Jim Simons Adds Westwood Holdings Group Inc to Portfolio

Introduction to the Transaction

Jim Simons (Trades, Portfolio)'s firm, Renaissance Technologies, has recently expanded its investment portfolio with the addition of Westwood Holdings Group Inc (NYSE:WHG). This move signifies a strategic investment by one of the world's leading quantitative hedge funds. The transaction involved the acquisition of 47,0651 shares in WHG, marking a notable addition to Simons's diverse array of investments.

Guru Profile: Jim Simons (Trades, Portfolio)

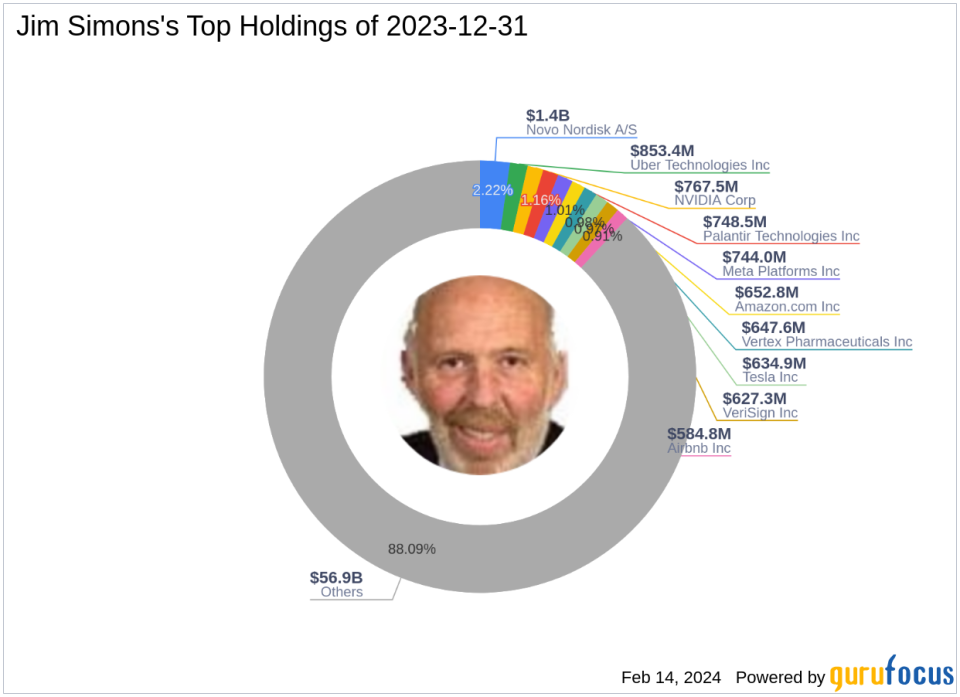

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its sophisticated mathematical models and automated trading strategies, which have consistently delivered exceptional returns. Simons's investment philosophy revolves around the scientific approach to data analysis and non-random price movement predictions. With a portfolio equity of $64.61 billion, Renaissance Technologies has a strong presence in sectors such as Technology and Healthcare. The firm's top holdings include Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

Details of the Trade

The transaction took place on December 29, 2023, with Renaissance Technologies adding 30,600 shares of Westwood Holdings Group Inc at a trade price of $12.57. This trade has increased the firm's total shareholding in WHG to 470,651, which represents a 5.15% ownership stake in the company. Despite the trade's minimal impact on the overall portfolio, holding a 0.01% position, it reflects Simons's confidence in WHG's potential.

Westwood Holdings Group Inc Company Overview

Westwood Holdings Group Inc, operating primarily in the United States, manages investment assets and provides services through its Advisory and Trust segments. The company, which went public on July 1, 2002, has a market capitalization of $109.748 million. The Advisory segment is the primary revenue generator, offering investment advisory services to a diverse client base, including corporate retirement plans and endowments. The Trust segment complements these services with trust and custodial offerings.

Stock Performance and Valuation

Currently, WHG's stock price stands at $12, which is below the GF Value of $17.17, indicating a price to GF Value ratio of 0.70. However, the stock is labeled as a "Possible Value Trap," suggesting investors should think twice before investing. The stock has experienced a -4.53% price change since the transaction and a -11.11% change since its IPO. The GF Score of 75/100 points to a potential for average performance, supported by a strong Financial Strength rank of 8/10 and a Profitability Rank of 7/10.

Sector and Market Analysis

Renaissance Technologies has a history of favoring investments in the Technology and Healthcare sectors. The addition of WHG, an Asset Management company, diversifies the firm's sector exposure. With a market capitalization that places it within the small-cap range, WHG offers a different risk-reward profile compared to Simons's typical investments.

Comparative Guru Holdings

While Renaissance Technologies has taken a significant position in WHG, the largest guru shareholder is GAMCO Investors. The comparison of Simons's position to other notable investors is not applicable as the largest guru share percentage data is not provided.

Conclusion and Summary of Key Points

Jim Simons (Trades, Portfolio)'s recent acquisition of Westwood Holdings Group Inc shares is a strategic addition to Renaissance Technologies' diverse portfolio. Despite the minimal impact on the portfolio's overall composition, the investment in WHG aligns with Simons's data-driven approach to value investing. The stock's current valuation and performance indicators suggest a cautious approach, but the firm's strong financial and profitability ranks may offer some reassurance to potential investors. As always, value investors should conduct their own research and consider the broader market context when evaluating this and any other investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.