Jim Simons Adjusts Position in GeoPark Ltd

Overview of Jim Simons (Trades, Portfolio)'s Recent Stock Transaction

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in GeoPark Ltd (NYSE:GPRK). The transaction involved the sale of 256,900 shares at a trade price of $8.57. Following this move, the firm's total shareholding in GeoPark Ltd stands at 3,091,863 shares, which represents a 5.51% ownership in the company and a 0.05% position in the firm's portfolio.

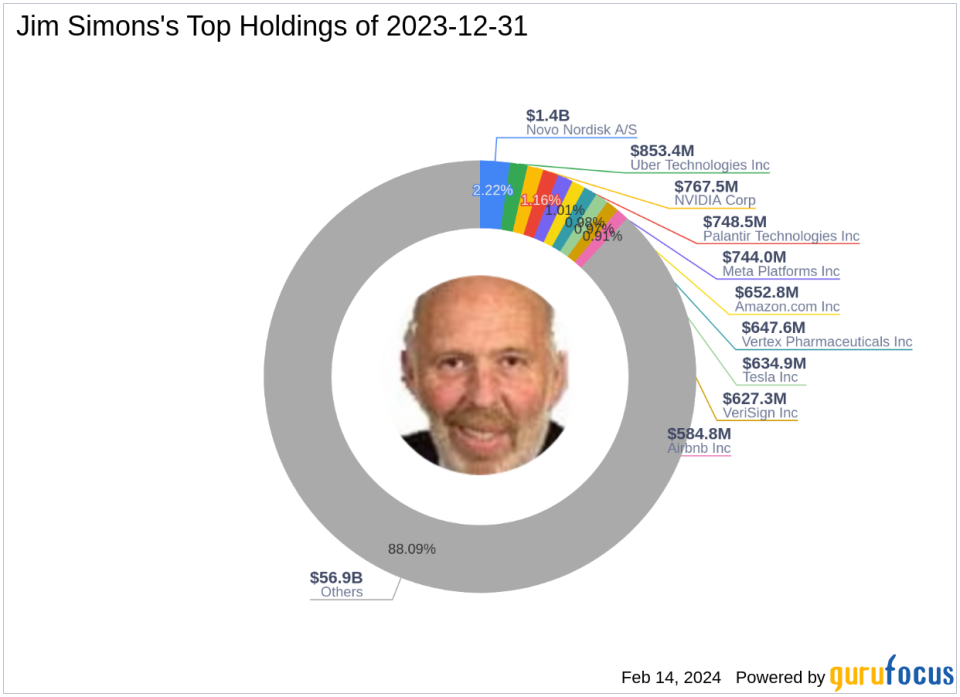

Profile of Jim Simons (Trades, Portfolio)

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements. This strategy has positioned Renaissance Technologies as one of the most successful hedge funds globally. The firm's investment philosophy emphasizes scientific thinking and statistical evidence to identify profitable trading opportunities. As of the latest data, Renaissance Technologies manages an equity portfolio worth $64.61 billion, with top holdings in technology and healthcare sectors, including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

GeoPark Ltd Company Overview

GeoPark Ltd is an oil and gas exploration and production company operating in Latin America, with a presence in Colombia, Ecuador, Chile, Brazil, and Argentina. Since its IPO on February 7, 2014, the company has focused on generating revenue through the sale of crude oil, natural gas, and related commodities. GeoPark Ltd's market capitalization stands at $474.758 million, with a PE ratio of 3.56, indicating profitability. The stock is currently priced at $8.46, which is significantly undervalued according to the GF Value of $16.35, suggesting a potential margin of safety for investors.

Analysis of the Trade Impact

The recent reduction in GeoPark Ltd by Renaissance Technologies has a minimal immediate impact on the firm's portfolio due to the small trade impact of 0. However, the decision to decrease the position size to 0.05% of the portfolio indicates a strategic shift by the firm. The significance of this move could be a reflection of the firm's assessment of GeoPark's future performance or a broader portfolio rebalancing effort.

