Jim Simons Adjusts Position in Hello Group Inc

Recent Transaction Overview

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently adjusted its holdings in Hello Group Inc (NASDAQ:MOMO). On December 29, 2023, the firm reduced its position in the company by 470,872 shares, resulting in a -4.75% change in its holdings. The transaction was executed at a price of $6.95 per share, bringing the total number of shares held by the firm to 9,435,138. This trade has a minor impact of -0.01% on the portfolio, with the current position in Hello Group Inc now representing 0.11% of the firm's holdings and 4.97% of the company's available stock.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies in 1982. The firm has since become one of the most successful hedge funds globally, known for its sophisticated mathematical models and automated trading strategies. Simons' investment philosophy revolves around data analysis and non-random price movement predictions, leveraging scientific thinking to avoid statistical flukes. With an equity portfolio of $64.61 billion, Renaissance Technologies has significant holdings in technology and healthcare sectors, including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

Understanding Hello Group Inc

Hello Group Inc, a China-based company, specializes in mobile-based social networking services. Since its IPO on December 11, 2014, the company has focused on helping users form social relationships based on location and interests. Hello Group operates through segments like Momo, QOOL, and Tantan, with the majority of its revenue stemming from Momo's service lines. Despite a market capitalization of $1.15 billion, the company's stock is currently priced at $6.08, reflecting a significant undervaluation according to GuruFocus metrics.

Impact of the Trade on Simons' Portfolio

The recent sale of Hello Group Inc shares by Renaissance Technologies has a negligible impact on the firm's overall portfolio, given the -0.01% trade impact. However, the adjustment reflects a strategic move by Simons, possibly aligning with the firm's data-driven investment approach. The current holding of 9,435,138 shares in Hello Group Inc still constitutes a significant stake in the company, indicating a sustained interest in its potential.

Stock Performance and Valuation of Hello Group Inc

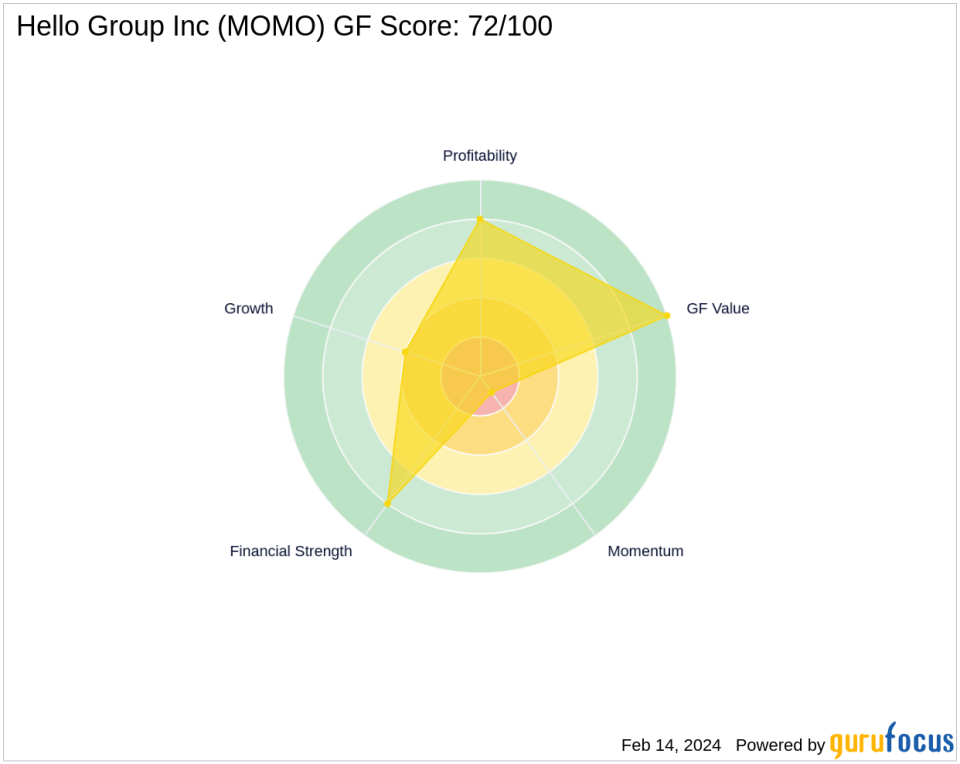

Hello Group Inc's stock performance has been underwhelming, with a -12.52% decline since the transaction date and a -57.78% drop from its IPO. The year-to-date change stands at -9.66%. Despite these figures, the company's stock is deemed "Significantly Undervalued" with a GF Value of $8.87 and a price to GF Value ratio of 0.69. The GF Score of 72/100 suggests a potential for average performance.

Sector and Market Context

Renaissance Technologies' top sector holdings are in technology and healthcare, with Hello Group Inc fitting into the broader context of the firm's interest in tech-driven companies. The market conditions and trends, particularly in the interactive media industry, may have influenced Simons' decision to adjust the firm's position in Hello Group Inc.

Comparative Financial Health

Hello Group Inc's financial health is robust, with a Financial Strength rank of 8/10 and a Profitability Rank of 8/10. The company's Piotroski F-Score is 7, indicating good financial health, while the Altman Z score of 2.89 suggests a low risk of bankruptcy. However, the company's Growth Rank is only 4/10, reflecting some concerns about its growth prospects.

Conclusion

Jim Simons (Trades, Portfolio)' recent reduction in Hello Group Inc shares is a calculated move that aligns with Renaissance Technologies' data-centric investment strategy. Despite the stock's underperformance, its valuation metrics indicate potential for future growth. Investors will be watching closely to see how this trade plays out in the context of the firm's sophisticated portfolio management approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.