Jim Simons Adds Vanda Pharmaceuticals to Portfolio in Recent Trade

Overview of Jim Simons (Trades, Portfolio)'s Latest Portfolio Addition

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently expanded its investment portfolio with the acquisition of 3,681,125 shares in Vanda Pharmaceuticals Inc (NASDAQ:VNDA). The transaction, which took place on December 29, 2023, reflects a significant addition to the firm's diverse array of holdings. With a trade price of $4.22 per share, the firm has demonstrated a strategic interest in the biopharmaceutical sector, marking a new investment direction with potential growth opportunities.

Jim Simons (Trades, Portfolio)'s Investment Firm and Philosophy

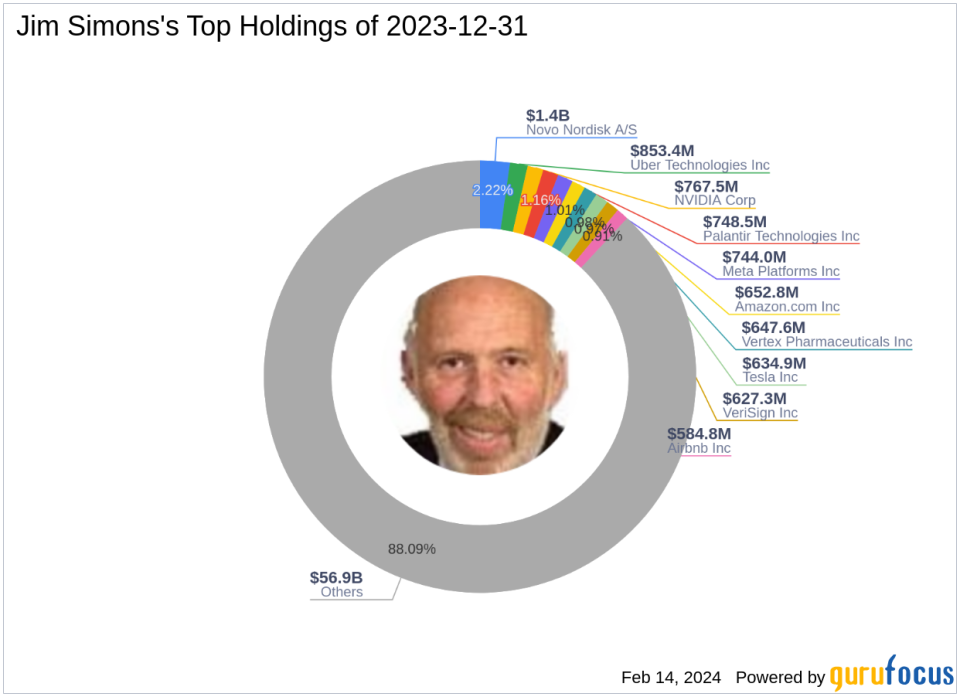

Jim Simons (Trades, Portfolio), the founder and CEO of Renaissance Technologies, has built a reputation for leveraging mathematical models and scientific methods to drive investment decisions. Since its inception in 1982, the firm has been at the forefront of quantitative trading, utilizing extensive data analysis to predict market movements and execute trades. This scientific approach to investing has distinguished Renaissance Technologies as a leader in the hedge fund industry, consistently delivering strong returns for its investors. The firm's top holdings include prominent companies such as Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO), showcasing a preference for technology and healthcare sectors.

Introducing Vanda Pharmaceuticals Inc

Vanda Pharmaceuticals Inc, based in the USA, operates within the biotechnology industry and has been publicly traded since April 12, 2006. The company focuses on developing and commercializing novel therapies to address unmet medical needs. VNDA's product portfolio includes HETLIOZ for Non-24-Hour Sleep-Wake Disorder and Fanapt for schizophrenia, among others. Despite a market capitalization of $233.602 million and a PE ratio of 78.19%, the company's stock is currently considered a possible value trap by GuruFocus, with a GF Value of $7.52 and a stock price to GF Value ratio of 0.54.

Impact of the Trade on Simons's Portfolio

The recent acquisition of VNDA shares by Renaissance Technologies has a modest impact on the firm's portfolio, with a position size of 0.03% and a share change of 415,100. This trade has increased the firm's holdings in VNDA to a 6.40% stake, indicating a strategic investment in the biopharmaceutical company. The trade's impact on the overall portfolio is yet to be fully realized, but it aligns with the firm's history of identifying potential growth opportunities in the healthcare sector.

