Jim Simons Increases Stake in Ennis Inc

Jim Simons (Trades, Portfolio)' Latest Portfolio Addition

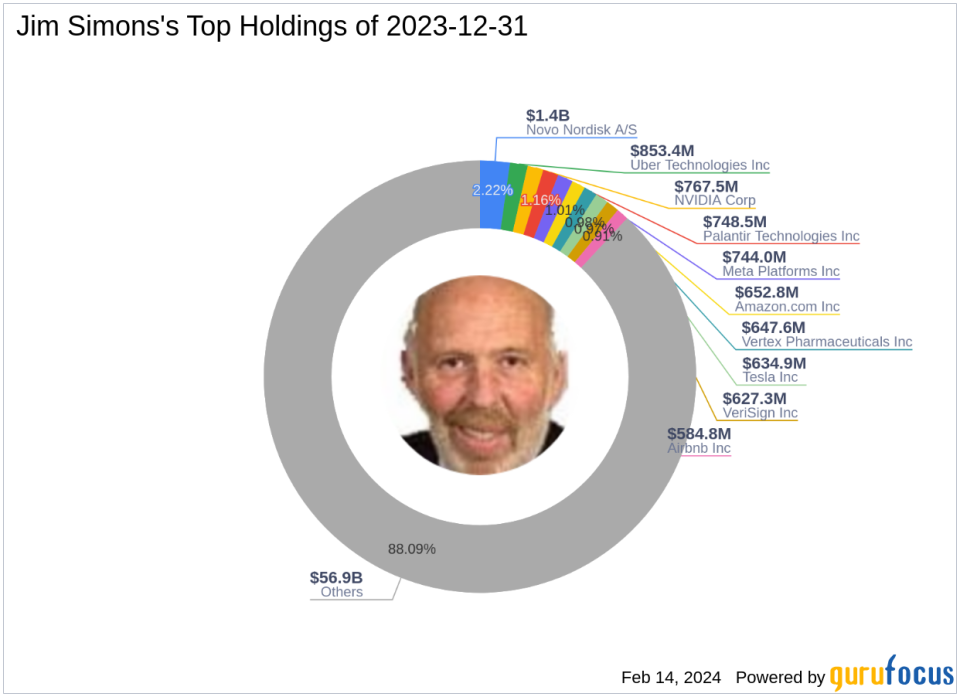

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), expanded its investment portfolio by adding shares of Ennis Inc (NYSE:EBF). The transaction involved the acquisition of 12,000 shares at a trade price of $21.91. Following this addition, the firm now holds a total of 1,534,346 shares in Ennis Inc, which represents a 5.93% ownership stake in the company and a 0.06% position in the firm's portfolio.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is renowned for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements. This strategy has positioned Renaissance Technologies as one of the most successful hedge funds globally. The firm's investment philosophy emphasizes scientific thinking and statistical evidence over intuition, ensuring that strategies are not merely statistical flukes but are grounded in rigorous analysis.

