Jim Simons Trims Position in Park Aerospace Corp

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

Jim Simons (Trades, Portfolio)'s firm, Renaissance Technologies, has recently adjusted its investment in Park Aerospace Corp (NYSE:PKE), marking a notable change in its portfolio. On December 29, 2023, the firm reduced its holdings in the company by 11,000 shares, which represents a 1.09% decrease from its previous stake. This transaction has altered the landscape of Simons's investment in the aerospace and defense sector.

Jim Simons (Trades, Portfolio)'s Investment Firm and Philosophy

Founded in 1982, Renaissance Technologies, under the leadership of Jim Simons (Trades, Portfolio), has become a powerhouse in the hedge fund industry. The firm is renowned for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements and execute trades. This scientific methodology has set the firm apart, allowing it to capitalize on patterns and trends that may elude traditional investors.

Introduction to Park Aerospace Corp

Park Aerospace Corp, with its stock symbol PKE, operates within the Aerospace & Defense industry in the United States. Since its IPO on April 25, 1984, the company has specialized in the design, development, and manufacturing of advanced composite materials for aerospace applications. With a market capitalization of $289.826 million and a presence across North America, Asia, and Europe, Park Aerospace Corp plays a significant role in its sector.

Details of the Recent Transaction

The recent transaction by Renaissance Technologies saw the firm's stake in Park Aerospace Corp decrease by 11,000 shares, with a trade price of $14.7 per share. Following this trade, the firm holds a total of 1,000,597 shares in PKE, which constitutes a 4.94% ownership and a 0.03% position in the firm's portfolio. Despite the reduction, the firm maintains a significant interest in the company.

