Jim Simons Adjusts Position in Usana Health Sciences Inc

Recent Transaction Overview

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Usana Health Sciences Inc (NYSE:USNA). The firm sold 9,300 shares at a price of $53.60 each, resulting in a total holding of 1,198,697 shares in the company. This trade has altered the firm's position in Usana by -0.77%, which now represents 0.11% of the portfolio and 6.27% of the company's shares.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

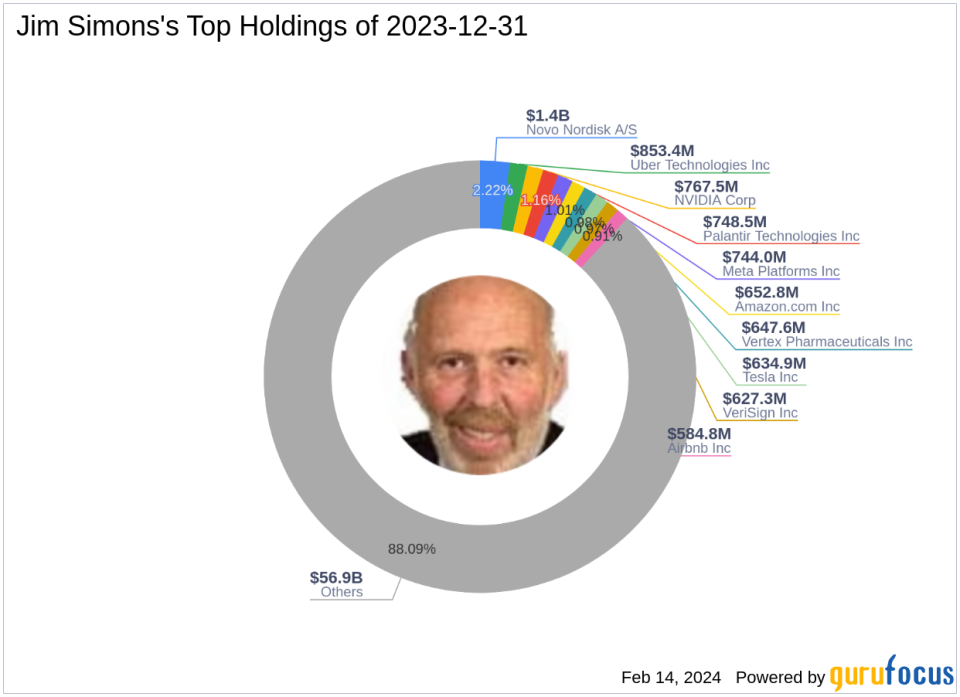

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements. This strategy has positioned Renaissance Technologies as one of the most successful hedge funds globally. The firm's top holdings include significant positions in technology and healthcare sectors, with Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO) among its largest investments.

Usana Health Sciences Inc at a Glance

Usana Health Sciences Inc, trading under the symbol USNA, is a company based in the USA that has been publicly traded since April 22, 1993. The company specializes in the development, manufacturing, and direct selling of science-based nutritional and personal-care products. With a diverse product range that includes supplements, meal replacement shakes, snack bars, and personal-care items, Usana operates globally across various regions including Asia-Pacific, the Americas, and Europe.

