Jim Simons Bolsters Position in Corcept Therapeutics Inc

Jim Simons (Trades, Portfolio)' Latest Investment Move

Renowned investment firm Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently increased its stake in Corcept Therapeutics Inc (NASDAQ:CORT), a pharmaceutical company specializing in the treatment of severe metabolic, oncologic, and neuropsychiatric disorders. On December 29, 2023, the firm added 111,000 shares to its portfolio, reflecting a 0.01% trade impact and bringing its total share count to 6,725,871. This transaction underscores the firm's confidence in Corcept Therapeutics, even as it navigates the volatile biotechnology sector.

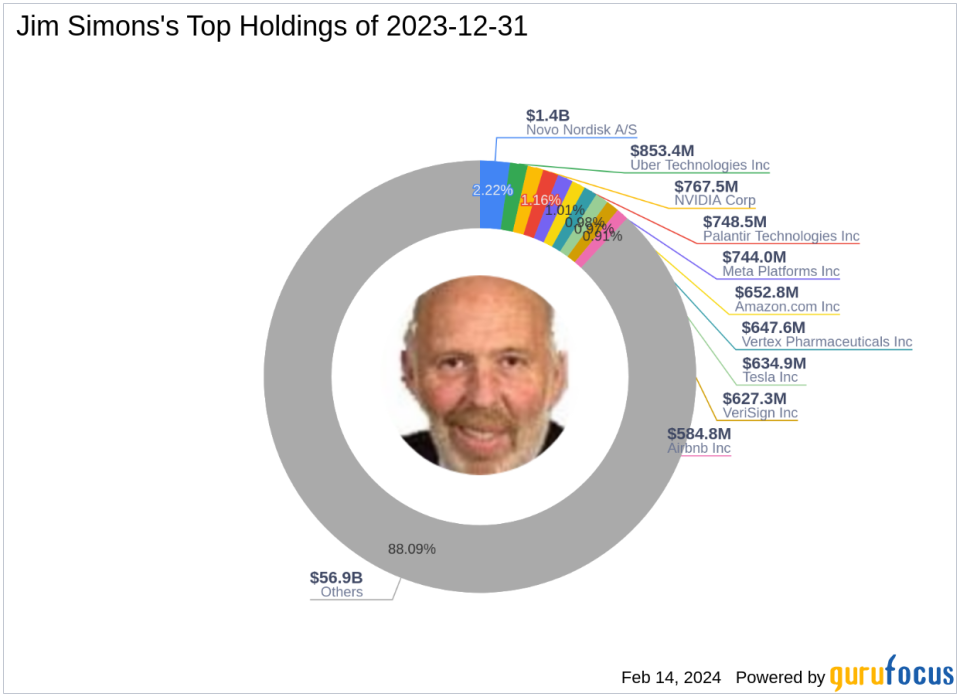

Jim Simons (Trades, Portfolio) and Renaissance Technologies

Jim Simons (Trades, Portfolio), the CEO of Renaissance Technologies, is a prominent figure in the investment world, known for his firm's data-driven and quantitative approach to trading. Since its inception in 1982, Renaissance Technologies has utilized complex mathematical models to predict market movements and execute trades. This scientific methodology aims to identify non-random price movements and capitalize on them, avoiding reliance on statistical flukes. The firm's portfolio is diverse, with significant holdings in technology and healthcare, including Meta Platforms Inc (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA). With an equity portfolio valued at $64.61 billion, Renaissance Technologies remains a formidable force in the investment landscape.

