Jim Simons Adjusts Position in Herbalife Ltd

Recent Transaction Overview

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Herbalife Ltd (NYSE:HLF). The firm sold 126,100 shares of the nutrition company at a trade price of $15.26 per share. Following this transaction, Renaissance Technologies holds a total of 5,926,601 shares in Herbalife, which represents a 5.98% ownership in the company and a 0.15% position in the firm's portfolio.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

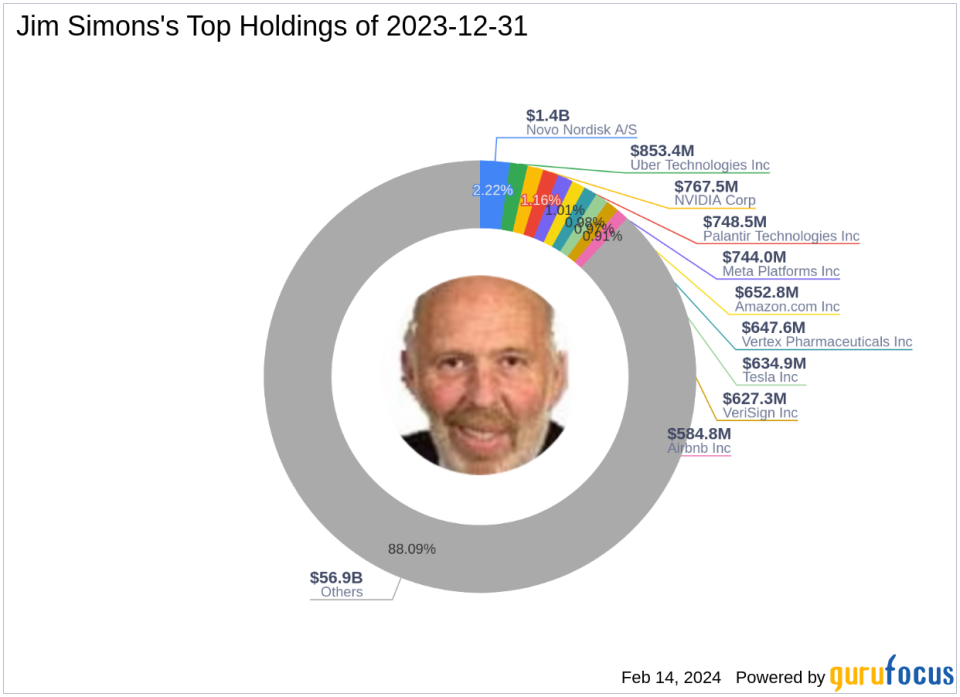

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies in 1982. The firm has since become one of the most successful hedge funds globally, known for its use of complex mathematical models and automated trading strategies. Renaissance Technologies' approach to the market is grounded in data analysis and scientific thinking, aiming to identify non-random price movements for predictive trading. As of now, the firm manages an equity portfolio worth $64.61 billion, with top holdings in technology and healthcare sectors, including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

Herbalife Ltd at a Glance

Herbalife Ltd, based in the Cayman Islands, operates as a global nutrition company, offering health and wellness products through a direct-selling model in 95 markets. The company's product portfolio includes weight management shakes, targeted nutrition supplements, and energy and fitness products. With a market capitalization of $1.17 billion and a P/E ratio of 6.31, Herbalife's financials reflect a company that is currently undervalued according to GuruFocus's GF Value, with a stock price to GF Value ratio of 0.44. The stock's current price stands at $11.8, which is significantly below the GF Value of $26.95.

Impact of the Trade on Simons' Portfolio

The recent sale of Herbalife shares by Renaissance Technologies has a minimal immediate impact on the firm's extensive portfolio. However, the reduction in Herbalife's position size, now at 0.15%, indicates a strategic decision by Simons to adjust the firm's exposure to the consumer packaged goods industry. This move could be a response to the stock's recent performance or a shift in the firm's investment strategy.

