Jim Simons' Renaissance Technologies Adds Shares in inTest Corp

Overview of the Recent Portfolio Addition

Renaissance Technologies, led by the renowned mathematician and investor Jim Simons (Trades, Portfolio), has recently expanded its investment portfolio with the addition of shares in inTest Corp (INTT). The transaction, which took place on December 29, 2023, saw the firm acquire 39,000 shares of the company, known for its test and process solutions in various high-tech markets. This move reflects the firm's strategic investment decisions based on complex mathematical models and extensive data analysis.

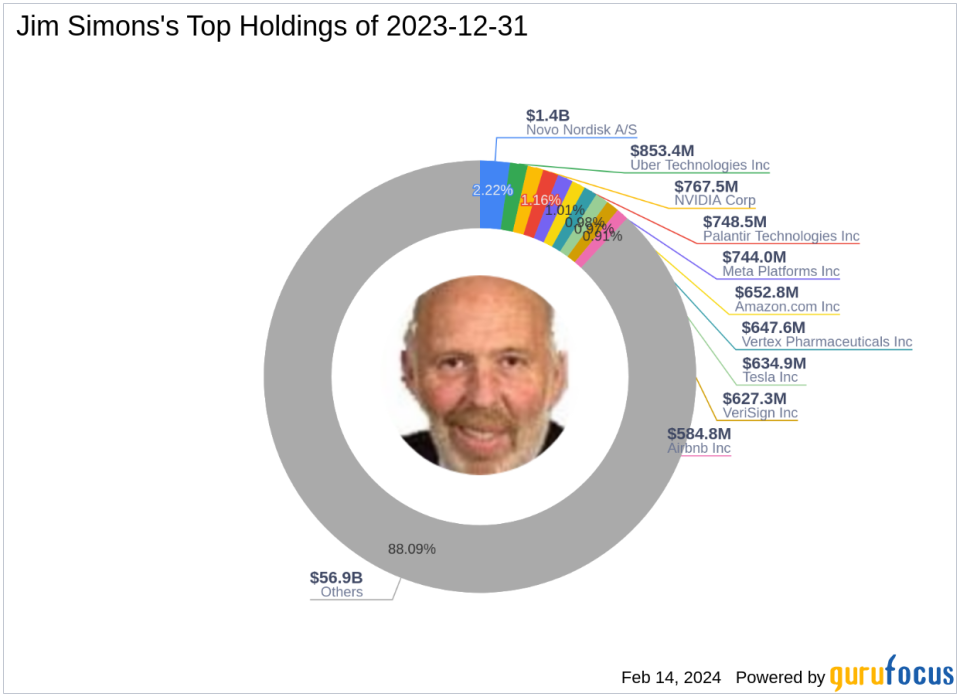

Guru Profile: Jim Simons (Trades, Portfolio) and Renaissance Technologies

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm is celebrated for its sophisticated quantitative trading strategies, which leverage mathematical and computational skills to identify non-random price movements. Renaissance Technologies is particularly known for its data-driven approach, which eschews gut feelings in favor of scientific thinking and statistical evidence. The firm's top holdings include major players in the technology and healthcare sectors, such as Meta Platforms Inc (NASDAQ:META) and Novo Nordisk A/S (NYSE:NVO).

inTest Corp Company Overview

inTest Corp, established in the USA with an IPO date of June 17, 1997, operates in the semiconductor industry, providing essential test and process solutions. The company's offerings are critical in the manufacturing and testing processes across various markets, including automotive, defense/aerospace, and telecommunications. inTest Corp has built a reputation for its Thermal Products and Electromechanical Semiconductor Products segments, contributing to its historical performance and presence in the stock market.

Transaction Specifics

The acquisition of inTest Corp shares by Renaissance Technologies was executed at a trade price of $13.60 per share. As of the trade date, the firm held a total of 657,037 shares, representing a 5.40% ownership in the company and a 0.02% position in the firm's portfolio. When compared to the current stock price of $11.34 and the GF Value of $17.63, inTest Corp is considered significantly undervalued, with a price to GF Value ratio of 0.64.

