Jim Simons Adjusts Position in Carriage Services Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Carriage Services Inc (NYSE:CSV). The transaction involved the sale of 47,000 shares at a price of $25.01 each. Following this trade, the firm's holding in Carriage Services Inc stands at 594,100 shares, which represents a 3.97% ownership in the company and a 0.03% position in Simons's portfolio.

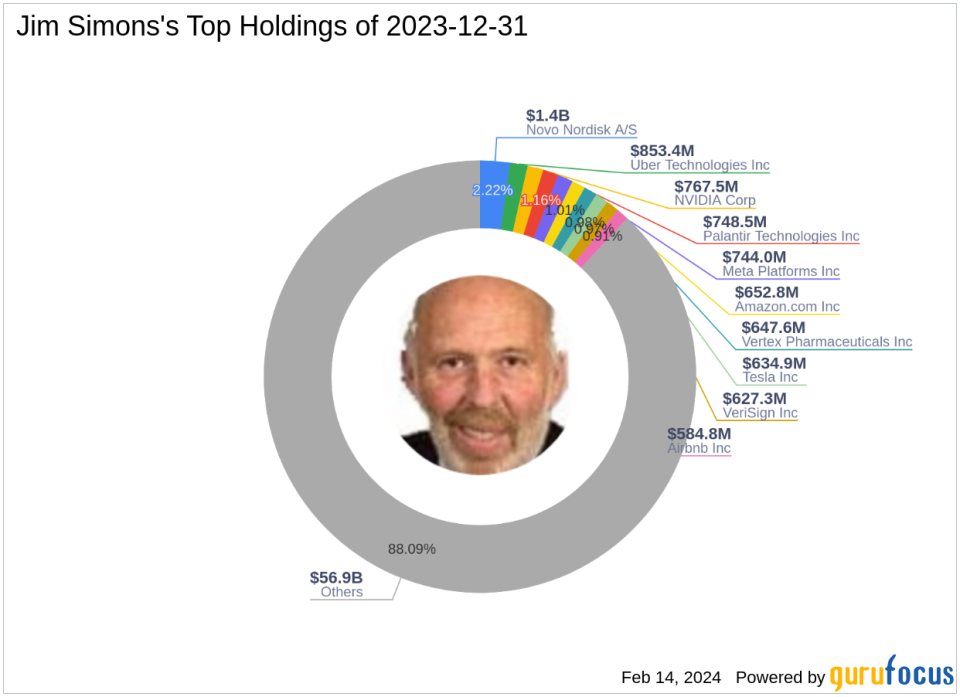

Jim Simons (Trades, Portfolio) and Renaissance Technologies Corporation

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies Corporation in 1982. The firm has since become one of the most successful hedge funds globally, known for its use of complex mathematical models and automated trading strategies. Renaissance Technologies' approach to investing is deeply rooted in data analysis and scientific thinking, aiming to identify non-random price movements for predictive trading. As of now, the firm manages an equity portfolio worth $64.61 billion, with top holdings in technology and healthcare sectors, including Meta Platforms Inc (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA).

Carriage Services Inc Company Profile

Carriage Services Inc, with its stock symbol CSV, is a prominent provider of funeral and cemetery services in the United States. Since its IPO on August 9, 1996, the company has operated through two main segments: Funeral Home Operations and Cemetery Operations. The former includes a range of services from burial and cremation to the sale of related merchandise, while the latter offers interment services and cemetery property. The majority of Carriage Services' revenue is generated from its Funeral Home Operations. The company's market capitalization stands at $364.349 million, with a stock price of $24.32 and a PE ratio of 12.60.

Analysis of the Trade Impact

The recent reduction in shares by Jim Simons (Trades, Portfolio) has brought the firm's total shareholding in Carriage Services Inc to 594,100. This adjustment reflects a minor change in the firm's portfolio, with a negligible trade impact of 0%. The trade price of $25.01 and the current position of the stock in Simons's portfolio at 0.03% indicate a strategic rebalancing rather than a significant shift in investment stance.

