Jim Simons Bolsters Position in PetMed Express Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On August 23, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), executed a notable transaction in the stock market by adding 325,815 shares of PetMed Express Inc (NASDAQ:PETS) at a price of $11.33 per share. This addition has increased the firm's total holdings in PetMed Express to 1,344,284 shares, reflecting a 0.01% impact on the portfolio and marking a 6.36% ownership in the company.

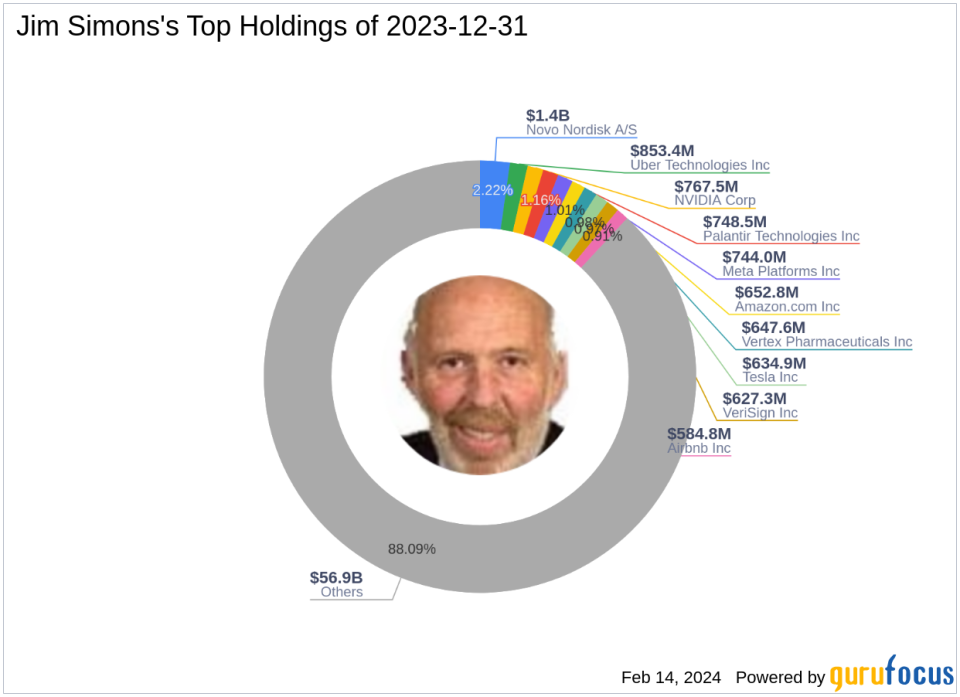

Profile of Renaissance Technologies

Founded in 1982 by Jim Simons (Trades, Portfolio), Renaissance Technologies Corporation stands as a pioneering private investment firm. Under Simons's leadership, the firm has become one of the most successful hedge funds globally, renowned for its quantitative, data-driven investment strategies. Renaissance Technologies employs sophisticated mathematical models to predict market movements and execute trades, often automatically. The firm's approach is grounded in scientific thinking and a rigorous analysis of vast datasets to identify profitable trading opportunities.

Introduction to PetMed Express Inc

PetMed Express Inc, operating in the USA since its IPO on September 17, 1997, is a leading nationwide pet pharmacy. The company specializes in marketing both prescription and non-prescription pet medications, health products, and supplies for dogs and cats, primarily to retail consumers. Despite its single-segment focus, PetMed Express has struggled in the market, with a current market capitalization of $113.242 million and a stock price of $5.355, which is significantly below its GF Value of $25.65. The company's stock performance has been underwhelming, with a PE Ratio of 0.00 indicating current losses and a GF Value Rank of 2/10, suggesting potential valuation concerns.

Impact of the Trade on Simons's Portfolio

The recent acquisition of PetMed Express shares by Renaissance Technologies has a modest yet strategic impact on the firm's portfolio. With a 0.02% position in the portfolio, the trade aligns with Simons's investment philosophy of leveraging data analysis to capitalize on market inefficiencies. The significance of this trade is underscored by the current market position of PetMed Express, which may present a unique opportunity for value investors.

