Jim Simons Adjusts Position in Vishay Precision Group Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Jim Simons (Trades, Portfolio)'s firm Renaissance Technologies executed a notable transaction in the stock market, specifically targeting Vishay Precision Group Inc (NYSE:VPG). The firm reduced its holdings in VPG by 29,458 shares, which represented a -4.76% change in the investment. This adjustment in the portfolio of one of the world's most renowned quantitative investment firms has caught the attention of value investors seeking insights into market movements.

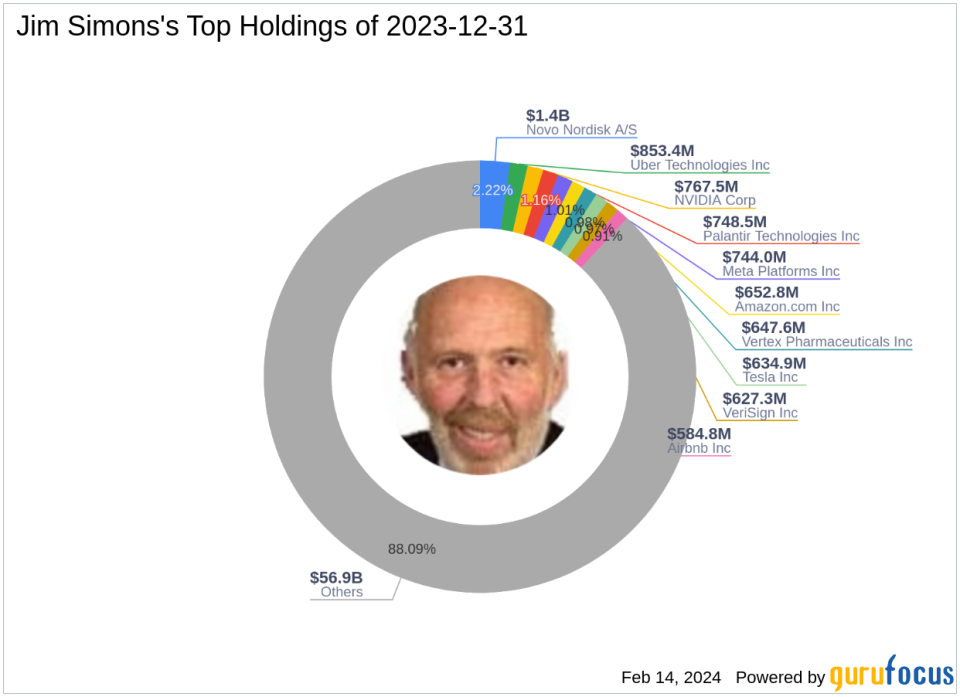

Jim Simons (Trades, Portfolio)'s Investment Firm and Philosophy

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, has been a prominent figure in the investment world since 1982. The firm is known for its sophisticated mathematical models and data-driven approach to trading. By employing advanced algorithms, Renaissance Technologies analyzes vast amounts of market data to identify non-random price movements and capitalize on them. The firm's success is attributed to its scientific approach to investing, which emphasizes the importance of statistical validation over intuition. As of the latest data, Renaissance Technologies manages an equity portfolio worth $64.61 billion, with a strong focus on the technology and healthcare sectors.

Introduction to Vishay Precision Group Inc

Vishay Precision Group Inc, with its stock symbol VPG, operates within the hardware industry in the United States and internationally. Since its IPO on June 23, 2010, the company has specialized in manufacturing sensors, sensor-based measurement systems, and specialty resistors. VPG's product offerings are critical in various applications, including stress, force, weight, pressure, and current measurements. The company's business is segmented into Measurement Systems, Sensors, and Weighing Solutions, and it has established a significant market presence, particularly in the United States, which contributes the majority of its revenue.

Details of the Transaction

The recent trade by Renaissance Technologies saw the firm's position in VPG decrease at a trade price of $34.07 per share. Following the transaction, the firm holds a total of 589,615 shares in VPG, which constitutes a 0.03% position in its portfolio and a 4.71% ownership of the traded company. Despite the reduction, the trade impact on the overall portfolio was negligible at 0%.

