Jim Simons Bolsters Position in Innoviva Inc with Recent Acquisition

Overview of the Recent Portfolio Addition

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently expanded its investment portfolio with the addition of 4,144,447 shares in Innoviva Inc (NASDAQ:INVA). The transaction, which took place on December 29, 2023, reflects a 3.63% increase from the previous holding, marking a significant vote of confidence in the biopharmaceutical company. With a trade price of $16.04 per share, the firm has demonstrated a strategic move to capitalize on Innoviva's market potential.

Insight into Jim Simons (Trades, Portfolio) and Renaissance Technologies

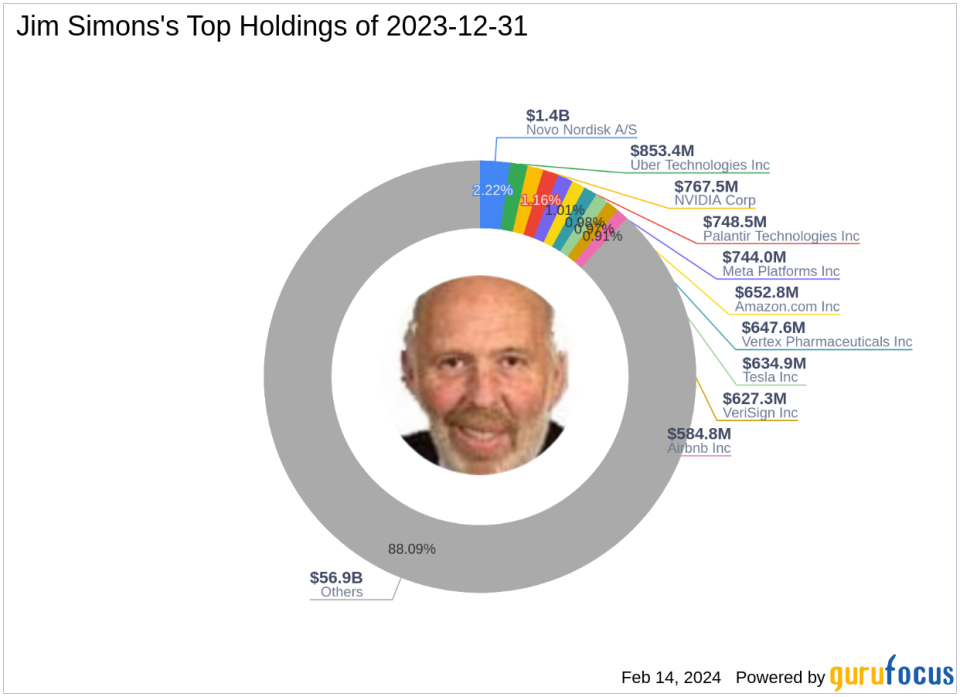

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, has been a prominent figure in the investment world since 1982. The firm is renowned for its data-driven and quantitative approach to investing, utilizing complex mathematical models to predict market movements. This scientific methodology has positioned Renaissance Technologies as a leading hedge fund, with a focus on delivering consistent returns. The firm's top holdings include major players in the technology and healthcare sectors, such as Meta Platforms Inc (NASDAQ:META) and Novo Nordisk A/S (NYSE:NVO), reflecting its strategic investment preferences.

Understanding Innoviva Inc's Business

Innoviva Inc, headquartered in the USA, has been a key player in the biopharmaceutical industry since its IPO in 2004. The company specializes in developing drugs for respiratory, antibiotic, and digestive health, with a product lineup that includes Relvar/Breo/Ellipta and Anoro Ellipta. In partnership with GlaxoSmithKline, Innoviva has been pushing the boundaries of medical innovation, aiming to address unmet medical needs in various therapeutic areas.

Impact of the Trade on Simons' Portfolio

The recent acquisition of Innoviva shares has a modest impact on Simons' portfolio, with a 0.11% position and a 6.47% stake in the company. This strategic move not only diversifies the portfolio but also aligns with the firm's interest in the healthcare sector, which is one of its top investment areas. The addition of Innoviva shares is a calculated decision, likely based on the firm's rigorous data analysis and predictive models.

Market Valuation and Performance of Innoviva

Currently, Innoviva Inc is considered fairly valued with a GF Value of $14.58 and a price to GF Value ratio of 1.06. Despite a slight decline of 3.49% in stock price since the transaction, the company's long-term growth prospects remain intact. Innoviva's GF Score of 81/100 indicates good potential for outperformance, supported by a solid profitability rank and growth rank.

Biotechnology Sector and Industry Analysis

Innoviva's addition to Simons' portfolio is consistent with the firm's investment in the healthcare sector, which is one of its top preferences. Within the biotechnology industry, Innoviva stands out with its innovative product offerings and strategic partnerships. The company's financial health and market performance, including a profitability rank of 8/10 and a growth rank of 6/10, make it a compelling choice for investors looking for exposure to the biotech sector.

Comparative Financial Analysis

When compared to industry averages, Innoviva's financial ratios and GF Score suggest a competitive edge. The company's financial strength, as indicated by its Financial Strength rank of 5/10, and its interest coverage rank of 295, demonstrate a stable financial position. Additionally, Innoviva's Profitability Rank and Piotroski F-Score further reinforce its robustness in the market.

Conclusion: The Strategic Significance of Simons' Innoviva Trade

Jim Simons (Trades, Portfolio)' recent investment in Innoviva Inc underscores the firm's confidence in the biopharmaceutical company's future. The trade aligns with Renaissance Technologies' data-driven investment philosophy and its focus on the healthcare sector. For value investors, this move by one of the world's most successful hedge funds could signal a noteworthy opportunity within the biotechnology industry. As Innoviva continues to innovate and grow, it will be interesting to watch how this investment plays out in Simons' portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.