Ennis Inc at a Glance

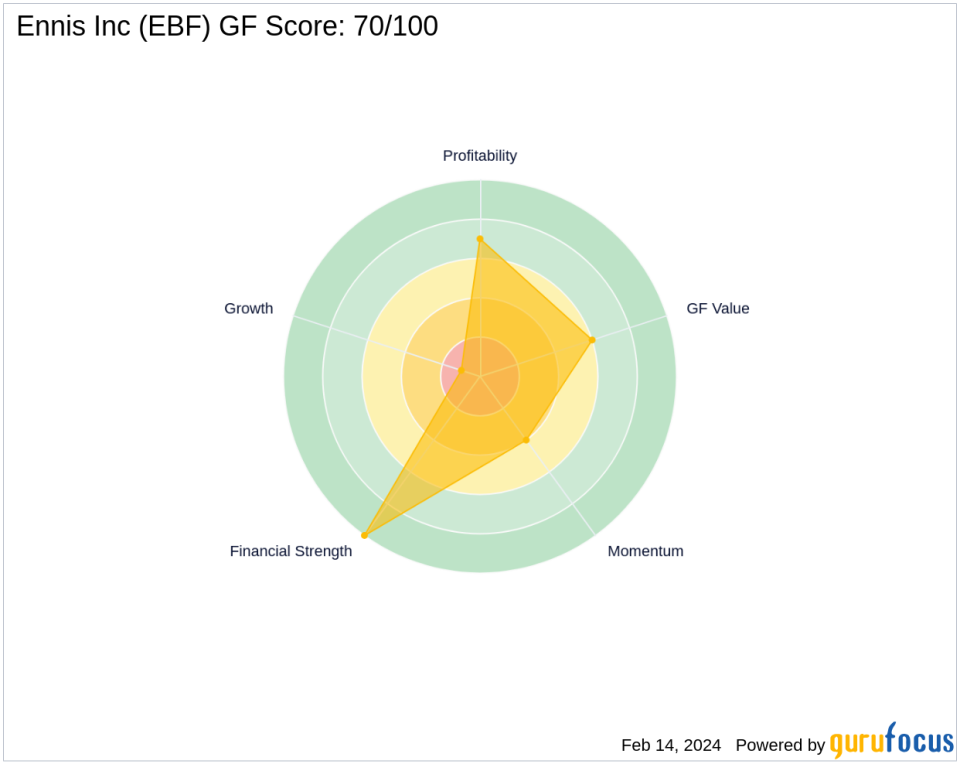

Ennis Inc, with a history dating back to 1969, operates as a manufacturer and supplier of print products for the wholesale trade. The company's diverse product range includes business forms, commercial printing, and labels, among others. As of the latest data, Ennis Inc boasts a market capitalization of $511.802 million and is considered fairly valued with a GF Value of $21.28. Despite a recent stock price decline to $19.78, the company maintains a PE Ratio of 11.50, indicating profitability.

Impact of the Trade on Simons' Portfolio

The recent trade has slightly increased the firm's exposure to the Industrial Products sector, with Ennis Inc now accounting for a 0.06% position in the portfolio. The trade price of $21.91 reflects a strategic entry point for Renaissance Technologies, as the stock is currently trading at a 9.72% decrease since the transaction date.

Financial Health and Valuation of Ennis Inc

Ennis Inc's financial health is robust, with a Financial Strength rank of 10/10 and an interest coverage ratio of 170.50. The company's Altman Z score of 8.80 further indicates low bankruptcy risk. However, Ennis Inc's Growth Rank is low at 1/10, suggesting limited growth potential. The Profitability Rank stands at 7/10, reflecting a solid track record of profitability.

Ennis Inc in the Industrial Products Sector

Ennis Inc's role in the Industrial Products sector is significant, given its long-standing presence and diverse product offerings. The company's performance and valuation must be considered in the context of the broader industry trends and its competitors.

Stock Performance Post-Trade

Since the trade date, Ennis Inc's stock has experienced a decline of 9.72%, with a year-to-date performance also showing a decrease of 10.82%. This performance is set against the backdrop of the company's historical growth, which has seen a 4020.83% increase since its IPO.

Comparison with Largest Shareholder

Hotchkis & Wiley Capital Management LLC is currently the largest guru shareholder in Ennis Inc. While specific shareholding percentages are not provided, Jim Simons (Trades, Portfolio)' recent transaction has solidified Renaissance Technologies' position as a significant investor in the company.

Conclusion

The acquisition of additional shares in Ennis Inc by Jim Simons (Trades, Portfolio)' Renaissance Technologies is a calculated move, aligning with the firm's data-driven investment strategy. Despite the stock's recent performance dip, the company's strong financial health and fair valuation suggest potential for future gains. Investors will be watching closely to see how this trade impacts Renaissance Technologies' portfolio in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.