Herbalife's Market Performance and Valuation

Since the trade date, Herbalife's stock has experienced a decline of 22.67%, with a year-to-date drop of 23.18%. Despite this downward trend, the company's long-term performance since its IPO in 2004 shows a significant increase of 237.14%. The current stock price represents a substantial discount to the GF Value, suggesting that the stock may be significantly undervalued.

Financial Health and Growth Prospects

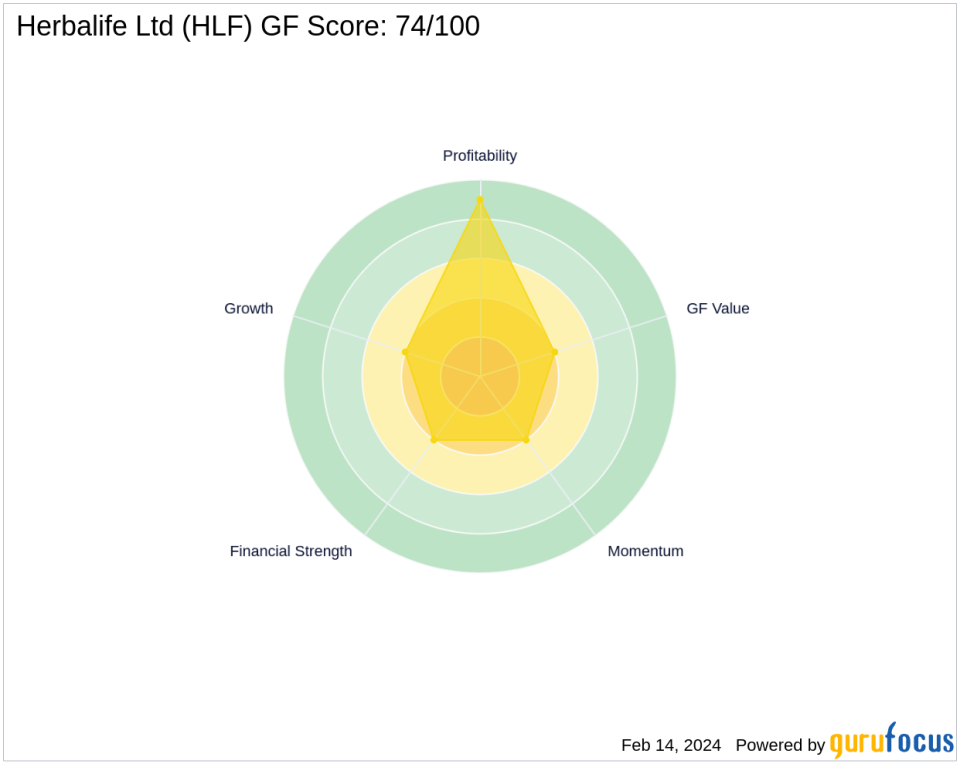

Herbalife's financial health is a mixed picture, with a Financial Strength rank of 4/10 and a Profitability Rank of 9/10. The company's Growth Rank and GF Value Rank are both at 4/10, indicating moderate growth potential and fair valuation. Herbalife's Momentum Rank also stands at 4/10, reflecting a lack of strong momentum in its stock price.

Market Sentiment and Other Gurus' Positions

The Baupost Group is currently the largest guru shareholder in Herbalife, while other notable investment firms like HOTCHKIS & WILEY and Barrow, Hanley, Mewhinney & Strauss also maintain positions in the company. This diversified interest from multiple gurus suggests a mixed market sentiment towards Herbalife's stock.

Conclusion

In summary, Jim Simons (Trades, Portfolio)' firm, Renaissance Technologies, has reduced its stake in Herbalife Ltd, a move that aligns with the firm's data-driven investment philosophy. Despite the stock's current undervaluation and strong profitability rank, the reduction in position size may reflect a strategic shift or a response to the stock's recent performance. For value investors, the current outlook for Herbalife Ltd warrants attention to the company's financial health, growth prospects, and market sentiment, as these factors will influence the stock's future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.