Usana's Financial Highlights

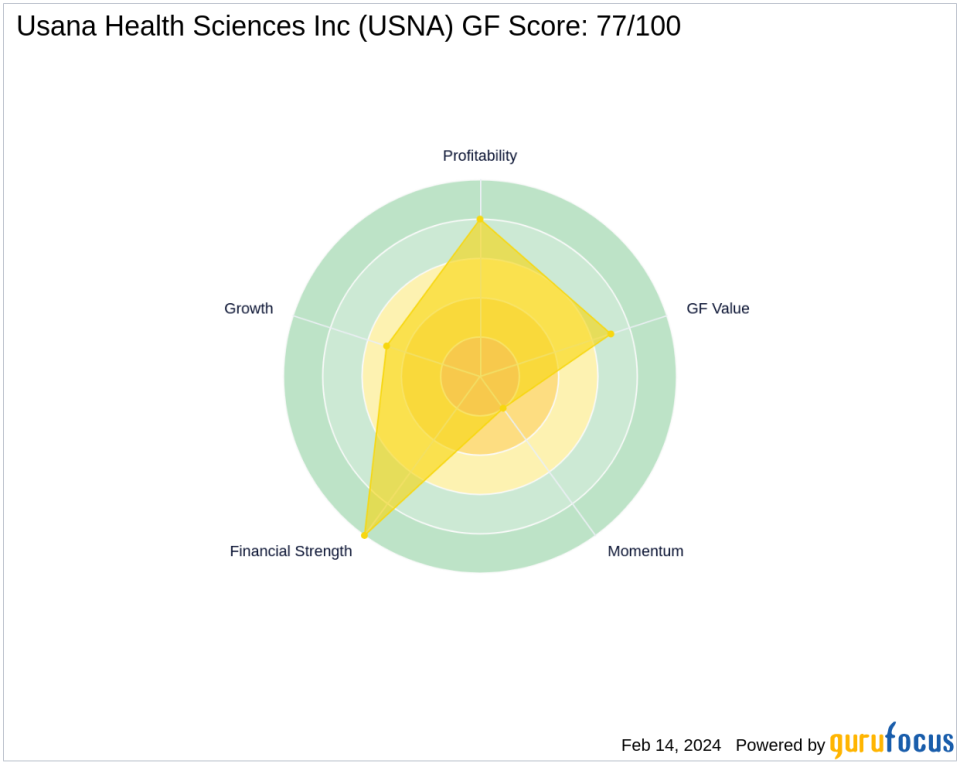

As of the data cutoff, Usana Health Sciences Inc boasts a market capitalization of $938.7 million, with a current stock price of $49.07. The company's P/E ratio stands at 14.87, indicating profitability. GuruFocus has assessed Usana as "Modestly Undervalued" with a GF Value of $61.96. The stock's price to GF Value ratio is 0.79, and it has experienced a year-to-date price change of -9.88%. Despite a recent decline of -8.45% since the transaction date, the stock has seen an impressive increase of 30,568.75% since its IPO.

Impact on Jim Simons (Trades, Portfolio)'s Portfolio

The recent transaction has slightly decreased Jim Simons (Trades, Portfolio)'s holdings in Usana Health Sciences Inc, which now account for a modest 0.11% of the firm's portfolio. Despite this reduction, the firm remains a significant shareholder with over 1.19 million shares, reflecting a continued belief in the company's potential.

Usana's Financial Strength and Performance

Usana Health Sciences Inc exhibits strong financial health with a Financial Strength rank of 10/10 and a Profitability Rank of 8/10. The company's cash to debt ratio is an impressive 420.38, and it has an interest coverage of 795.48. Usana's ROE and ROA are 13.71% and 10.50%, respectively. However, the company's Growth Rank is 5/10, indicating potential concerns regarding future expansion.

Market Sentiment and Technical Indicators

The stock's performance since its IPO has been remarkable, but recent technical indicators suggest a mixed sentiment. The RSI (14 Day) stands at 49.00, indicating a neutral position, while the Momentum Index for the past 6 months shows a decline of -23.64, suggesting a loss of momentum in the stock's price movement.

Other Notable Investors in Usana

Pzena Investment Management LLC is currently the largest guru shareholder in Usana Health Sciences Inc. Other significant investors include HOTCHKIS & WILEY and Barrow, Hanley, Mewhinney & Strauss, indicating a continued interest from institutional investors in the company's prospects.

Transaction Analysis

Jim Simons (Trades, Portfolio)'s recent reduction in Usana Health Sciences Inc does not significantly impact the firm's diverse and extensive portfolio. However, it reflects a strategic adjustment that may be based on the firm's proprietary models and market analysis. As Usana continues to navigate the competitive consumer packaged goods industry, investors will closely monitor the company's financial health and market performance for future opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.