Jim Simons Trims Stake in Enzo Biochem Inc

Recent Stock Transaction Overview

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), made a notable adjustment to its investment portfolio by reducing its stake in Enzo Biochem Inc (NYSE:ENZ). The firm sold 76,869 shares at a trade price of $1.39, which resulted in a -3.01% change in the holding. After this transaction, Renaissance Technologies holds a total of 2,479,195 shares in Enzo Biochem Inc, equating to a 4.91% ownership and a 0.01% position in the firm's portfolio. Despite the reduction, the trade had a negligible impact on the overall portfolio.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

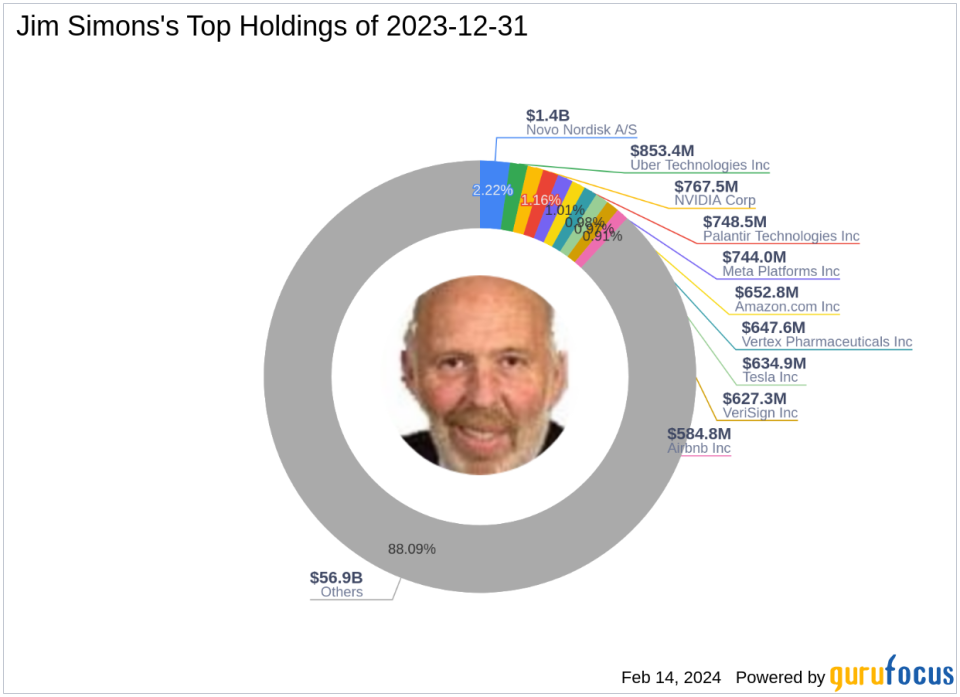

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies in 1982. The firm has since become one of the most successful hedge funds globally, known for its sophisticated mathematical models and automated trading strategies. Simons' investment philosophy revolves around data analysis and non-random price movement predictions, leveraging scientific thinking to avoid statistical flukes in strategy. With an equity of $64.61 billion and top holdings in technology and healthcare sectors, Renaissance Technologies maintains a diverse portfolio.

Enzo Biochem Inc at a Glance

Enzo Biochem Inc, a bioscience company based in the USA, specializes in developing and selling proprietary solutions for clinical laboratories, specialty clinics, and researchers. With a focus on technology application in clinical needs, the company operates through segments like Clinical Services and Products. Enzo Biochem Inc has a market capitalization of $68.161 million, a current stock price of $1.35, and a PE percentage of 2.70. However, the stock is currently deemed Significantly Overvalued with a GF Value of $0.61 and a Price to GF Value ratio of 2.21.

Impact of the Trade on Simons' Portfolio

The recent sale of Enzo Biochem Inc shares by Renaissance Technologies represents a minor adjustment in the firm's vast portfolio. With a trade position of just 0.01%, the transaction's impact is minimal, yet it reflects a strategic decision by the firm. The 4.91% holding in Enzo Biochem Inc indicates a continued, albeit reduced, confidence in the company's prospects.

