Jim Simons' Renaissance Technologies Adds EchoStar Corp to Its Portfolio

Introduction to the Transaction

Renaissance Technologies, led by the renowned mathematician and investor Jim Simons (Trades, Portfolio), has recently expanded its investment portfolio with the addition of EchoStar Corp (NASDAQ:SATS). The transaction, which took place on November 14, 2023, saw the firm acquire 1,871,804 shares in the satellite services provider. This strategic move by Simons' firm reflects a continued interest in the technology and communications sectors.

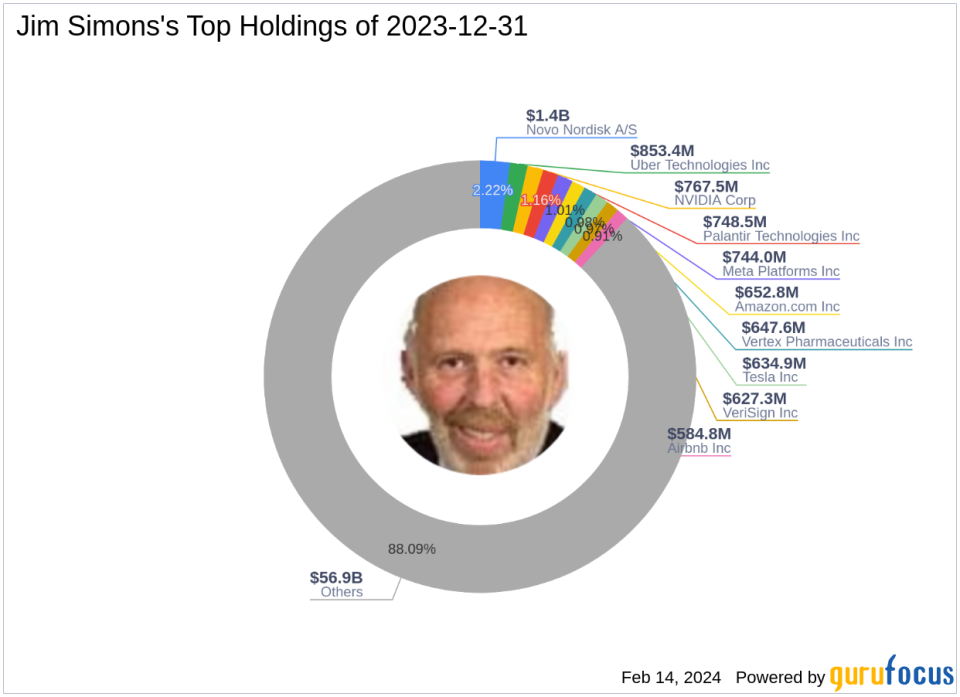

Profile of Jim Simons (Trades, Portfolio)

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is known for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements. Simons' investment philosophy emphasizes the scientific method, seeking to identify strategies that are statistically sound rather than relying on intuition or market trends.

EchoStar Corp's Stock Overview

EchoStar Corp, with its significant presence in the satellite television and wireless network markets, serves millions of customers across the United States. The company's future growth is largely tied to its wireless business, including a nationwide network and the Boost brand acquired from Sprint. EchoStar's financial health and stock performance have been areas of interest for investors, particularly given its status as significantly undervalued according to GuruFocus GF Value.

Transaction Details

On November 14, 2023, Renaissance Technologies added 1,871,804 shares of EchoStar Corp to its holdings at a trade price of $10.17 per share. This addition has a modest 0.03% impact on the firm's portfolio, yet it represents a significant 5.17% stake in EchoStar Corp. The transaction showcases Simons' confidence in the company's potential for growth.

EchoStar Corp's Market Valuation

EchoStar's current stock price stands at $12.56, which, when compared to the GuruFocus GF Value of $193.91, indicates that the stock is significantly undervalued. This discrepancy suggests a substantial margin of safety for investors and potential for appreciation, a likely factor in Renaissance Technologies' decision to invest.

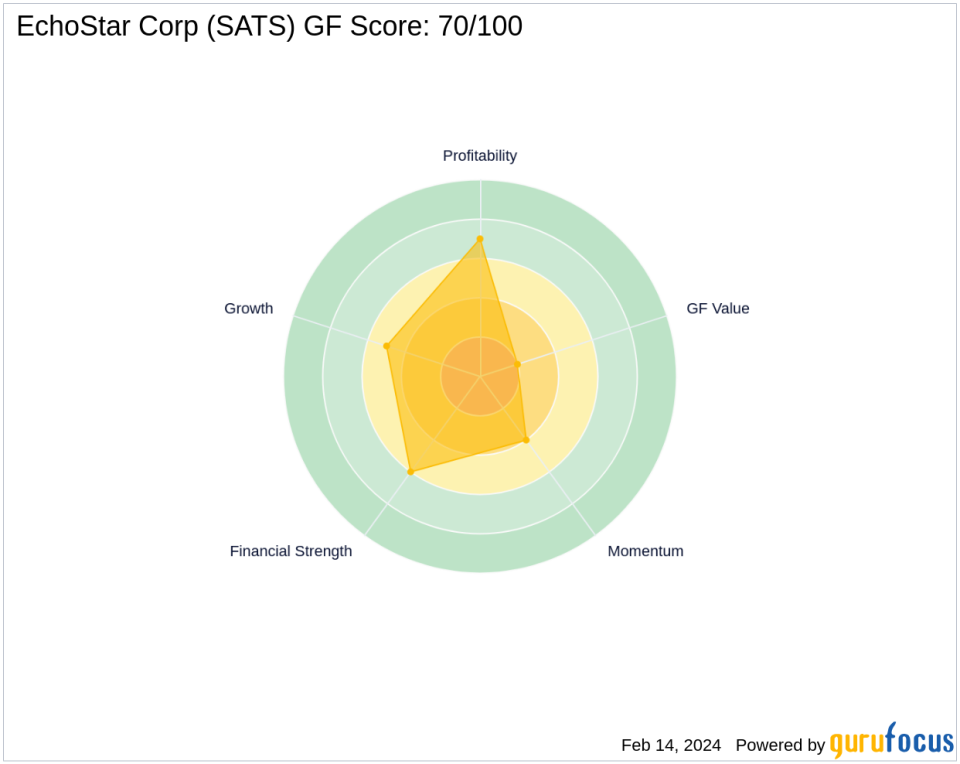

Performance and Rankings

EchoStar's GF Score of 70/100 points to a moderate future performance potential. The company's financial strength and profitability are reflected in its ranks, with a Financial Strength of 6/10 and a Profitability Rank of 7/10. Additionally, EchoStar's Piotroski F-Score of 7 indicates a healthy financial situation.

Sector and Industry Context

Renaissance Technologies has shown a preference for the technology and healthcare sectors, with EchoStar fitting well within the firm's technology interests. Within the hardware industry, EchoStar's strategic moves and market positioning are of particular relevance to Simons' data-driven investment approach.

Other Notable Investors

Jim Simons (Trades, Portfolio) is not the only guru with an interest in EchoStar. Joel Greenblatt (Trades, Portfolio) also holds shares in the company, although the largest guru shareholder is GAMCO Investors. The collective interest from these seasoned investors further underscores EchoStar's potential value.

Transaction Analysis

The acquisition of EchoStar shares by Renaissance Technologies is a calculated move that aligns with the firm's analytical investment strategy. Given EchoStar's undervalued status and solid financial rankings, this addition could bode well for the future performance of Simons' portfolio. As the stock market continues to evolve, the firm's stake in EchoStar may prove to be a strategic asset in achieving long-term growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.