Jim Simons Adds Winmark Corp to Investment Portfolio

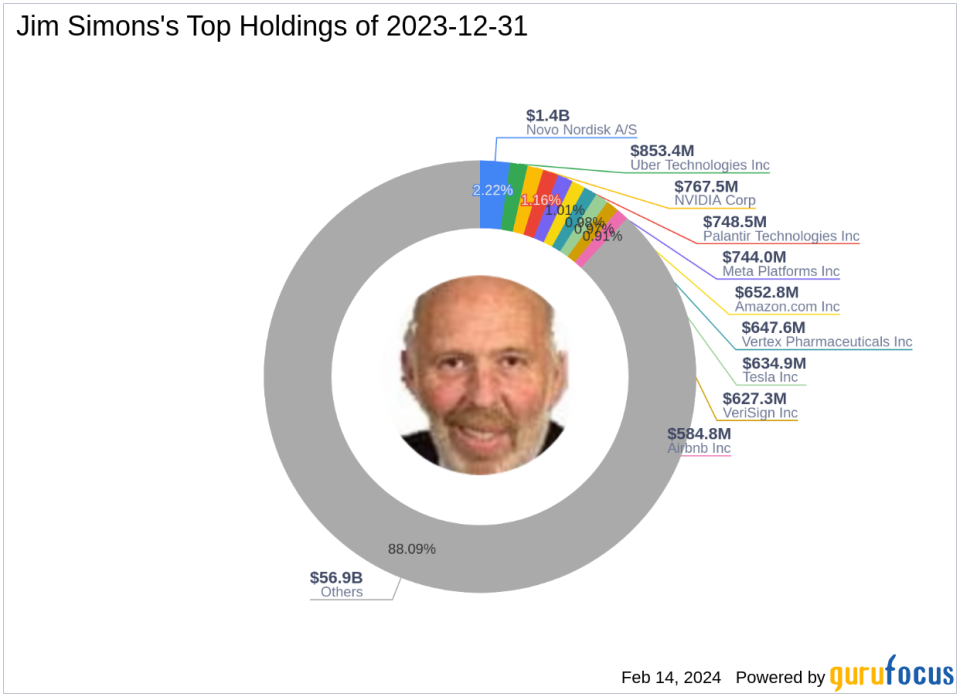

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 20, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable addition to its investment portfolio by acquiring 9,200 shares of Winmark Corp (NASDAQ:WINA), a franchisor of value-oriented retail store concepts. The transaction was executed at a price of $414.66 per share, increasing the firm's total holdings in Winmark to 177,231 shares. This trade has a modest impact of 0.01% on the portfolio, with the position in Winmark Corp now representing 0.13% of the firm's holdings and 5.08% of Winmark's available stock.

Profile of Investment Firm: Renaissance Technologies

Founded in 1982 by Jim Simons (Trades, Portfolio), Renaissance Technologies is a private investment firm that has grown into one of the world's leading hedge funds. The firm is renowned for its use of complex mathematical models and automated trading strategies, which are based on extensive data analysis to predict price changes in financial instruments. Simons's scientific approach to trading emphasizes the importance of not relying on statistical flukes but rather on solid, data-driven strategies.

Winmark Corp: A Franchise Powerhouse

Winmark Corp, with its franchising and leasing segments, specializes in operating value-oriented retail stores that buy, sell, trade, and consign gently used merchandise. The company, which went public on August 25, 1993, has a market capitalization of $1.31 billion. Despite being labeled as "Significantly Overvalued" with a GF Value of $271.79, Winmark has demonstrated a robust financial performance, boasting a PE Ratio of 33.21. The stock's price has seen a decline of 9.48% since the transaction date, currently standing at $375.35.

Impact of the Trade on Simons's Portfolio

The recent acquisition of Winmark shares by Renaissance Technologies has slightly increased the diversity of the firm's portfolio, which is heavily weighted in the technology and healthcare sectors. The trade's impact, while minimal in terms of portfolio percentage, signifies a strategic investment in the retail-cyclical industry, where Winmark Corp is a key player.