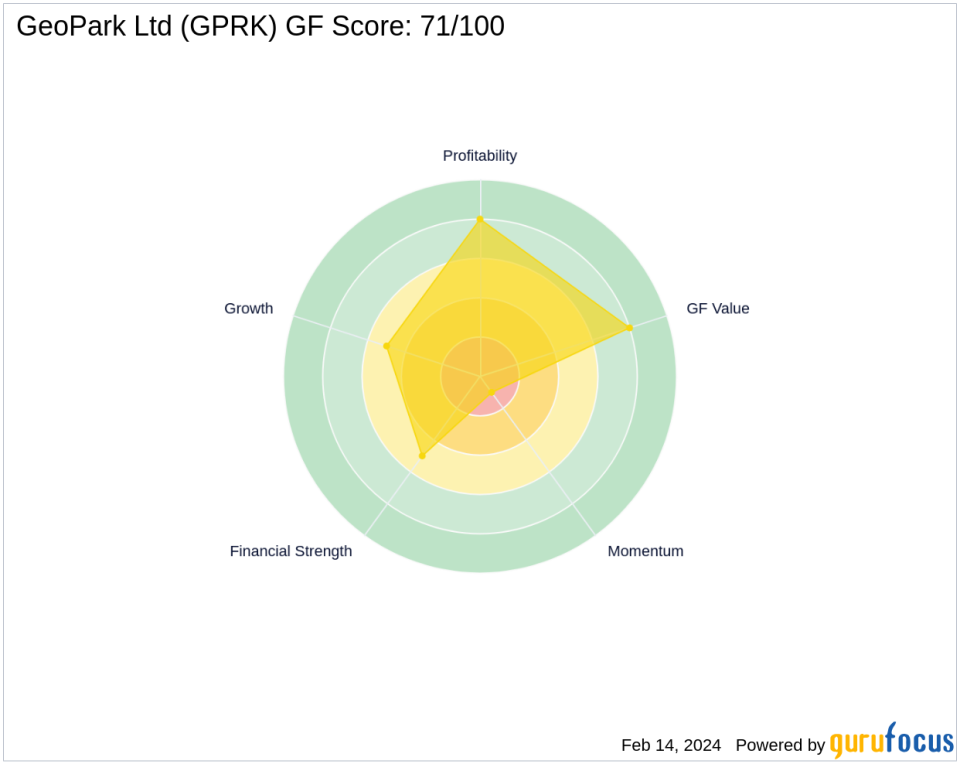

GeoPark Ltd's Stock Performance and Valuation

GeoPark Ltd's stock price has experienced a slight decline of 1.28% since the transaction, with a current price-to-GF Value ratio of 0.52. The stock's historical performance shows a decrease of 17.3% since its IPO and a year-to-date drop of 4.94%. Despite these figures, GeoPark Ltd holds a GF Score of 71/100, indicating a likelihood of average performance. The company's financial strength and profitability are reflected in its ranks, with a Financial Strength rank of 5/10 and a Profitability Rank of 8/10.

Sector and Market Context

Renaissance Technologies' top holdings predominantly lie within the technology and healthcare sectors, showcasing a diversified investment approach. GeoPark Ltd, as part of the oil and gas industry, represents a strategic allocation within the energy sector, which is subject to different market dynamics compared to the firm's primary focus areas.

Comparative Analysis

When compared to the largest guru shareholder in GeoPark Ltd, Dodge & Cox, Renaissance Technologies' share percentage stands at 5.51%. The investment strategies between the two may differ, with Dodge & Cox potentially having a different perspective on the value and future prospects of GeoPark Ltd.

Conclusion

The recent transaction by Jim Simons (Trades, Portfolio)' Renaissance Technologies in GeoPark Ltd reflects a calculated adjustment within its portfolio. Despite the stock's current undervaluation and solid GF Score, the firm has chosen to reduce its stake, possibly due to a reassessment of the stock's future performance or as part of a broader portfolio strategy. Investors will be watching closely to see how this move aligns with Renaissance Technologies' overall investment philosophy and whether it signals a change in sentiment towards the oil and gas sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.