Jim Simons Trims Stake in Commercial Vehicle Group Inc

Overview of Jim Simons (Trades, Portfolio)'s Recent Trade

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Commercial Vehicle Group Inc (NASDAQ:CVGI). The firm sold 153,845 shares at a price of $7.01 each, resulting in a total holding of 1,768,159 shares. This trade action represents a -8.00% change in the firm's holdings and a 5.25% ownership of CVGI's outstanding shares, reflecting a minor 0.02% position in the firm's portfolio.

Guru Profile: Jim Simons (Trades, Portfolio)

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a pioneer in the use of mathematical models for stock trading since 1982. Under Simons's leadership, Renaissance Technologies has become one of the most successful hedge funds globally. The firm's investment philosophy revolves around the analysis of vast amounts of data to identify non-random price movements and execute trades, often automated. This scientific approach to trading has set a new standard in the investment world.

Commercial Vehicle Group Inc (NASDAQ:CVGI) Overview

Commercial Vehicle Group Inc, with its stock symbol CVGI, operates in the Vehicles & Parts industry in the USA since its IPO on August 5, 2004. CVGI supplies cab-related products and systems through its segments: Aftermarket and Accessories, Electrical Systems, Industrial Automation, and Vehicle Solutions. The company's diverse product offerings include commercial vehicle seats, plastic components, and warehouse automation subsystems, among others.

Financial Snapshot of CVGI

As of the latest data, Commercial Vehicle Group Inc boasts a market capitalization of $210.332 million, with a current stock price of $6.24. However, the company's PE percentage stands at 0.00, indicating it is not generating a profit. CVGI is considered modestly undervalued with a GF Value of $8.35 and a price to GF Value ratio of 0.75.

CVGI's Stock Performance Metrics

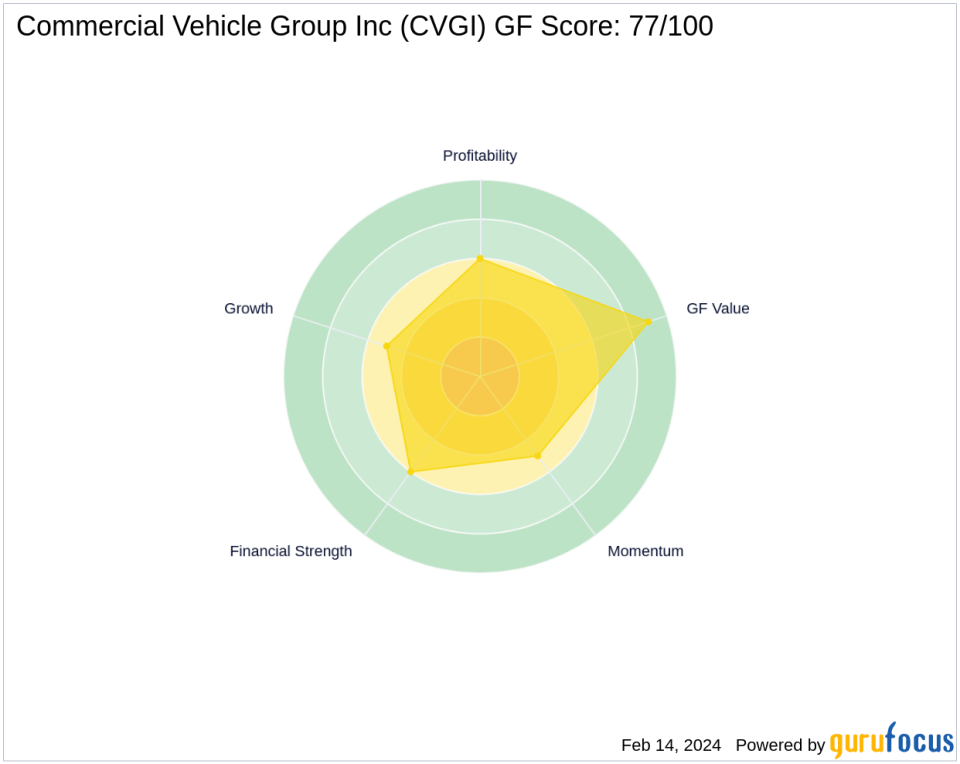

Since the trade date, CVGI's stock has experienced a -10.98% price change, while the change since its IPO is a significant -52.18%. The year-to-date price change ratio stands at -9.3%. CVGI's GF Score is 77/100, indicating a potential for average performance in the future.

CVGI's Financial Health Indicators

Commercial Vehicle Group's financial health is reflected in its Financial Strength rank of 6/10 and Profitability Rank of 6/10. The company's Growth Rank is 5/10, while its GF Value Rank is an impressive 9/10. CVGI's cash to debt ratio is 0.29, and its interest coverage stands at 3.47.

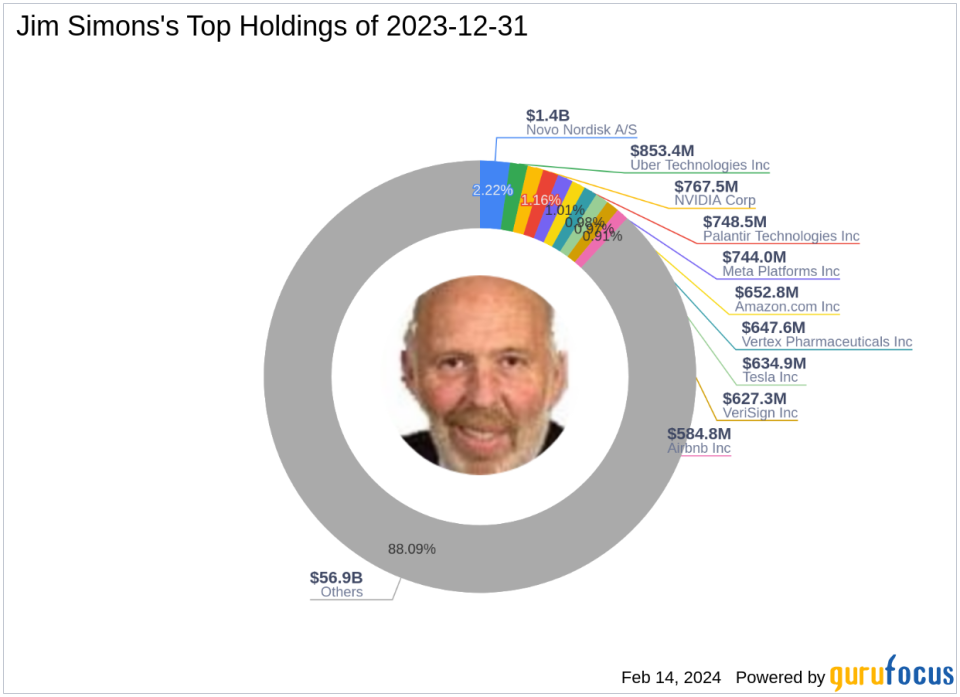

Comparative Analysis of Guru Holdings

Jim Simons (Trades, Portfolio)'s current portfolio is heavily weighted in the Technology and Healthcare sectors, with top holdings including Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO). When compared to the largest guru shareholder in CVGI, GAMCO Investors, Simons's position represents a significant 5.25% ownership of the company's outstanding shares.

Market Context and Implications

The recent trade by Jim Simons (Trades, Portfolio) has a minimal impact on the firm's diverse and extensive portfolio, valued at $64.61 billion. However, the reduction in CVGI shares could signal a strategic move based on the firm's advanced predictive models. The broader market implications of this trade and CVGI's future prospects remain to be seen, as investors and analysts alike monitor the company's performance and Simons's investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.