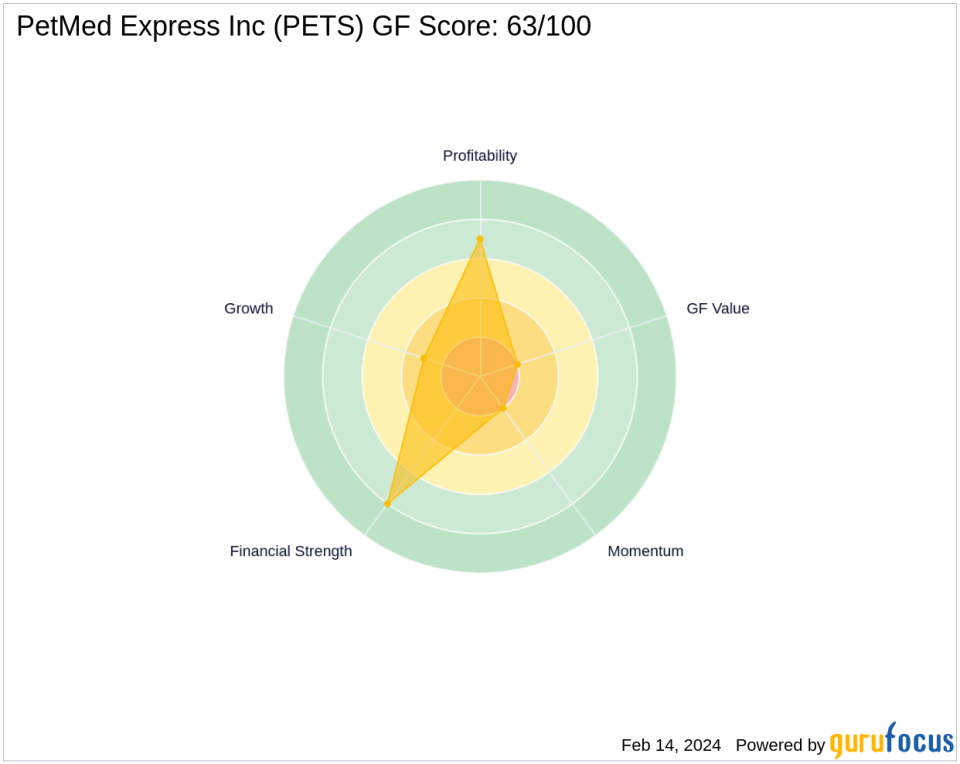

Performance Metrics of PetMed Express Inc

PetMed Express Inc's stock performance indicators paint a mixed picture. The company's GF Score of 63/100 suggests poor future performance potential, while its Financial Strength is relatively solid with a rank of 8/10. The Piotroski F-Score of 2 and a Z-Score of 4.36 indicate some concerns regarding financial stability. The company's profitability, as indicated by its Profitability Rank of 7/10, is reasonable, but its Growth Rank of 3/10 and Momentum Rank of 2/10 suggest that the company is facing significant challenges in these areas.

Sector and Market Context

PetMed Express Inc operates within the competitive healthcare providers & services industry. The company's performance must be contextualized within broader sector trends, which can influence its stock price and growth prospects. Comparing PetMed Express to its industry peers reveals that the company is navigating a challenging market environment, with its stock price experiencing a significant decline of 52.74% since the transaction date.

Largest Guru Shareholder in PetMed Express Inc

Hotchkis & Wiley Capital Management LLC holds the title of the largest guru shareholder in PetMed Express Inc. Although the specific share percentage is not provided, the firm's investment in PetMed Express signifies confidence in the company's potential or a strategic play on its valuation.

Conclusion and Future Outlook

In conclusion, Jim Simons (Trades, Portfolio)'s recent addition to the firm's stake in PetMed Express Inc aligns with Renaissance Technologies' data-centric investment strategy. Despite the company's current financial challenges, the firm's increased investment could be indicative of an anticipated turnaround or an undervalued opportunity. Investors will be watching closely to see how this trade plays out in the context of PetMed Express's performance and its alignment with Simons's renowned investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.