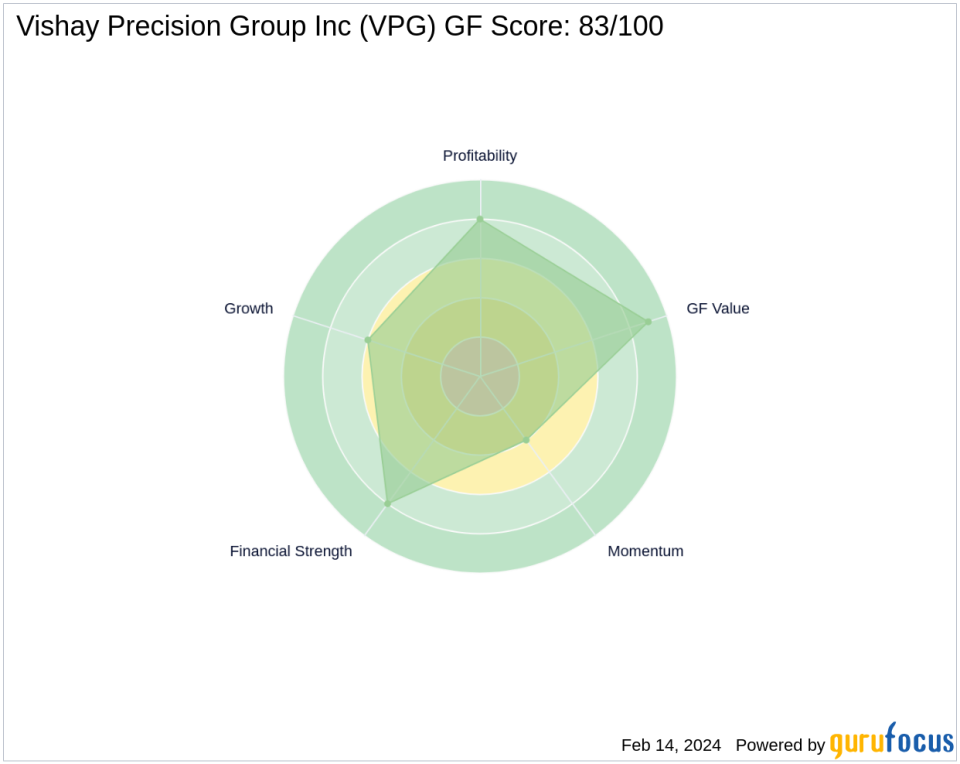

VPG Stock Performance and Valuation

Currently, VPG's stock price stands at $31.86, which reflects a -6.49% change since the transaction and a 154.88% increase since its IPO. The stock is considered modestly undervalued with a GF Value of $41.06 and a price to GF Value ratio of 0.78. The stock's PE Percentage is 14.76, indicating a reasonable valuation in the current market.

Financial Health and Growth Metrics of VPG

Vishay Precision Group's financial health is robust, with a Financial Strength rank of 8/10 and a Profitability Rank of 8/10. The company's Growth Rank stands at 6/10, reflecting steady growth over the past three years, including an 8.20% revenue growth. VPG's Piotroski F-Score is a strong 8, and its Altman Z-Score of 3.72 indicates low financial distress risk. The company's cash to debt ratio is 1.19, and it has an interest coverage of 10.99.

Market Position and Guru Holdings

VPG's standing in the hardware industry is solid, with competitive advantages in its specialized product offerings. While Renaissance Technologies has adjusted its holdings, it remains one of the significant investors in VPG. The largest guru shareholder in VPG is GAMCO Investors, although the exact share percentage is not disclosed.

Conclusion

The recent transaction by Jim Simons (Trades, Portfolio)'s Renaissance Technologies in Vishay Precision Group Inc reflects a strategic adjustment in its portfolio. While the reduction in VPG shares is modest, it aligns with the firm's data-driven investment philosophy and may signal a recalibration based on the firm's proprietary models. For value investors, this move by a leading quantitative investment firm warrants attention, as it may have implications for VPG's stock performance and the broader market dynamics within the hardware industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.