Portfolio Impact

The addition of inTest Corp to Jim Simons (Trades, Portfolio)' portfolio may seem modest in terms of overall impact, given the 0% trade impact. However, the 5.40% stake in the company signifies a notable investment in a firm that aligns with Renaissance Technologies' data-centric investment philosophy. The trade also diversifies the portfolio, which is heavily invested in technology and healthcare sectors.

inTest Corp's Financial Health and Market Valuation

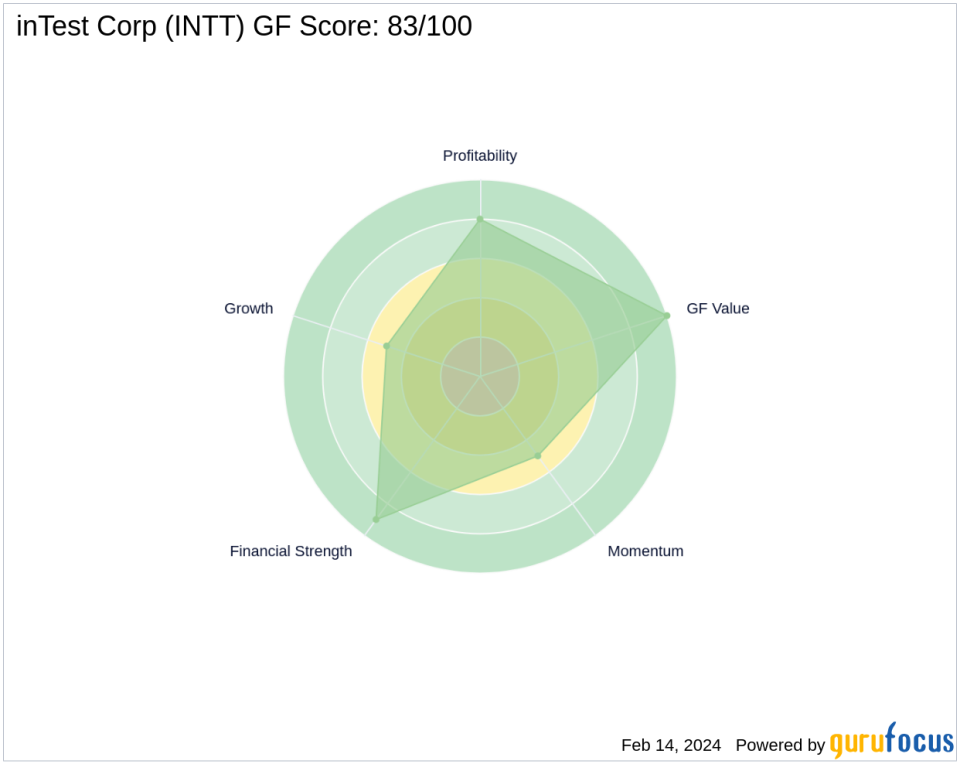

inTest Corp boasts a market capitalization of $137.909 million and exhibits strong financial health with a Financial Strength rank of 9/10. The company's interest coverage ratio stands at 20.14, and it has a robust Altman Z score of 4.44. With a Profitability Rank of 8/10 and a Piotroski F-Score of 7, the company's financials suggest a stable and profitable operation. The Growth Rank and GF Value Rank are also favorable, indicating potential for future appreciation.

Comparative Analysis

When compared to industry standards, inTest Corp's performance is robust, with a GF Score of 83/100, suggesting good outperformance potential. The company's financial metrics, such as ROE and ROA, are competitive within the semiconductors industry, and its historical growth rates in revenue and EBITDA are commendable.

Market Reaction and Future Outlook

Since the trade, inTest Corp's stock price has experienced a decline of -16.62%, with a year-to-date performance of -14.42%. Despite the recent dip, the company's strong financial health and undervalued status according to the GF Value suggest that it may have solid growth prospects and investment potential moving forward.

Transaction Analysis

The acquisition of inTest Corp shares by Renaissance Technologies is a strategic move that aligns with the firm's analytical investment approach. The current undervaluation of inTest Corp, combined with its strong financials and market position, may offer Renaissance Technologies an opportunity for significant returns. As the market adjusts to this transaction, investors will be watching closely to see how this addition influences both the stock's performance and the firm's portfolio in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.