Jim Simons Adjusts Position in Heidrick & Struggles International Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently adjusted its holdings in Heidrick & Struggles International Inc (NASDAQ:HSII), a prominent leadership advisory firm. On December 29, 2023, the firm reduced its position in HSII, signaling a strategic shift in its investment portfolio. This move by one of the world's most successful hedge funds has caught the attention of investors and market analysts alike, as they seek to understand the implications of this transaction.

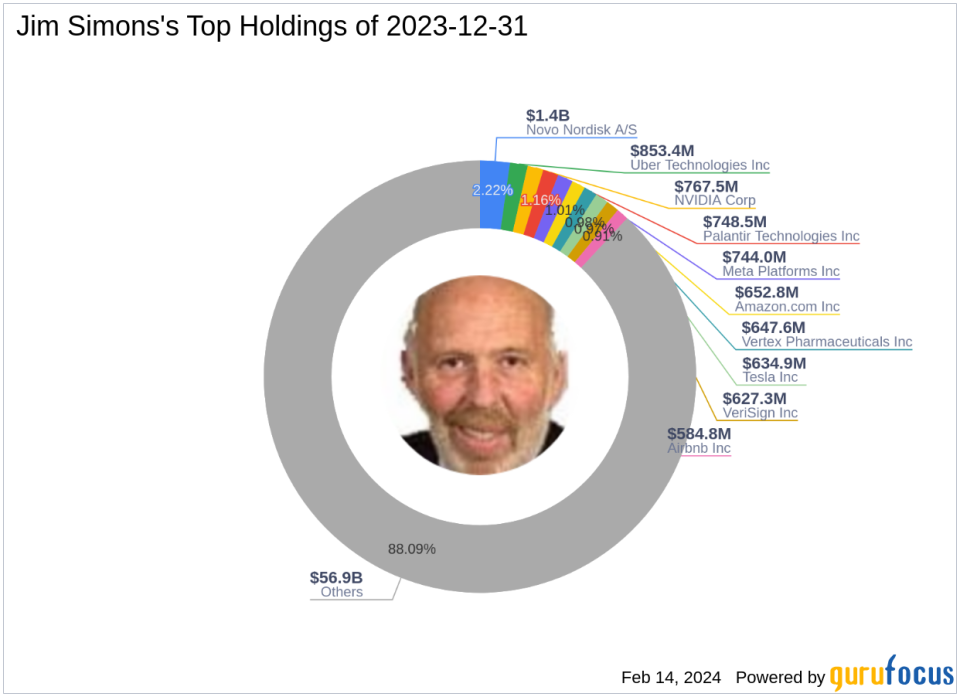

Jim Simons (Trades, Portfolio) and Renaissance Technologies

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a notable figure in the investment world since 1982. The firm is renowned for its use of complex mathematical models and automated trading strategies, which have consistently delivered exceptional returns. Renaissance Technologies' investment philosophy is grounded in data analysis and scientific thinking, avoiding reliance on statistical flukes. The firm's top holdings include Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO), with a significant equity of $64.61 billion predominantly in the Technology and Healthcare sectors.

Heidrick & Struggles International Inc at a Glance

Heidrick & Struggles International Inc, trading under the symbol HSII, operates in the Business Services industry, offering executive search and consulting services globally. Since its IPO on April 27, 1999, the company has expanded its services to include Executive Search, Heidrick Consulting, and On-Demand Talent. With a market capitalization of $581.733 million and a current stock price of $28.91, HSII is considered modestly undervalued according to the GF Value, with a GF Value of $32.01.

Details of the Transaction

The transaction on December 29 saw Renaissance Technologies reduce its stake in HSII by 16,700 shares, priced at $29.53 each. Following the trade, the firm holds 1,082,940 shares, representing a 5.38% ownership in the company and a 0.05% position in the hedge fund's portfolio. Despite the reduction, the trade had a negligible impact on the overall portfolio.