Enzo Biochem Inc's Market Performance

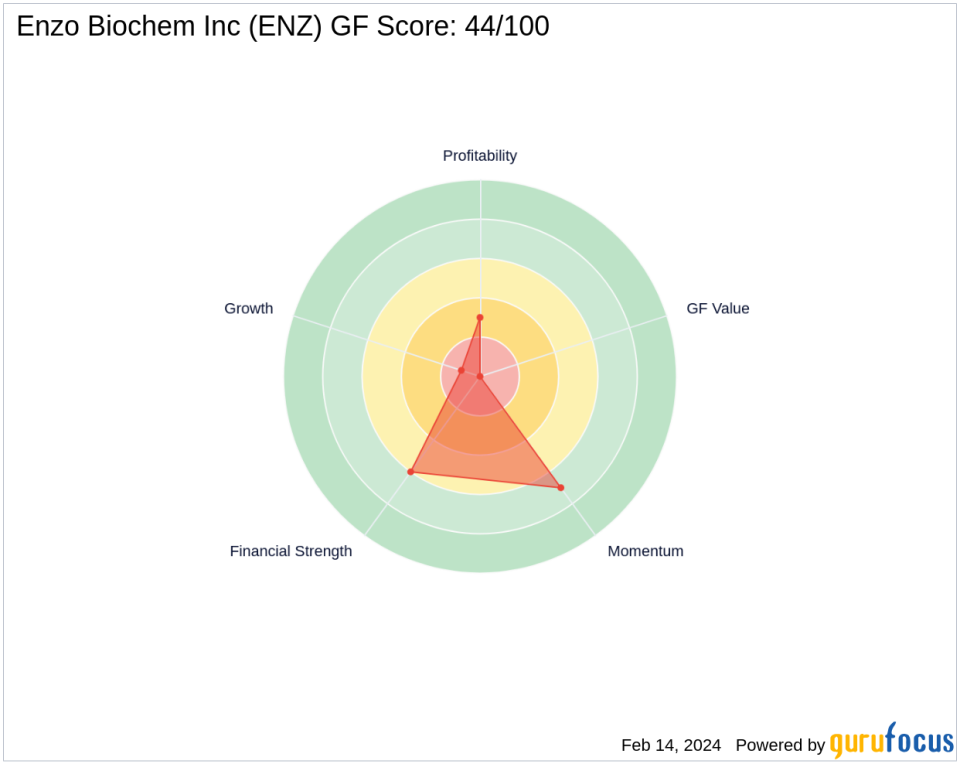

Enzo Biochem Inc's valuation according to GuruFocus metrics suggests a challenging outlook. The stock has experienced a -2.88% price change since the transaction and a -10% year-to-date price change. Despite a 95.65% increase since its IPO, the company's current valuation is a concern, with a GF Score of 44/100, indicating poor future performance potential.

Financial Health and Rankings

Enzo Biochem Inc's financial health presents a mixed picture. The company has a Financial Strength rank of 6/10 and a Piotroski F-Score of 6, suggesting stability. However, its Profitability Rank is low at 3/10, and the Growth Rank is even lower at 1/10. The company's GF Value Rank is not applicable, and its Momentum Rank stands at 7/10.

Sector and Top Holdings of Jim Simons (Trades, Portfolio)

Renaissance Technologies' top sector investments include Technology and Healthcare, with leading positions in companies like Meta Platforms Inc (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA). Enzo Biochem Inc's performance is currently lagging behind these top holdings, but it remains a part of the firm's diverse investment strategy.

Conclusion

Jim Simons (Trades, Portfolio)' recent reduction in Enzo Biochem Inc shares is a strategic move that aligns with the firm's data-driven investment approach. While the transaction has a minimal impact on the portfolio, it reflects Renaissance Technologies' ongoing assessment of the company's performance and market valuation. For value investors, this trade decision underscores the importance of continuous portfolio evaluation and the potential need for adjustments in response to financial metrics and market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.