Jim Simons Adjusts Position in First Financial Northwest Inc

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently made a notable adjustment in its investment portfolio by reducing its stake in First Financial Northwest Inc (NASDAQ:FFNW). On December 29, 2023, the firm sold 7,800 shares of FFNW at a trade price of $13.48. Following this transaction, Renaissance Technologies holds a total of 486,801 shares in the company, which represents a 5.30% ownership and a minimal 0.01% position in the firm's portfolio, indicating a relatively small trade impact.

Jim Simons (Trades, Portfolio) and Renaissance Technologies: A Profile

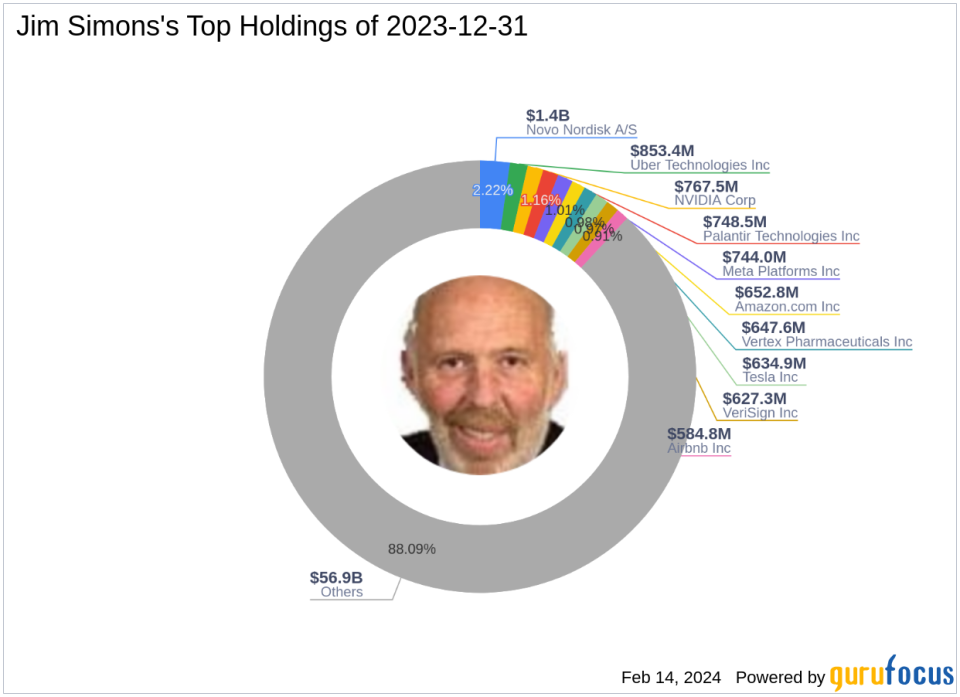

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, has been a prominent figure in the investment world since establishing the firm in 1982. The firm is renowned for its quantitative, data-driven investment approach, utilizing complex mathematical models to predict market movements. This strategy has positioned Renaissance Technologies as one of the most successful hedge funds globally. The firm's top holdings include Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), Novo Nordisk A/S (NYSE:NVO), Uber Technologies Inc (NYSE:UBER), and Palantir Technologies Inc (NYSE:PLTR), with a significant equity portfolio valued at $64.61 billion, primarily concentrated in the Technology and Healthcare sectors.

Overview of First Financial Northwest Inc

First Financial Northwest Inc, with its stock symbol FFNW, operates as the holding company for First Financial Northwest Bank. Since its IPO on October 10, 2007, the company has focused on attracting deposits and originating various types of loans, including residential, commercial real estate, and consumer loans. With a market capitalization of $190.658 million, First Financial Northwest Inc has established itself as a player in the banking industry, operating within a single segment.

Impact of the Trade on Simons' Portfolio

The recent trade by Jim Simons (Trades, Portfolio)' Renaissance Technologies has had no significant impact on the firm's portfolio, with the trade impact recorded at 0. This suggests that the transaction was a minor adjustment rather than a strategic shift in the firm's investment stance towards First Financial Northwest Inc.