Winmark Corp's Stock Performance and Valuation

Winmark's stock has experienced a significant appreciation since its IPO, with an increase of 2,402.33%. However, the year-to-date performance shows a decrease of 7.99%. The stock's valuation metrics indicate that it is trading above its GF Value, with a Price to GF Value ratio of 1.38, suggesting that the stock may be overvalued at its current price.

Financial Health and Growth Prospects of Winmark Corp

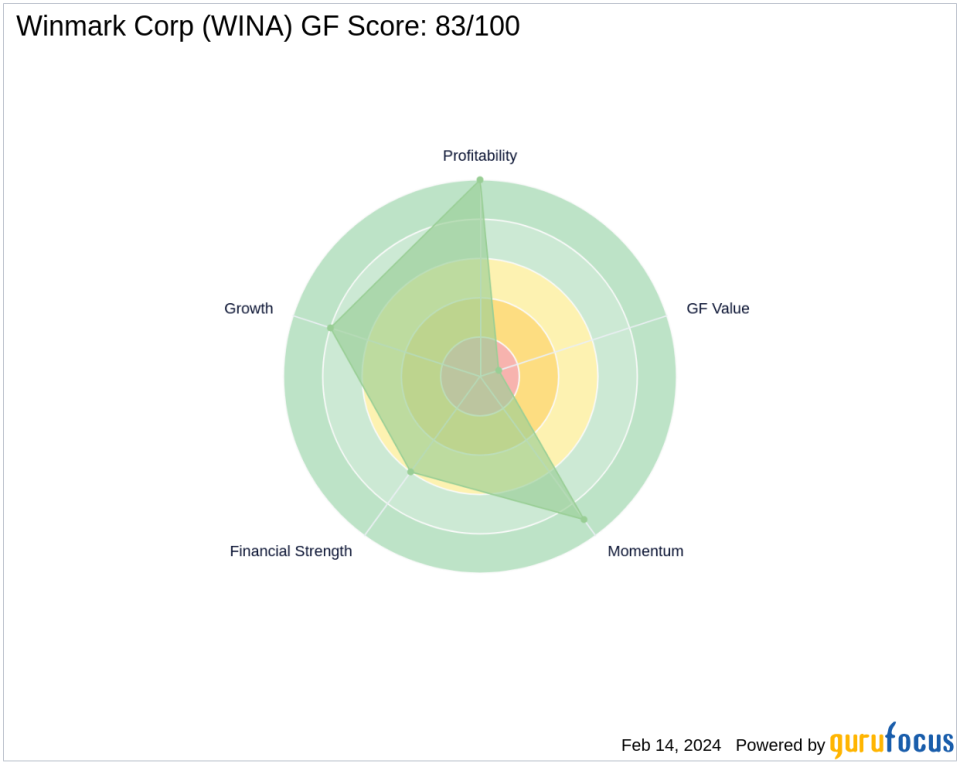

Winmark's financial health is solid, with a Financial Strength rank of 6/10 and an impressive Profitability Rank of 10/10. The company's Growth Rank stands at 8/10, reflecting its potential for future expansion. Additionally, Winmark's Piotroski F-Score is 8, indicating a healthy financial situation, and its Altman Z-Score of 13.35 suggests a low probability of financial distress.

Market Reaction and Future Outlook for Winmark Corp

Following the transaction, Winmark's stock price has not shown significant movement, which could be attributed to the overall market conditions or the stock's current valuation. The stock's GF Score of 83/100 indicates good potential for future performance, but investors should be cautious given the stock's current valuation status.

Winmark Corp in the Retail-Cyclical Industry

Within the retail-cyclical industry, Winmark Corp stands out for its unique franchising model and consistent financial performance. The company's strategic positioning and growth prospects make it an attractive investment, particularly for a firm like Renaissance Technologies, which values data-driven investment decisions.

Conclusion

Jim Simons (Trades, Portfolio)'s recent investment in Winmark Corp reflects a calculated move to diversify Renaissance Technologies' portfolio. While the trade's impact on the overall portfolio is minimal, it showcases the firm's confidence in Winmark's business model and growth potential. As the stock currently appears overvalued based on GF Value metrics, investors should monitor the company's performance closely, considering its strong financial health and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.