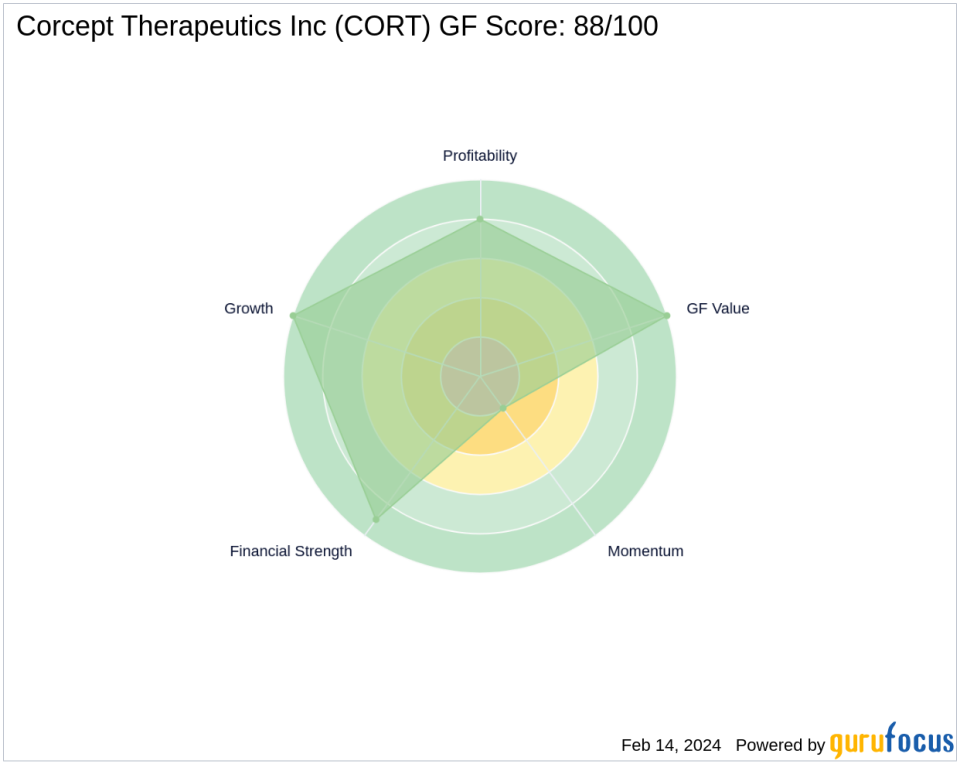

Corcept Therapeutics at a Glance

Corcept Therapeutics Inc, trading under the symbol CORT, has been a player in the biotechnology industry since its IPO on April 14, 2004. The company's focus on developing medications that modulate the effects of cortisol has positioned it as a leader in addressing complex health conditions. Despite the inherent risks of the biotech sector, Corcept has demonstrated financial resilience, with a market capitalization of $2.38 billion and a stock price that is currently deemed significantly undervalued according to GuruFocus's GF Value. The company's GF Score of 88/100 indicates a strong potential for outperformance, supported by high ranks in financial strength, profitability, and growth.

Details of the Recent Trade

The acquisition of additional shares in Corcept Therapeutics by Renaissance Technologies took place at a trade price of $32.48. Since then, the stock has experienced a decline, currently trading at $23.05, which represents a -29.03% change. Despite this downturn, the firm's position in Corcept now accounts for 0.37% of its portfolio and 6.52% of the company's outstanding shares, indicating a significant level of commitment to the stock.

Portfolio Impact of Corcept Therapeutics

Corcept Therapeutics holds a strategic position within Jim Simons (Trades, Portfolio)' portfolio, aligning with the firm's focus on technology and healthcare sectors. The recent trade has slightly increased the stock's weight in the portfolio, demonstrating a calculated move by the firm to capitalize on the stock's current undervaluation. This addition is consistent with the firm's investment philosophy of leveraging data analysis to identify market opportunities.

Market Dynamics and Corcept's Performance

Corcept Therapeutics' stock has faced challenges in the market, with a year-to-date price change ratio of -4.59%. However, the company's long-term performance since its IPO has been positive, with an 88.16% price change. The stock's current valuation metrics, including a PE ratio of 28.46 and a price to GF Value of 0.70, suggest that it is significantly undervalued, potentially offering an attractive entry point for investors.

Financial Health and Rankings of Corcept Therapeutics

Corcept Therapeutics boasts a robust balance sheet, with a Financial Strength rank of 9/10 and an impressive cash to debt ratio of 1,578.78. The company's Profitability Rank stands at 8/10, while its Growth Rank is a perfect 10/10, indicating strong potential for future expansion. The GF Value Rank also hits the top mark at 10/10, further reinforcing the stock's undervaluation status. However, the Momentum Rank is low at 2/10, reflecting recent market headwinds.

Comparative Analysis and Market Sentiment

When compared to the largest guru shareholder in Corcept Therapeutics, Gotham Asset Management, LLC, Renaissance Technologies' recent move signals a bullish stance on the stock's prospects. Market sentiment and momentum indicators, such as the RSI and Momentum Index, suggest a mixed outlook, with the stock currently facing some negative pressure. Nonetheless, the firm's decision to increase its holdings may be indicative of a contrarian approach, banking on the company's strong fundamentals and potential for recovery.

Transaction Influence and Outlook

The recent acquisition by Jim Simons (Trades, Portfolio)' firm has a modest yet strategic impact on its portfolio, reinforcing its position in a stock that exhibits strong financial health and growth prospects. While the market has yet to reflect the firm's optimism, the underlying fundamentals of Corcept Therapeutics, combined with its significantly undervalued status, could lead to favorable long-term returns. Investors will be watching closely to see if this calculated addition by one of the world's most successful hedge funds will pay off as anticipated.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.