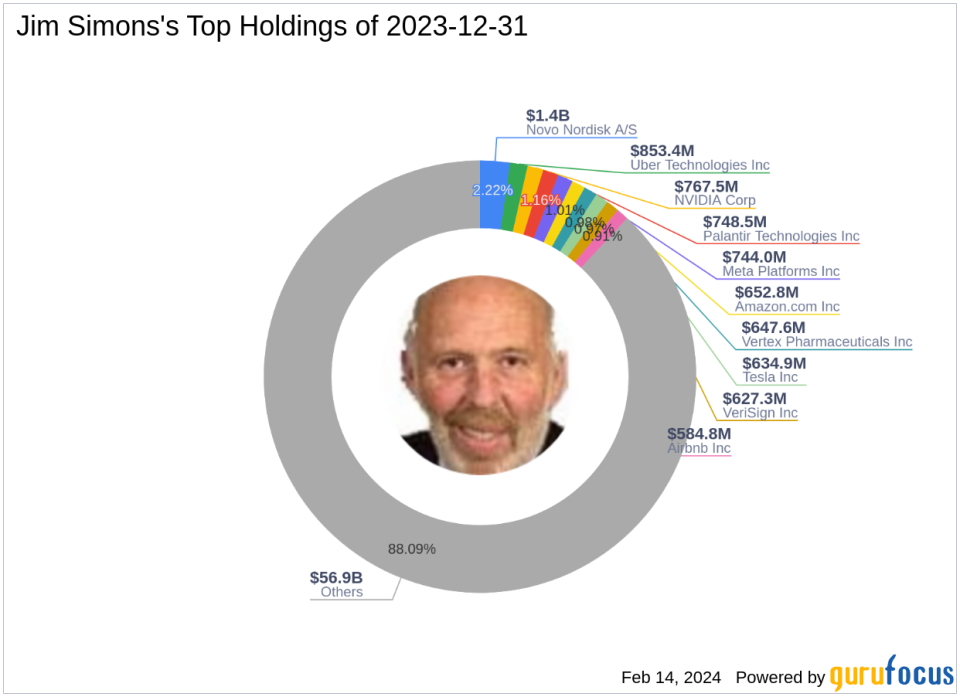

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies Corporation in 1982. The firm has since become one of the world's leading hedge funds, known for its sophisticated mathematical models and automated trading strategies. Renaissance Technologies' approach to investing is grounded in data analysis and scientific thinking, aiming to identify non-random price movements for predictive trading. With a diverse portfolio including top holdings such as Meta Platforms Inc (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA), the firm's equity stands at a staggering $64.61 billion, with a strong focus on technology and healthcare sectors.

StealthGas Inc: Business and Financial Snapshot

StealthGas Inc operates within the international shipping industry, specializing in the transportation of liquefied petroleum gas (LPG) and other petroleum products. Since its IPO on October 6, 2005, the company has been committed to serving LPG producers and users, as well as oil producers and refineries. Despite a challenging market, StealthGas Inc boasts a market capitalization of $246.459 million and a stock price of $6.98 as of the latest data. The company's stock performance has seen a significant gain of 132.67% since the trade date, although it has experienced a decline of 51.2% since its IPO.

Impact of the Trade on Jim Simons (Trades, Portfolio)'s Portfolio

The acquisition of StealthGas Inc shares by Renaissance Technologies represents a strategic move, albeit with a minimal immediate impact on the firm's portfolio, as indicated by the trade impact of 0. The position in StealthGas Inc now accounts for 0.01% of the firm's portfolio, with the firm holding a 6.01% stake in the traded stock. This suggests a cautious approach to the investment, aligning with the firm's data-driven and scientific investment philosophy.

StealthGas Inc's Market Performance and Valuation

Currently, StealthGas Inc's stock is trading at a price-to-GF Value ratio of 2.46, with the stock's GF Value listed at $2.84. This indicates that the stock is trading above its intrinsic value, and investors should exercise caution. The company's PE ratio stands at 5.27, suggesting a potentially undervalued stock based on earnings. However, the GF Value Rank is at the lowest at 1/10, signaling that the stock may not be as attractive from a valuation perspective.

Financial Health and Growth Prospects of StealthGas Inc

StealthGas Inc's financial health is reflected in its Financial Strength with a Balance Sheet Rank of 7/10, and a Profitability Rank of 6/10. However, the company's Growth Rank is low at 2/10, indicating potential concerns regarding its growth trajectory. The Piotroski F-Score of 9 suggests good financial health, while the Altman Z score of 1.86 raises some caution about the company's financial stability. The cash to debt ratio of 0.57, along with an interest coverage of 3.93, provides a mixed view of the company's ability to manage its debt.

Valuation and Performance Metrics

StealthGas Inc's valuation and performance metrics present a varied picture. The company's GF Score stands at 44/100, indicating potential challenges in future performance. The GF Value Rank and Momentum Rank are both at the lower end, suggesting that the stock may not be poised for strong momentum or attractive valuation in the near term.

Looking Ahead: StealthGas Inc's Prospects

Considering the earning growth and predictability, StealthGas Inc has shown a remarkable three-year earning growth of 134.20%. However, the lack of a Predictability Rank suggests uncertainty in future earnings. Jim Simons (Trades, Portfolio)'s investment in StealthGas Inc may signal confidence in the company's long-term potential, offering value investors an opportunity to consider the stock's prospects amidst the firm's data-driven investment approach.

In conclusion, Jim Simons (Trades, Portfolio)'s recent trade involving StealthGas Inc represents a calculated addition to Renaissance Technologies' diverse portfolio. While the immediate impact on the portfolio is minimal, the firm's significant stake in the company and the stock's current market performance may indicate a strategic long-term investment. Value investors should closely monitor StealthGas Inc's financial health, growth metrics, and market valuation to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.