Jim Simons Increases Stake in Exelixis Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Portfolio Addition

Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently bolstered its investment in Exelixis Inc (NASDAQ:EXEL), a notable player in the biopharmaceutical industry. The transaction, which took place on December 19, 2023, saw the firm adding 398,800 shares to its holdings, reflecting a 2.62% change in the position size. This strategic move has increased the firm's total share count in Exelixis to 15,615,716, marking a significant vote of confidence in the company's prospects.

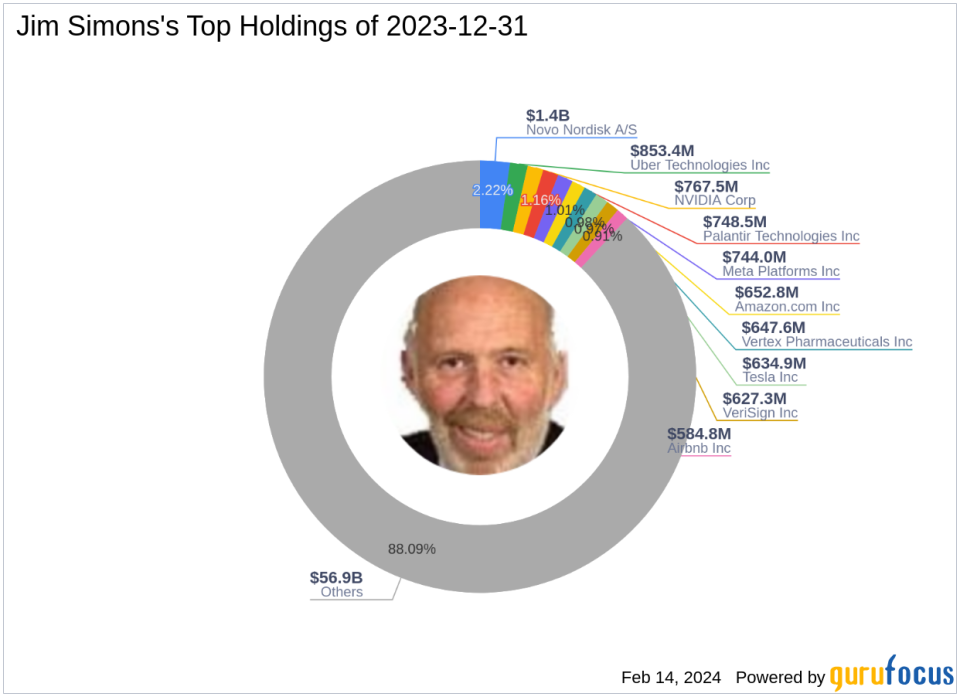

Jim Simons (Trades, Portfolio) and Renaissance Technologies: A Brief Profile

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation in 1982, continues to lead the firm as CEO. The New York-based private investment firm is renowned for its highly successful hedge funds, which leverage complex mathematical models and automated trading strategies. Simons's investment philosophy emphasizes the use of extensive data analysis to identify non-random price movements and capitalize on them. The firm's scientific approach to trading has set it apart in the financial world, with a focus on technology and healthcare sectors among its top holdings.

Exelixis Inc: A Biopharmaceutical Innovator

Exelixis Inc, headquartered in the USA, has been a pioneer in cancer treatment since its IPO on April 11, 2000. The company's flagship products, CABOMETYX and COMETRIQ, target various forms of cancer, including metastatic medullary thyroid, kidney, and liver cancers. In collaboration with Roche, Exelixis has also developed Cotellic for melanoma treatment. With a market capitalization of $6.13 billion, Exelixis continues to be a key player in the biotechnology industry.

Details of the Transaction

The acquisition of additional shares in Exelixis by Renaissance Technologies was executed at a trade price of $23.84 per share. Post-transaction, the firm's position in Exelixis represents 0.63% of its portfolio, with a 5.16% ownership of the company. The trade had a modest impact of 0.02% on the portfolio, indicating a targeted yet cautious investment approach.