Performance and Valuation Metrics of VNDA

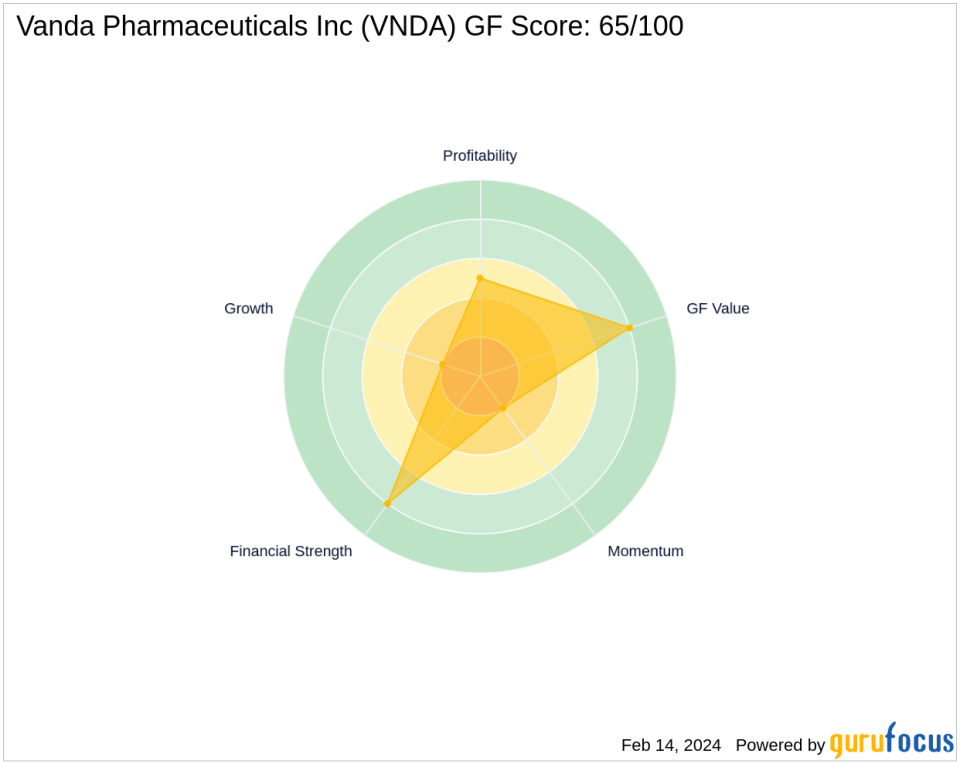

Vanda Pharmaceuticals' current stock price stands at $4.06, which is a 3.79% decrease since the trade date and a 10.18% decline year-to-date. The stock's performance has been underwhelming, with a GF Score of 65/100, indicating poor future performance potential. The company's financial health, as reflected by its Financial Strength and Profitability Rank, is mixed, with a strong cash to debt ratio of 41.29 but a low Growth Rank of 2/10. VNDA's valuation ranks, including GF Value Rank and Momentum Rank, suggest caution for investors considering this stock.

Sector Focus and Top Holdings of Jim Simons (Trades, Portfolio)

Renaissance Technologies, under Jim Simons (Trades, Portfolio)'s leadership, has a significant investment focus on the technology and healthcare sectors. The firm's top holdings reflect this focus, with major positions in companies that are leaders in their respective industries. The addition of VNDA to the portfolio further emphasizes the firm's commitment to diversifying within these sectors and seeking out companies with strong growth potential.

Market Reaction and Future Outlook for VNDA

Since the acquisition by Jim Simons (Trades, Portfolio)'s firm, VNDA's stock price has experienced a slight decline. However, the long-term outlook for the company may be influenced by its growth prospects and position within the biotechnology industry. Investors will be closely monitoring Vanda Pharmaceuticals' performance, particularly in light of its current valuation and market trends.

Comparative Financial Health Analysis of VNDA

An evaluation of VNDA's financial health reveals a company with a solid balance sheet, as indicated by its Financial Strength rank of 8/10. However, the company's Profitability Rank and Growth Rank suggest areas of concern, with profitability being average and growth lagging. The Piotroski F-Score of 6 points to a somewhat stable financial situation, but the low Altman Z score and negative growth in operating margin highlight potential risks. These financial indicators will be critical for investors to consider when assessing VNDA's investment viability.

Transaction Analysis and Portfolio Influence

The recent trade by Renaissance Technologies has introduced Vanda Pharmaceuticals into its portfolio, potentially signaling confidence in the company's future despite mixed financial indicators. The transaction's influence on the stock and the firm's portfolio will be closely watched, as it may provide insights into the firm's broader investment strategy and the biopharmaceutical sector's attractiveness to value investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.