Carriage Services Inc Stock Analysis

Carriage Services Inc's current market capitalization is approximately $364.349 million, with a stock price of $24.32. The stock's PE ratio is 12.60, suggesting a reasonable valuation relative to earnings. However, the GF Valuation labels the stock as a "Possible Value Trap, Think Twice," with a GF Value of $44.36 and a price to GF Value ratio of 0.55. Since the trade date, the stock has experienced a price change of -2.76%, indicating a slight decline.

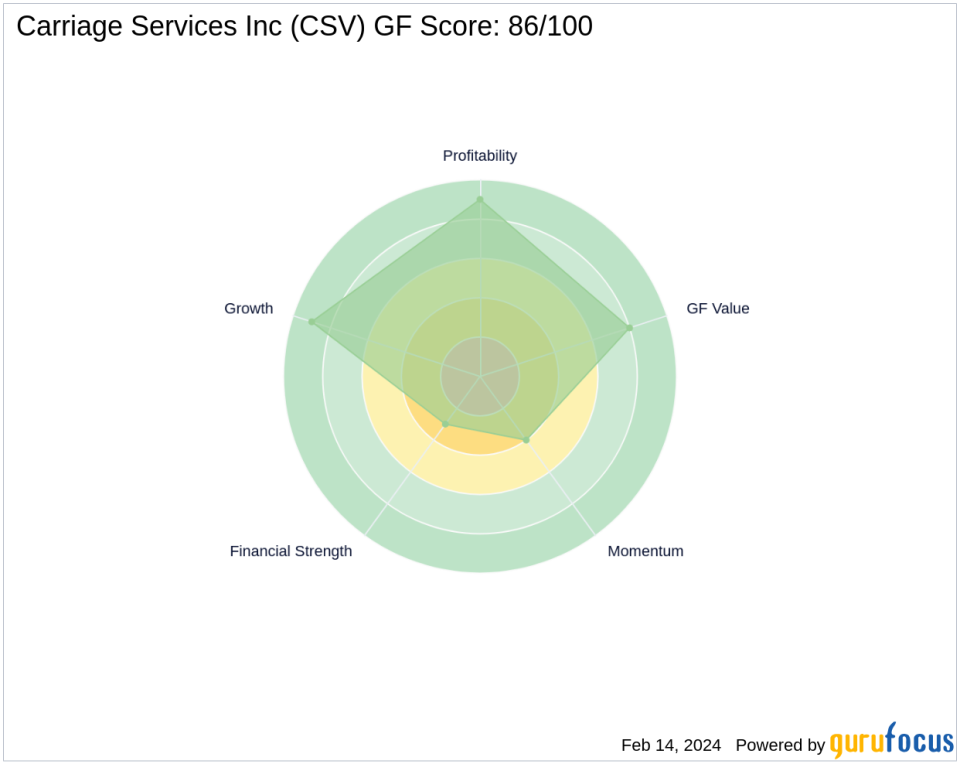

Performance Metrics and Rankings

Carriage Services Inc boasts a strong GF Score of 86/100, suggesting good outperformance potential. The company's Profitability Rank is high at 9/10, and its Growth Rank is equally impressive at 9/10. However, its Financial Strength is lower, with a score of 3/10. The GF Value Rank stands at 8/10, while the Momentum Rank is at 4/10.

Market and Historical Context

Comparing the stock's current price to its GF Value, Carriage Services Inc appears to be undervalued, with a ratio of 0.55. Historically, since its IPO, the stock has seen a price change of 47.39%. However, the year-to-date price change ratio stands at -2.76%, reflecting recent market fluctuations.

Conclusion

The recent transaction by Jim Simons (Trades, Portfolio) in Carriage Services Inc represents a minor adjustment in Renaissance Technologies' portfolio. While the firm has reduced its stake, the overall impact on its investment strategy appears limited. For value investors, the current undervaluation of CSV according to GF Value, combined with its strong profitability and growth rankings, may present an opportunity, albeit with caution due to the "Possible Value Trap" warning. As always, investors should conduct their due diligence and consider the broader market context when evaluating potential investments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.