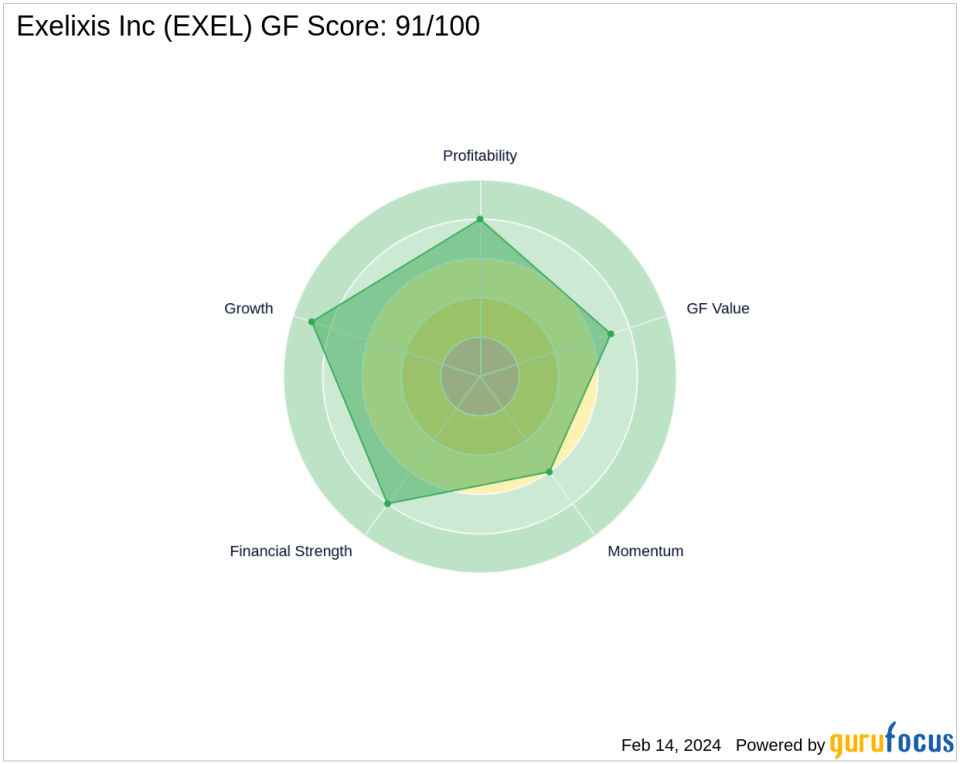

Exelixis Inc Stock Performance and Valuation

Exelixis's stock is currently trading at $20.23, with a PE Ratio of 31.46, indicating profitability. The stock is considered modestly undervalued, with a GF Value of $24.11 and a price to GF Value ratio of 0.84. Despite a recent decline of 15.14% since the trade date and a year-to-date drop of 15.46%, the company's long-term performance remains positive, with a 12.39% increase since its IPO. The GF Score of 91/100 suggests a high potential for outperformance.

Financial Health and Growth Prospects of Exelixis Inc

Exelixis's financial health is robust, with a cash to debt ratio of 5.24 and strong performance metrics, including an 8/10 Financial Strength rank and an 8/10 Profitability Rank. The company has demonstrated impressive growth, with a 22.40% revenue increase and a 17.70% EBITDA growth over the past three years. These figures underscore Exelixis's capacity for sustained expansion in the biotechnology sector.

Exelixis Inc in the Eyes of Market Gurus

Since the trade, Exelixis's stock has faced market headwinds, yet it remains a component of several notable investment gurus' portfolios, including Joel Greenblatt (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), and Richard Pzena (Trades, Portfolio). Their continued interest in Exelixis, alongside Jim Simons (Trades, Portfolio)'s recent acquisition, signals a collective belief in the company's value proposition and future potential.

Exelixis Within the Biotechnology Landscape

Jim Simons (Trades, Portfolio)'s investment in Exelixis aligns with Renaissance Technologies' significant exposure to the technology and healthcare sectors. Within the competitive biotechnology industry, Exelixis's focus on cancer treatment innovation positions it as a company with both challenges and opportunities ahead. The firm's increased stake in Exelixis reflects a strategic decision to invest in a company with a strong track record and promising growth trajectory.

Transaction Analysis: Impact on Portfolio and Stock

The recent addition of Exelixis shares by Renaissance Technologies is a calculated enhancement to its portfolio, reflecting confidence in the company's future. While the trade's immediate impact on the portfolio was minimal, the long-term implications could be significant, given Exelixis's strong financial health and growth prospects. As the stock navigates current market volatility, Jim Simons (Trades, Portfolio)'s firm remains poised to benefit from any positive developments in Exelixis's journey.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.