Stock Performance and Valuation Metrics

HSII's stock performance has seen a slight decline of 2.1% since the trade, with the current stock price sitting below the trade price. The stock's PE Ratio stands at 10.66, and it is trading at a 0.90 ratio to its GF Value, indicating a modest undervaluation. The company's stock has experienced a 105.62% increase since its IPO and a 1.23% uptick year-to-date.

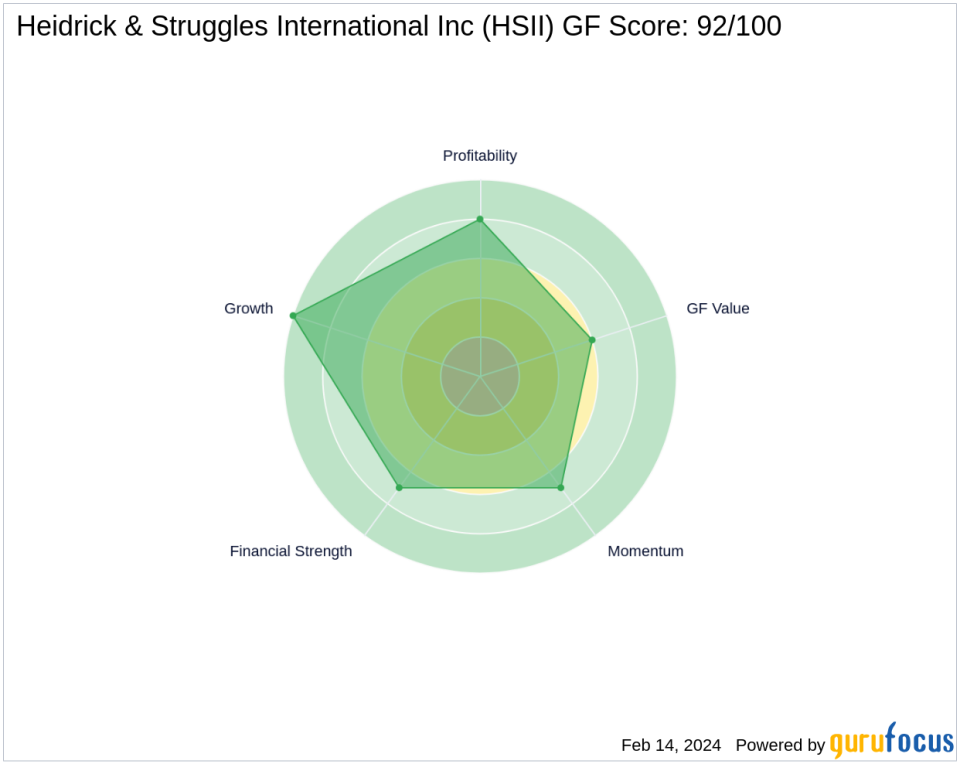

Financial Health and Ranking Insights

Heidrick & Struggles International Inc boasts a strong Financial Strength with a Balance Sheet Rank of 7/10 and a Profitability Rank of 8/10. The company's Growth Rank is impressive at 10/10, while the GF Value Rank and Momentum Rank stand at 6/10 and 7/10, respectively. With a Cash to Debt ratio of 4.35, HSII demonstrates a solid capacity to cover its debts.

Market Position and Future Outlook

Heidrick & Struggles International Inc holds a competitive position within the Business Services sector. The stock's future performance potential is underscored by a high GF Score of 92/100, suggesting a strong likelihood of outperforming the market. The company's strategic focus on leadership advisory and executive search services positions it well for continued growth.

Investor Landscape

Among the significant investors in HSII, Hotchkis & Wiley Capital Management LLC stands out as the largest guru investor, while Keeley-Teton Advisors, LLC (Trades, Portfolio) also maintains a stake in the company. The involvement of these reputable investment firms further validates the stock's appeal to value investors.

Transaction Impact Analysis

The recent reduction in HSII shares by Renaissance Technologies may reflect a strategic reallocation of resources or a response to market conditions. While the transaction's impact on the firm's portfolio is minimal, it could signal a shift in confidence or a rebalancing of positions. Investors and analysts will be watching closely to see how this trade influences HSII's stock performance and Renaissance Technologies' future investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.