Stock Performance and Valuation

Since the trade date, First Financial Northwest Inc's stock price has seen a substantial increase, currently trading at $20.77, which represents a 54.08% gain. The stock is deemed Significantly Overvalued according to the GF Value, with a current Price to GF Value ratio of 1.36. This valuation suggests that the stock may not offer a sufficient margin of safety at its current price.

Financial Health and Growth Prospects

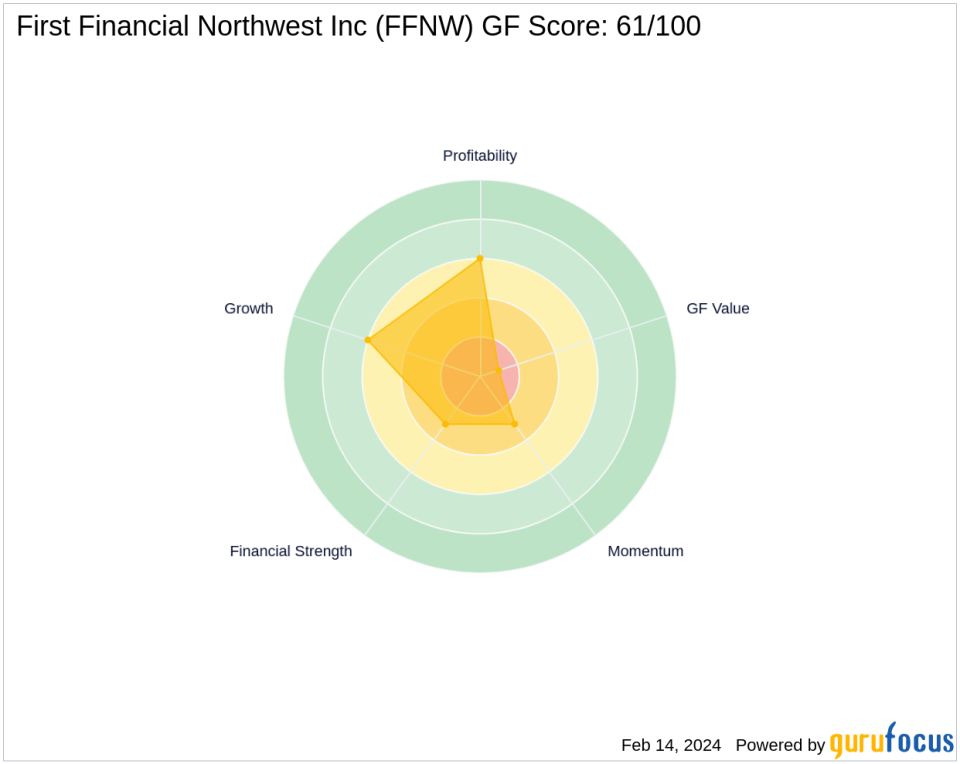

First Financial Northwest Inc's financial health is reflected in its Financial Strength rank of 3/10, with a Cash to Debt ratio of 0.24. The company's growth metrics, including a 12.10% Earning Growth over the past three years, indicate potential for future performance. However, the GF Score of 61/100 suggests that the stock may have poor future performance potential.

Comparative Market Analysis

In the context of the banking industry, First Financial Northwest Inc's market position is moderate, with a Return on Equity (ROE) of 3.94% and Return on Assets (ROA) of 0.41%. The stock's ranks in terms of Profitability Rank (6/10), Growth Rank (6/10), and Momentum Rank (3/10) provide a comparative perspective for investors considering this stock.

Transaction Analysis and Conclusion

The reduction in shares of First Financial Northwest Inc by Renaissance Technologies may be interpreted as a tactical move rather than a significant change in the firm's investment philosophy. Given the stock's current valuation and performance metrics, it appears that Jim Simons (Trades, Portfolio)' firm is adjusting its holdings in response to the stock's recent price movements and potential overvaluation concerns. Investors should consider these factors, along with the company's financial health and growth prospects, when evaluating First Financial Northwest Inc as a potential investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.