Analysis of Park Aerospace Corp's Stock Performance

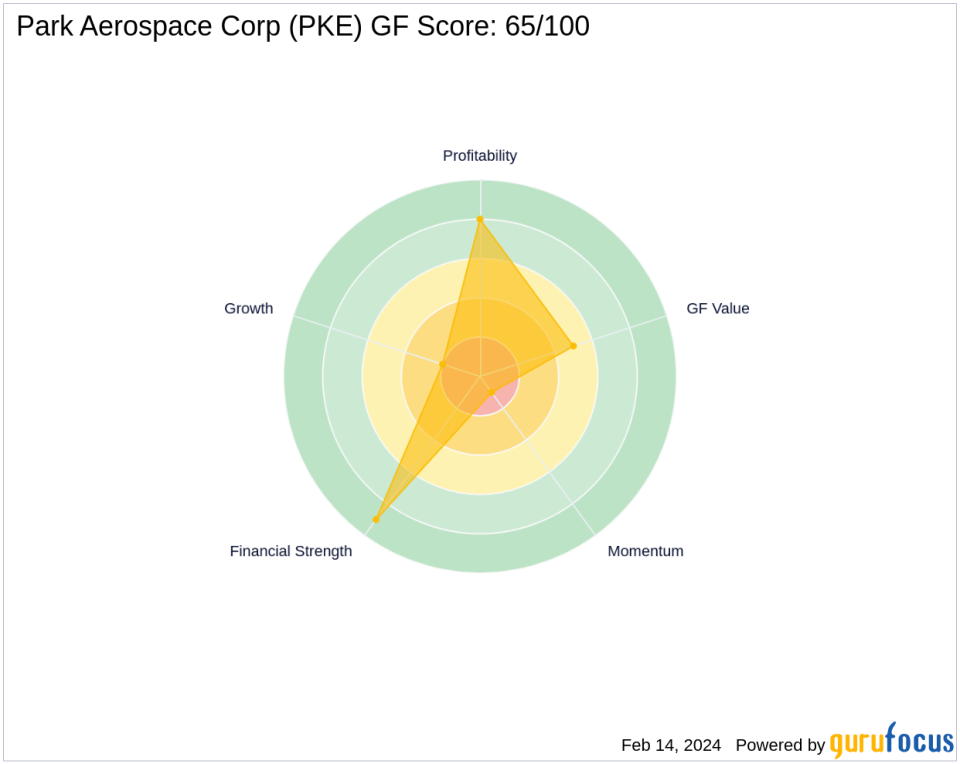

Currently, Park Aerospace Corp's stock is trading at $14.31, slightly below the trade price and has been deemed "Fairly Valued" according to the GF Value of $13.49. The stock's PE Percentage stands at 30.45, and it has a GF Score of 65/100, indicating moderate future performance potential. The company's financial strength and profitability are reflected in its Balance Sheet Rank of 9/10 and Profitability Rank of 8/10, respectively.

Sector and Market Context

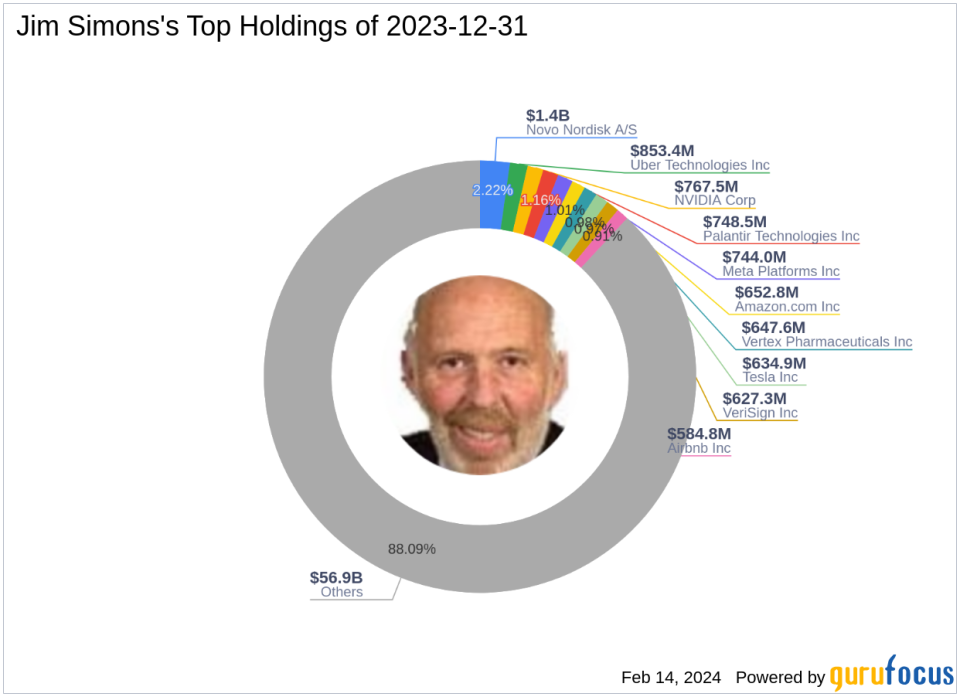

Jim Simons (Trades, Portfolio)'s firm has a diverse portfolio with top holdings in the technology and healthcare sectors, including companies like Meta Platforms Inc (NASDAQ:META) and Novo Nordisk A/S (NYSE:NVO). Within the Aerospace & Defense industry, Park Aerospace Corp maintains a competitive stance, contributing to the firm's strategic positioning in this sector.

Other Notable Investors in Park Aerospace Corp

Brandes Investment is currently the largest guru shareholder in Park Aerospace Corp, while other notable investors like Mario Gabelli (Trades, Portfolio) also hold stakes in the company. These investments by prominent gurus underscore the company's relevance in the investment community.

Conclusion

The recent reduction in shares of Park Aerospace Corp by Jim Simons (Trades, Portfolio)'s Renaissance Technologies may reflect a strategic rebalancing of the firm's portfolio. Despite the decrease in shares, the firm's continued investment suggests a sustained belief in the company's market position and future outlook. As Park Aerospace Corp navigates the Aerospace & Defense industry, investors will be watching closely to see how this trade impacts both the firm's portfolio and the company's stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.